Form Uce-151 - Instructions For Preparation Of Employer Status Report (Uce-151)

ADVERTISEMENT

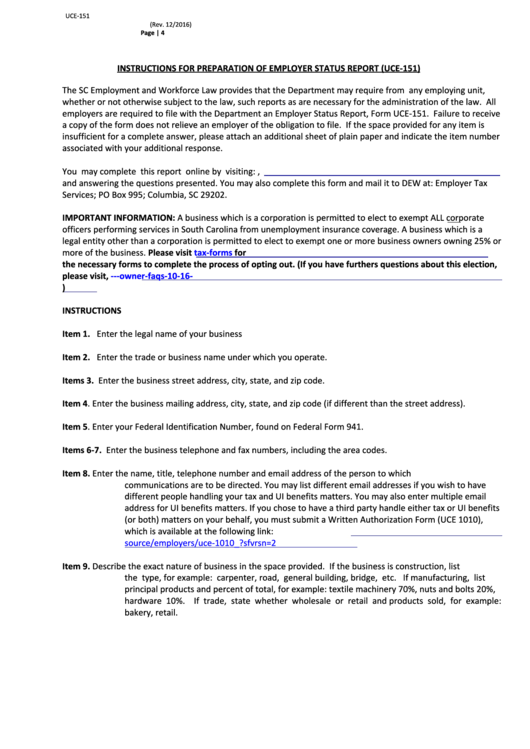

UCE-151

(Rev. 12/2016)

Page | 4

INSTRUCTIONS FOR PREPARATION OF EMPLOYER STATUS REPORT (UCE-151)

The SC Employment and Workforce Law provides that the Department may require from any employing unit,

whether or not otherwise subject to the law, such reports as are necessary for the administration of the law. All

employers are required to file with the Department an Employer Status Report, Form UCE-151. Failure to receive

a copy of the form does not relieve an employer of the obligation to file. If the space provided for any item is

insufficient for a complete answer, please attach an additional sheet of plain paper and indicate the item number

associated with your additional response.

You may complete this report online by visiting: ,

and answering the questions presented. You may also complete this form and mail it to DEW at: Employer Tax

Services; PO Box 995; Columbia, SC 29202.

IMPORTANT INFORMATION: A business which is a corporation is permitted to elect to exempt ALL corporate

officers performing services in South Carolina from unemployment insurance coverage. A business which is a

legal entity other than a corporation is permitted to elect to exempt one or more business owners owning 25% or

more of the business. Please visit

https://

for

the necessary forms to complete the process of opting out. (If you have furthers questions about this election,

please

visit,

https://

15v2.pdf)

INSTRUCTIONS

Item 1.

Enter the legal name of your business

Item 2.

Enter the trade or business name under which you operate.

Items 3.

Enter the business street address, city, state, and zip code.

Item 4.

Enter the business mailing address, city, state, and zip code (if different than the street address).

Item 5.

Enter your Federal Identification Number, found on Federal Form 941.

Items 6-7.

Enter the business telephone and fax numbers, including the area codes.

Item 8.

Enter the name, title, telephone number and email address of the person to which

communications are to be directed. You may list different email addresses if you wish to have

different people handling your tax and UI benefits matters. You may also enter multiple email

address for UI benefits matters. If you chose to have a third party handle either tax or UI benefits

(or both) matters on your behalf, you must submit a Written Authorization Form (UCE 1010),

which

is

available

at

the

following

link:

https://

source/employers/uce-1010_powerofattorney.pdf?sfvrsn=2

Item 9.

Describe the exact nature of business in the space provided. If the business is construction, list

the type, for example: carpenter, road, general building, bridge, etc. If manufacturing, list

principal products and percent of total, for example: textile machinery 70%, nuts and bolts 20%,

hardware 10%. If trade, state whether wholesale or retail and products sold, for example:

bakery, retail.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3