Instructions For Form Ftb 3535 - Manufacturers' Investment Credit

ADVERTISEMENT

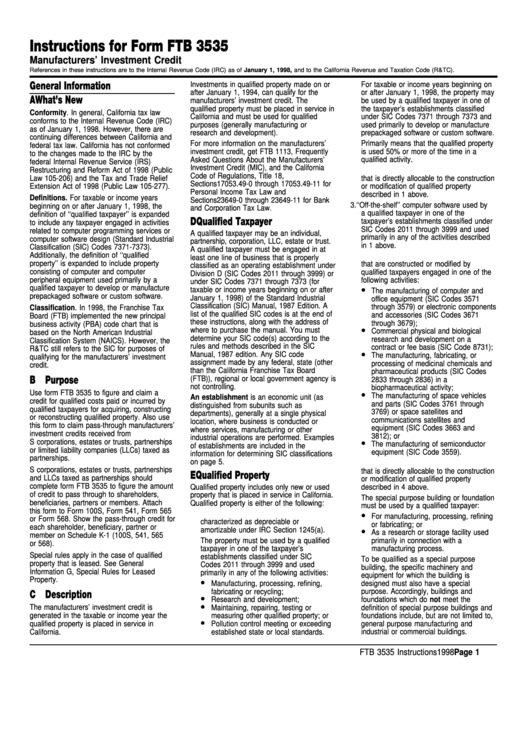

Instructions for Form FTB 3535

Manufacturers’ Investment Credit

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

General Information

Investments in qualified property made on or

For taxable or income years beginning on

after January 1, 1994, can qualify for the

or after January 1, 1998, the property may

A What’s New

manufacturers’ investment credit. The

be used by a qualified taxpayer in one of

qualified property must be placed in service in

the taxpayer’s establishments classified

Conformity. In general, California tax law

California and must be used for qualified

under SIC Codes 7371 through 7373 and

conforms to the Internal Revenue Code (IRC)

purposes (generally manufacturing or

used primarily to develop or manufacture

as of January 1, 1998. However, there are

prepackaged software or custom software.

research and development).

continuing differences between California and

For more information on the manufacturers’

Primarily means that the qualified property

federal tax law. California has not conformed

investment credit, get FTB 1113, Frequently

is used 50% or more of the time in a

to the changes made to the IRC by the

Asked Questions About the Manufacturers’

qualified activity.

federal Internal Revenue Service (IRS)

Investment Credit (MIC), and the California

Restructuring and Reform Act of 1998 (Public

2. The value of any capitalized labor costs

Code of Regulations, Title 18,

Law 105-206) and the Tax and Trade Relief

that is directly allocable to the construction

Sections 17053.49-0 through 17053.49-11 for

Extension Act of 1998 (Public Law 105-277).

or modification of qualified property

Personal Income Tax Law and

described in 1 above.

Definitions. For taxable or income years

Sections 23649-0 through 23649-11 for Bank

3. ‘‘Off-the-shelf’’ computer software used by

beginning on or after January 1, 1998, the

and Corporation Tax Law.

a qualified taxpayer in one of the

definition of ‘‘qualified taxpayer’’ is expanded

D Qualified Taxpayer

taxpayer’s establishments classified under

to include any taxpayer engaged in activities

SIC Codes 2011 through 3999 and used

related to computer programming services or

A qualified taxpayer may be an individual,

primarily in any of the activities described

computer software design (Standard Industrial

partnership, corporation, LLC, estate or trust.

in 1 above.

Classification (SIC) Codes 7371-7373).

A qualified taxpayer must be engaged in at

Additionally, the definition of ‘‘qualified

4. Special purpose buildings and foundations

least one line of business that is properly

property’’ is expanded to include property

that are constructed or modified by

classified as an operating establishment under

consisting of computer and computer

qualified taxpayers engaged in one of the

Division D (SIC Codes 2011 through 3999) or

peripheral equipment used primarily by a

following activities:

under SIC Codes 7371 through 7373 (for

•

qualified taxpayer to develop or manufacture

taxable or income years beginning on or after

The manufacturing of computer and

prepackaged software or custom software.

January 1, 1998) of the Standard Industrial

office equipment (SIC Codes 3571

Classification (SIC) Manual, 1987 Edition. A

through 3579) or electronic components

Classification. In 1998, the Franchise Tax

list of the qualified SIC codes is at the end of

and accessories (SIC Codes 3671

Board (FTB) implemented the new principal

these instructions, along with the address of

through 3679);

business activity (PBA) code chart that is

•

where to purchase the manual. You must

Commercial physical and biological

based on the North American Industrial

determine your SIC code(s) according to the

research and development on a

Classification System (NAICS). However, the

rules and methods described in the SIC

contract or fee basis (SIC Code 8731);

R&TC still refers to the SIC for purposes of

•

Manual, 1987 edition. Any SIC code

The manufacturing, fabricating, or

qualifying for the manufacturers’ investment

assignment made by any federal, state (other

processing of medicinal chemicals and

credit.

than the California Franchise Tax Board

pharmaceutical products (SIC Codes

B Purpose

(FTB)), regional or local government agency is

2833 through 2836) in a

not controlling.

biopharmaceutical activity;

•

Use form FTB 3535 to figure and claim a

The manufacturing of space vehicles

An establishment is an economic unit (as

credit for qualified costs paid or incurred by

and parts (SIC Codes 3761 through

distinguished from subunits such as

qualified taxpayers for acquiring, constructing

3769) or space satellites and

departments), generally at a single physical

or reconstructing qualified property. Also use

communications satellites and

location, where business is conducted or

this form to claim pass-through manufacturers’

equipment (SIC Codes 3663 and

where services, manufacturing or other

investment credits received from

3812); or

industrial operations are performed. Examples

•

S corporations, estates or trusts, partnerships

The manufacturing of semiconductor

of establishments are included in the

or limited liability companies (LLCs) taxed as

equipment (SIC Code 3559).

information for determining SIC classifications

partnerships.

on page 5.

5. The value of any capitalized labor costs

S corporations, estates or trusts, partnerships

that is directly allocable to the construction

E Qualified Property

and LLCs taxed as partnerships should

or modification of qualified property

complete form FTB 3535 to figure the amount

Qualified property includes only new or used

described in 4 above.

of credit to pass through to shareholders,

property that is placed in service in California.

The special purpose building or foundation

beneficiaries, partners or members. Attach

Qualified property is either of the following:

must be used by a qualified taxpayer:

this form to Form 100S, Form 541, Form 565

•

1. Tangible personal property that is

For manufacturing, processing, refining

or Form 568. Show the pass-through credit for

characterized as depreciable or

or fabricating; or

each shareholder, beneficiary, partner or

•

amortizable under IRC Section 1245(a).

As a research or storage facility used

member on Schedule K-1 (100S, 541, 565

The property must be used by a qualified

primarily in connection with a

or 568).

taxpayer in one of the taxpayer’s

manufacturing process.

Special rules apply in the case of qualified

establishments classified under SIC

To be qualified as a special purpose

property that is leased. See General

Codes 2011 through 3999 and used

building, the specific machinery and

Information G, Special Rules for Leased

primarily in any of the following activities:

equipment for which the building is

•

Property.

Manufacturing, processing, refining,

designed must also have a special

fabricating or recycling;

purpose. Accordingly, buildings and

C Description

•

Research and development;

foundations which do not meet the

•

The manufacturers’ investment credit is

Maintaining, repairing, testing or

definition of special purpose buildings and

generated in the taxable or income year the

measuring other qualified property; or

foundations include, but are not limited to,

•

qualified property is placed in service in

Pollution control meeting or exceeding

general purpose manufacturing and

California.

established state or local standards.

industrial or commercial buildings.

FTB 3535 Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6