Form 592-F Draft - Foreign Partner Or Member Annual Return - 2010

ADVERTISEMENT

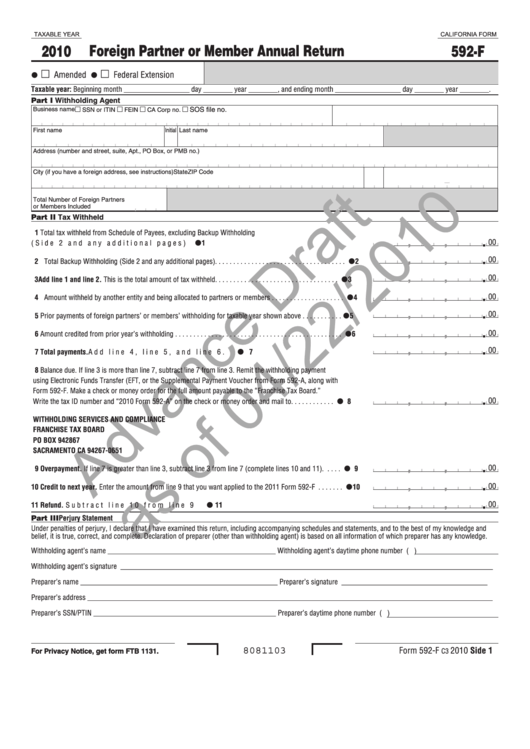

TAXABLE YEAR

CALIFORNIA FORM

Foreign Partner or Member Annual Return

2010

592-F

I

I

Amended

Federal Extension

Taxable year: Beginning month __________________ day ________ year ________, and ending month __________________ day ________ year ________.

Part I Withholding Agent

SOS file no.

Business name

SSN or ITIN

FEIN

CA Corp no.

First name

Initial Last name

Address (number and street, suite, Apt., PO Box, or PMB no.)

City (if you have a foreign address, see instructions)

State ZIP Code

Total Number of Foreign Partners

or Members Included

Part II Tax Withheld

Total tax withheld from Schedule of Payees, excluding Backup Withholding

I

.

00

,

,

(Side 2 and any additional pages) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I

.

00

,

,

2 Total Backup Withholding (Side 2 and any additional pages). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

I

.

00

,

,

3 Add line and line 2. This is the total amount of tax withheld. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

I

.

00

,

,

4 Amount withheld by another entity and being allocated to partners or members . . . . . . . . . . . . . . . . . . . .

4

I

.

00

,

,

5 Prior payments of foreign partners’ or members’ withholding for taxable year shown above . . . . . . . . . . .

5

I

.

00

,

,

6 Amount credited from prior year’s withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

I

.

00

,

,

7 Total payments. Add line 4, line 5, and line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Balance due. If line 3 is more than line 7, subtract line 7 from line 3. Remit the withholding payment

using Electronic Funds Transfer (EFT, or the Supplemental Payment Voucher from Form 592-A, along with

Form 592-F. Make a check or money order for the full amount payable to the “Franchise Tax Board.”

I

.

00

,

,

Write the tax ID number and “2010 Form 592-A” on the check or money order and mail to. . . . . . . . . . . .

8

WITHHOLDING SERVICES AND COMPLIANCE

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-065

I

.

00

,

,

9 Overpayment. If line 7 is greater than line 3, subtract line 3 from line 7 (complete lines 10 and 11). . . . .

9

I

.

,

00

,

0 Credit to next year. Enter the amount from line 9 that you want applied to the 2011 Form 592-F . . . . . . .

0

I

.

00

,

,

Refund. Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part III Perjury Statement

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge.

Withholding agent’s name ______________________________________________

Withholding agent’s daytime phone number (

)

Withholding agent’s signature ______________________________________________________________________________________________________

Preparer’s name ______________________________________________________

Preparer’s signature ________________________________________

Preparer’s address _______________________________________________________________________________________________________________

Preparer’s SSN/PTIN __________________________________________________

Preparer’s daytime phone number (

)

Form 592-F

2010 Side

8081103

For Privacy Notice, get form FTB 1131.

For Privacy Notice, get form FTB 1131.

C3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4