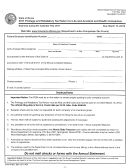

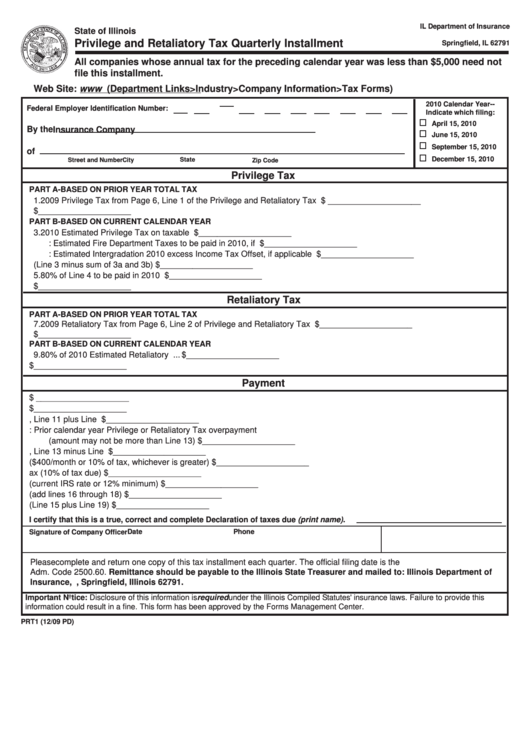

Form Prt1 - Privilege And Retaliatory Tax Quarterly Installment - State Of Illinois

ADVERTISEMENT

IL Department of Insurance

State of Illinois

P.O. Box 7087

Privilege and Retaliatory Tax Quarterly Installment

Springfield, IL 62791

All companies whose annual tax for the preceding calendar year was less than $5,000 need not

file this installment.

Web Site: (Department Links>Industry>Company Information>Tax Forms)

2010 Calendar Year--

Federal Employer Identification Number:

Indicate which filing:

April 15, 2010

By the

Insurance Company

June 15, 2010

September 15, 2010

of

December 15, 2010

State

Street and Number

City

Zip Code

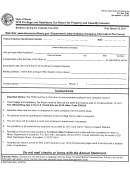

Privilege Tax

PART A-BASED ON PRIOR YEAR TOTAL TAX

1. 2009 Privilege Tax from Page 6, Line 1 of the Privilege and Retaliatory Tax Return ....................... $ ____________________

2. Installment amount due is 1/4 of Line 1 ........................................................................................... $____________________

PART B-BASED ON CURRENT CALENDAR YEAR

3. 2010 Estimated Privilege Tax on taxable premiums ........................................................................ $____________________

3a.

Less: Estimated Fire Department Taxes to be paid in 2010, if applicable ............................. $____________________

3b.

Less: Estimated Intergradation 2010 excess Income Tax Offset, if applicable ...................... $____________________

4. Net Privilege Tax for 2010 (Line 3 minus sum of 3a and 3b) ........................................................... $____________________

5. 80% of Line 4 to be paid in 2010 ..................................................................................................... $____________________

6. Installment amount due is 1/4 of Line 5 ........................................................................................... $____________________

Retaliatory Tax

PART A-BASED ON PRIOR YEAR TOTAL TAX

7. 2009 Retaliatory Tax from Page 6, Line 2 of Privilege and Retaliatory Tax Return ......................... $____________________

8. Installment amount due is 1/4 of Line 7 ........................................................................................... $____________________

PART B-BASED ON CURRENT CALENDAR YEAR

9. 80% of 2010 Estimated Retaliatory Tax ........................................................................................... $____________________

10. Installment amount due is 1/4 of Line 9 ........................................................................................... $____________________

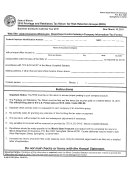

Payment

11. Amount due as a Privilege Tax from Line 2 or Line 6 ...................................................................... $ ____________________

12. Amount due as a Retaliatory Tax either Line 8 or Line 10 ............................................................... $____________________

13. Amount due this installment, Line 11 plus Line 12 ........................................................................... $____________________

14. Less: Prior calendar year Privilege or Retaliatory Tax overpayment

(amount may not be more than Line 13) ......................................................................................... $____________________

15. Amount of tax payment due this installment, Line 13 minus Line 14 ............................................... $____________________

16. Penalty for failure to file tax statement ($400/month or 10% of tax, whichever is greater) .............. $____________________

17. Penalty for failure to pay tax (10% of tax due) ................................................................................. $____________________

18. Interest on tax paid after due date (current IRS rate or 12% minimum) .......................................... $____________________

19. Total penalty and interest (add lines 16 through 18) ........................................................................ $____________________

20. Balance due (Line 15 plus Line 19) ................................................................................................. $____________________

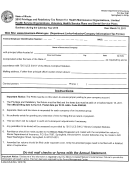

I certify that this is a true, correct and complete Declaration of taxes due (print name).

Date

Phone

Signature of Company Officer

Please complete and return one copy of this tax installment each quarter. The official filing date is the U.S. Postal date per 50 Ill.

Adm. Code 2500.60. Remittance should be payable to the Illinois State Treasurer and mailed to: Illinois Department of

Insurance, P.O. Box 7087, Springfield, Illinois 62791.

Important Notice: Disclosure of this information is required under the Illinois Compiled Statutes' insurance laws. Failure to provide this

information could result in a fine. This form has been approved by the Forms Management Center.

PRT1 (12/09 PD)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1