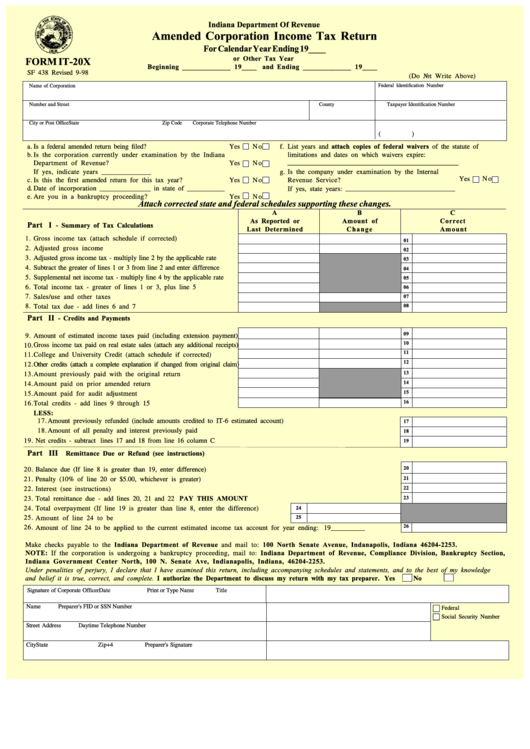

Indiana Department Of Revenue

Amended Corporation Income Tax Return

For Calendar Year Ending 19____

or Other Tax Year

FORM IT-20X

Beginning _____________ 19____

and Ending _____________ 19____

SF 438 Revised 9-98

(Do Not Write Above)

Name of Corporation

Federal Identification Number

Number and Street

County

Taxpayer Identification Number

City or Post Office

State

Zip Code

Corporate Telephone Number

(

)

List years and attach copies of federal waivers of the statute of

a.

Is a federal amended return being filed? .............................................

Yes

N o

f.

b.

Is the corporation currently under examination by the Indiana

limitations and dates on which waivers expire:

___________________________________________

Department of Revenue? ...........................................................

Yes

N o

If yes, indicate years ______________

g.

Is the company under examination by the Internal

Yes

N o

c.

Is this the first amended return for this tax year? ......................

Yes

N o

Revenue Service? ...........................................................

d.

Date of incorporation _______________ in state of ___________

If yes, state years:

e.

Are you in a bankruptcy proceeding? .........................................

Yes

N o

Attach corrected state and federal schedules supporting these changes.

A

B

C

As Reported or

Amount of

Correct

Part I

- Summary of Tax Calculations

Last Determined

C h a n g e

Amount

1.

Gross income tax (attach schedule if corrected) ................................

01

2.

Adjusted gross income ......................................................................

02

3.

Adjusted gross income tax - multiply line 2 by the applicable rate ............

03

4.

Subtract the greater of lines 1 or 3 from line 2 and enter difference ..........

04

5.

Supplemental net income tax - multiply line 4 by the applicable rate ......

05

6.

Total income tax - greater of lines 1 or 3, plus line 5 .......................

06

07

7.

Sales/use and other taxes ..................................................................

08

8.

Total tax due - add lines 6 and 7 .......................................................

Part II

- Credits and Payments

09

9.

Amount of estimated income taxes paid (including extension payment)

10

10.

Gross income tax paid on real estate sales (attach any additional receipts)

11

11.

College and University Credit (attach schedule if corrected) .............

12

12.

Other credits (attach a complete explanation if changed from original claim)

13

13.

Amount previously paid with the original return ..............................

14

14.

Amount paid on prior amended return ..............................................

15

15.

Amount paid for audit adjustment .....................................................

16

16.

Total credits - add lines 9 through 15 ...............................................

LESS:

17.

Amount previously refunded (include amounts credited to IT-6 estimated account) ...............................................................

17

18.

18

Amount of all penalty and interest previously paid ................................................................................................................

19.

Net credits - subtract lines 17 and 18 from line 16 column C ..........................................................................................................

19

Part

III

Remittance Due or Refund (see instructions)

20

20.

Balance due (If line 8 is greater than 19, enter difference) ...............................................................................................................

21

21.

Penalty (10% of line 20 or $5.00, whichever is greater) ................................................................................................................

22

22.

Interest (see instructions) ...........................................................................................................................................................

Total remittance due - add lines 20, 21 and 22 .................................................................................... PAY THIS AMOUNT

23

23.

24

24.

Total overpayment (If line 19 is greater than line 8, enter the difference).................

25

25.

Amount of line 24 to be refunded...............................................................................

26

26.

Amount of line 24 to be applied to the current estimated income tax account for year ending: 19__________

Make checks payable to the Indiana Department of Revenue and mail to: 100 North Senate Avenue, Indanapolis, Indiana 46204-2253.

NOTE: If the corporation is undergoing a bankruptcy proceeding, mail to: Indiana Department of Revenue, Compliance Division, Bankruptcy Section,

Indiana Government Center North, 100 N. Senate Ave, Indianapolis, Indiana, 46204-2253.

Under penalities of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief it is true, correct, and complete. I authorize the Department to discuss my return with my tax preparer. Yes

No

Signature of Corporate Officer

Date

Print or Type Name

Title

Name

Preparer's FID or SSN Number

Federal I.D. Number

Social Security Number

Street Address

Daytime Telephone Number

City

State

Zip+4

Preparer's Signature

1

1