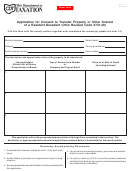

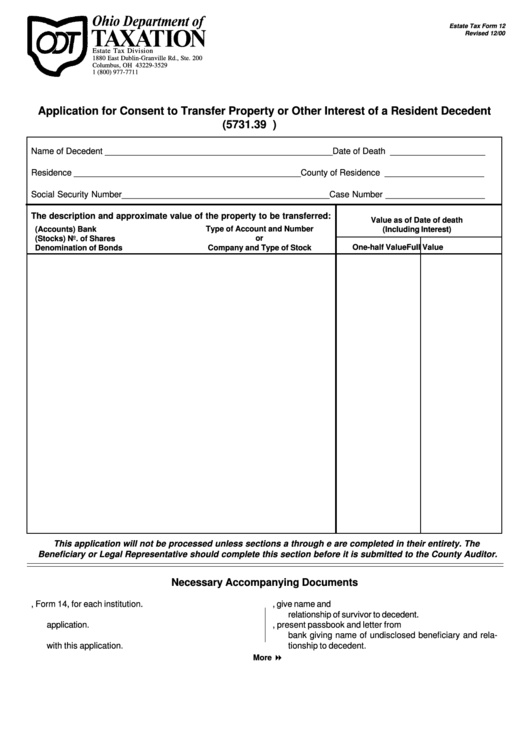

Form 12 - Application For Consent To Transfer Property Or Other Interest Of A Resident Decedent (5731.39 O.r.c.)

ADVERTISEMENT

Estate Tax Form 12

Revised 12/00

Estate Tax Division

1880 East Dublin-Granville Rd., Ste. 200

Columbus, OH 43229-3529

1 (800) 977-7711

Application for Consent to Transfer Property or Other Interest of a Resident Decedent

(5731.39 O.R.C.)

Name of Decedent ________________________________________________ Date of Death ____________________

Residence ________________________________________________ County of Residence _____________________

Social Security Number ____________________________________________ Case Number _____________________

The description and approximate value of the property to be transferred:

Value as of Date of death

Type of Account and Number

(Accounts) Bank

(Including Interest)

(Stocks) No. of Shares

or

One-half Value

Full Value

Company and Type of Stock

Denomination of Bonds

This application will not be processed unless sections a through e are completed in their entirety. The

Beneficiary or Legal Representative should complete this section before it is submitted to the County Auditor.

Necessary Accompanying Documents

1. Typed tax releases, Form 14, for each institution.

4. For joint and survivorship property, give name and

2. Exhibit letters of Probate Court appointment upon first

relationship of survivor to decedent.

application.

5. For P.O.D. accounts, present passbook and letter from

3. Savings passbooks and certificates must be presented

bank giving name of undisclosed beneficiary and rela-

with this application.

tionship to decedent.

8

More

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2