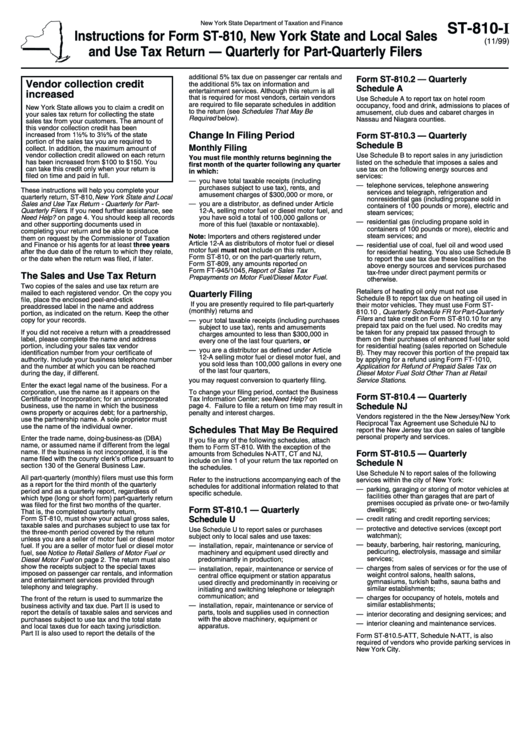

Instructions For Form St-810 - New York State And Local Sales And Use Tax Return - Quarterly For Part-Quarterly Filers

ADVERTISEMENT

New York State Department of Taxation and Finance

ST-810-I

Instructions for Form ST-810, New York State and Local Sales

(11/99)

and Use Tax Return — Quarterly for Part-Quarterly Filers

additional 5% tax due on passenger car rentals and

Form ST-810.2 — Quarterly

Vendor collection credit

the additional 5% tax on information and

Schedule A

entertainment services. Although this return is all

increased

that is required for most vendors, certain vendors

Use Schedule A to report tax on hotel room

are required to file separate schedules in addition

occupancy, food and drink, admissions to places of

New York State allows you to claim a credit on

to the return (see Schedules That May Be

amusement, club dues and cabaret charges in

your sales tax return for collecting the state

Required below).

Nassau and Niagara counties.

sales tax from your customers. The amount of

this vendor collection credit has been

Change In Filing Period

increased from 1½% to 3½% of the state

Form ST-810.3 — Quarterly

portion of the sales tax you are required to

Schedule B

Monthly Filing

collect. In addition, the maximum amount of

vendor collection credit allowed on each return

Use Schedule B to report sales in any jurisdiction

You must file monthly returns beginning the

has been increased from $100 to $150. You

listed on the schedule that imposes a sales and

first month of the quarter following any quarter

can take this credit only when your return is

use tax on the following energy sources and

in which:

filed on time and paid in full.

services:

— you have total taxable receipts (including

— telephone services, telephone answering

purchases subject to use tax), rents, and

These instructions will help you complete your

services and telegraph, refrigeration and

amusement charges of $300,000 or more, or

quarterly return, ST-810, New York State and Local

nonresidential gas (including propane sold in

Sales and Use Tax Return - Quarterly for Part-

— you are a distributor, as defined under Article

containers of 100 pounds or more), electric and

Quarterly Filers . If you need further assistance, see

12-A, selling motor fuel or diesel motor fuel, and

steam services;

Need Help? on page 4. You should keep all records

you have sold a total of 100,000 gallons or

— residential gas (including propane sold in

and other supporting documents used in

more of this fuel (taxable or nontaxable).

containers of 100 pounds or more), electric and

completing your return and be able to produce

steam services; and

Note: Importers and others registered under

them on request by the Commissioner of Taxation

Article 12-A as distributors of motor fuel or diesel

and Finance or his agents for at least three years

— residential use of coal, fuel oil and wood used

motor fuel must not include on this return,

after the due date of the return to which they relate,

for residential heating. You also use Schedule B

Form ST-810, or on the part-quarterly return,

or the date when the return was filed, if later.

to report the use tax due these localities on the

Form ST-809, any amounts reported on

above energy sources and services purchased

Form FT-945/1045, Report of Sales Tax

tax-free under direct payment permits or

The Sales and Use Tax Return

Prepayments on Motor Fuel/Diesel Motor Fuel.

otherwise.

Two copies of the sales and use tax return are

Retailers of heating oil only must not use

mailed to each registered vendor. On the copy you

Quarterly Filing

Schedule B to report tax due on heating oil used in

file, place the enclosed peel-and-stick

If you are presently required to file part-quarterly

their motor vehicles. They must use Form ST-

preaddressed label in the name and address

(monthly) returns and

810.10 , Quarterly Schedule FR for Part-Quarterly

portion, as indicated on the return. Keep the other

Filers and take credit on Form ST-810.10 for any

copy for your records.

— your total taxable receipts (including purchases

prepaid tax paid on the fuel used. No credits may

subject to use tax), rents and amusements

If you did not receive a return with a preaddressed

be taken for any prepaid tax passed through to

charges amounted to less than $300,000 in

label, please complete the name and address

them on their purchases of enhanced fuel later sold

every one of the last four quarters, or

portion, including your sales tax vendor

for residential heating (sales reported on Schedule

— you are a distributor as defined under Article

identification number from your certificate of

B). They may recover this portion of the prepaid tax

12-A selling motor fuel or diesel motor fuel, and

authority. Include your business telephone number

by applying for a refund using Form FT-1010,

you sold less than 100,000 gallons in every one

and the number at which you can be reached

Application for Refund of Prepaid Sales Tax on

of the last four quarters,

during the day, if different.

Diesel Motor Fuel Sold Other Than at Retail

you may request conversion to quarterly filing.

Service Stations .

Enter the exact legal name of the business. For a

corporation, use the name as it appears on the

To change your filing period, contact the Business

Form ST-810.4 — Quarterly

Certificate of Incorporation; for an unincorporated

Tax Information Center; see Need Help? on

Schedule NJ

business, use the name in which the business

page 4. Failure to file a return on time may result in

owns property or acquires debt; for a partnership,

penalty and interest charges.

Vendors registered in the the New Jersey/New York

use the partnership name. A sole proprietor must

Reciprocal Tax Agreement use Schedule NJ to

use the name of the individual owner.

Schedules That May Be Required

report the New Jersey tax due on sales of tangible

personal property and services.

Enter the trade name, doing-business-as (DBA)

If you file any of the following schedules, attach

name, or assumed name if different from the legal

them to Form ST-810. With the exception of the

name. If the business is not incorporated, it is the

Form ST-810.5 — Quarterly

amounts from Schedules N-ATT, CT and NJ,

name filed with the county clerk’s office pursuant to

include on line 1 of your return the tax reported on

Schedule N

section 130 of the General Business Law.

the schedules.

Use Schedule N to report sales of the following

All part-quarterly (monthly) filers must use this form

Refer to the instructions accompanying each of the

services within the city of New York:

as a report for the third month of the quarterly

schedules for additional information related to that

— parking, garaging or storing of motor vehicles at

period and as a quarterly report, regardless of

specific schedule.

facilities other than garages that are part of

which type (long or short form) part-quarterly return

premises occupied as private one- or two-family

was filed for the first two months of the quarter.

Form ST-810.1 — Quarterly

dwellings;

That is, the completed quarterly return,

Form ST-810, must show your actual gross sales,

Schedule U

— credit rating and credit reporting services;

taxable sales and purchases subject to use tax for

— protective and detective services (except port

Use Schedule U to report sales or purchases

the three-month period covered by the return

watchman);

subject only to local sales and use taxes:

unless you are a seller of motor fuel or diesel motor

— beauty, barbering, hair restoring, manicuring,

— installation, repair, maintenance or service of

fuel. If you are a seller of motor fuel or diesel motor

pedicuring, electrolysis, massage and similar

machinery and equipment used directly and

fuel, see Notice to Retail Sellers of Motor Fuel or

services;

predominantly in production;

Diesel Motor Fuel on page 2. The return must also

show the receipts subject to the special taxes

— charges from sales of services or for the use of

— installation, repair, maintenance or service of

imposed on passenger car rentals, and information

weight control salons, health salons,

central office equipment or station apparatus

and entertainment services provided through

gymnasiums, turkish baths, sauna baths and

used directly and predominantly in receiving or

telephony and telegraphy.

similar establishments;

initiating and switching telephone or telegraph

communication; and

— charges for occupancy of hotels, motels and

The front of the return is used to summarize the

business activity and tax due. Part II is used to

similar establishments;

— installation, repair, maintenance or service of

report the details of taxable sales and services and

parts, tools and supplies used in connection

— interior decorating and designing services; and

purchases subject to use tax and the total state

with the above machinery, equipment or

— interior cleaning and maintenance services.

and local taxes due for each taxing jurisdiction.

apparatus.

Part II is also used to report the details of the

Form ST-810.5-ATT, Schedule N-ATT, is also

required of vendors who provide parking services in

New York City.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4