Instructions For Idaho Form 82r (Draft)

ADVERTISEMENT

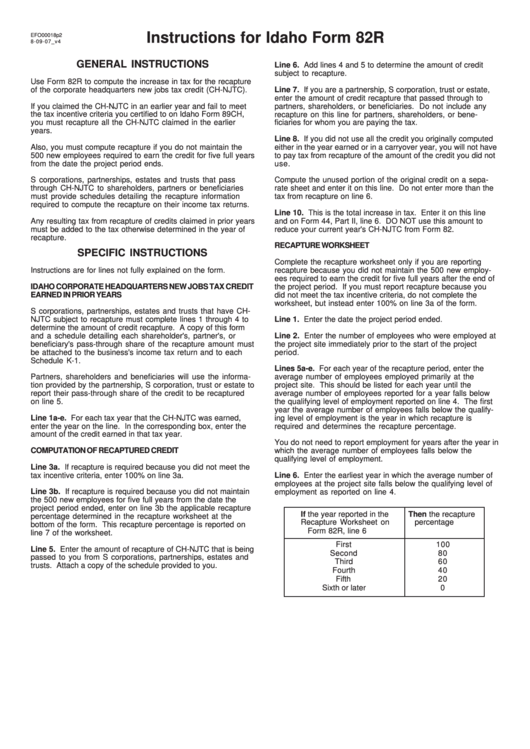

Instructions for Idaho Form 82R

EFO00018p2

8-09-07_v4

GENERAL INSTRUCTIONS

Line 6. Add lines 4 and 5 to determine the amount of credit

subject to recapture.

Use Form 82R to compute the increase in tax for the recapture

of the corporate headquarters new jobs tax credit (CH-NJTC).

Line 7. If you are a partnership, S corporation, trust or estate,

enter the amount of credit recapture that passed through to

If you claimed the CH-NJTC in an earlier year and fail to meet

partners, shareholders, or beneficiaries. Do not include any

the tax incentive criteria you certified to on Idaho Form 89CH,

recapture on this line for partners, shareholders, or bene-

you must recapture all the CH-NJTC claimed in the earlier

ficiaries for whom you are paying the tax.

years.

Line 8. If you did not use all the credit you originally computed

Also, you must compute recapture if you do not maintain the

either in the year earned or in a carryover year, you will not have

500 new employees required to earn the credit for five full years

to pay tax from recapture of the amount of the credit you did not

from the date the project period ends.

use.

S corporations, partnerships, estates and trusts that pass

Compute the unused portion of the original credit on a sepa-

through CH-NJTC to shareholders, partners or beneficiaries

rate sheet and enter it on this line. Do not enter more than the

must provide schedules detailing the recapture information

tax from recapture on line 6.

required to compute the recapture on their income tax returns.

Line 10. This is the total increase in tax. Enter it on this line

Any resulting tax from recapture of credits claimed in prior years

and on Form 44, Part II, line 6. DO NOT use this amount to

must be added to the tax otherwise determined in the year of

reduce your current year's CH-NJTC from Form 82.

recapture.

RECAPTURE WORKSHEET

SPECIFIC INSTRUCTIONS

Complete the recapture worksheet only if you are reporting

Instructions are for lines not fully explained on the form.

recapture because you did not maintain the 500 new employ-

ees required to earn the credit for five full years after the end of

IDAHO CORPORATE HEADQUARTERS NEW JOBS TAX CREDIT

the project period. If you must report recapture because you

EARNED IN PRIOR YEARS

did not meet the tax incentive criteria, do not complete the

worksheet, but instead enter 100% on line 3a of the form.

S corporations, partnerships, estates and trusts that have CH-

NJTC subject to recapture must complete lines 1 through 4 to

Line 1. Enter the date the project period ended.

determine the amount of credit recapture. A copy of this form

and a schedule detailing each shareholder's, partner's, or

Line 2. Enter the number of employees who were employed at

beneficiary's pass-through share of the recapture amount must

the project site immediately prior to the start of the project

be attached to the business's income tax return and to each

period.

Schedule K-1.

Lines 5a-e. For each year of the recapture period, enter the

Partners, shareholders and beneficiaries will use the informa-

average number of employees employed primarily at the

tion provided by the partnership, S corporation, trust or estate to

project site. This should be listed for each year until the

report their pass-through share of the credit to be recaptured

average number of employees reported for a year falls below

on line 5.

the qualifying level of employment reported on line 4. The first

year the average number of employees falls below the qualify-

Line 1a-e. For each tax year that the CH-NJTC was earned,

ing level of employment is the year in which recapture is

enter the year on the line. In the corresponding box, enter the

required and determines the recapture percentage.

amount of the credit earned in that tax year.

You do not need to report employment for years after the year in

COMPUTATION OF RECAPTURED CREDIT

which the average number of employees falls below the

qualifying level of employment.

Line 3a. If recapture is required because you did not meet the

tax incentive criteria, enter 100% on line 3a.

Line 6. Enter the earliest year in which the average number of

employees at the project site falls below the qualifying level of

Line 3b. If recapture is required because you did not maintain

employment as reported on line 4.

the 500 new employees for five full years from the date the

project period ended, enter on line 3b the applicable recapture

If the year reported in the

Then the recapture

percentage determined in the recapture worksheet at the

Recapture Worksheet on

percentage is...

bottom of the form. This recapture percentage is reported on

Form 82R, line 6 is...

line 7 of the worksheet.

First

100

Line 5. Enter the amount of recapture of CH-NJTC that is being

Second

80

passed to you from S corporations, partnerships, estates and

Third

60

trusts. Attach a copy of the schedule provided to you.

Fourth

40

Fifth

20

Sixth or later

0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1