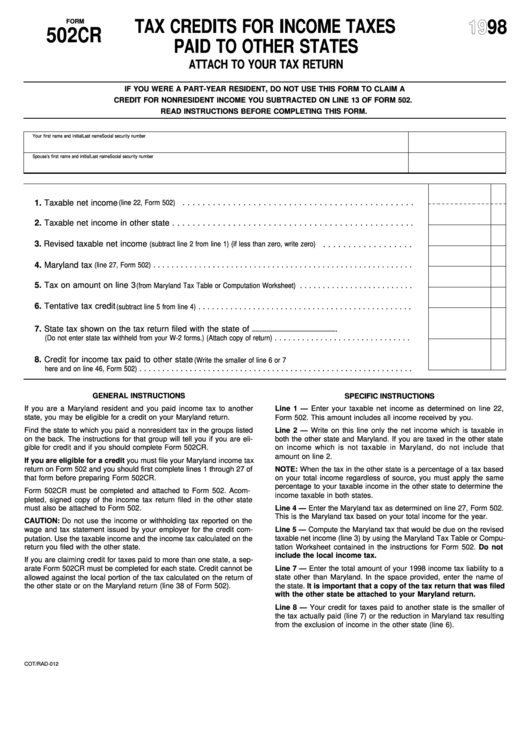

FORM

TAX CREDITS FOR INCOME TAXES

98

19

502 CR

PAID TO OTHER STATES

ATTACH TO YOUR TAX RETURN

IF YOU WERE A PART-YEAR RESIDENT, DO NOT USE THIS FORM TO CLAIM A

CREDIT FOR NONRESIDENT INCOME YOU SUBTRACTED ON LINE 13 OF FORM 502.

READ INSTRUCTIONS BEFORE COMPLETING THIS FORM.

Your first name and initial

Last name

Social security number

Spouse’s first name and initial

Last name

Social security number

1. Taxable net income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(line 22, Form 502)

2. Taxable net income in other state . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Revised taxable net income

. . . . . . . . . . . . . . . . . .

(subtract line 2 from line 1) (if less than zero, write zero)

4. Maryland tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(line 27, Form 502)

5. Tax on amount on line 3

. . . . . . . . . . . . . . . . . . . . . . . . .

(from Maryland Tax Table or Computation Worksheet)

6. Tentative tax credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 5 from line 4)

7. State tax shown on the tax return filed with the state of __________________ .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Do not enter state tax withheld from your W-2 forms.) (Attach copy of return)

8. Credit for income tax paid to other state

(Write the smaller of line 6 or 7

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

here and on line 46, Form 502)

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

If you are a Maryland resident and you paid income tax to another

Line 1 — Enter your taxable net income as determined on line 22,

state, you may be eligible for a credit on your Maryland return.

Form 502. This amount includes all income received by you.

Find the state to which you paid a nonresident tax in the groups listed

Line 2 — Write on this line only the net income which is taxable in

on the back. The instructions for that group will tell you if you are eli-

both the other state and Maryland. If you are taxed in the other state

gible for credit and if you should complete Form 502CR.

on income which is not taxable in Maryland, do not include that

amount on line 2.

If you are eligible for a credit you must file your Maryland income tax

return on Form 502 and you should first complete lines 1 through 27 of

NOTE: When the tax in the other state is a percentage of a tax based

that form before preparing Form 502CR.

on your total income regardless of source, you must apply the same

percentage to your taxable income in the other state to determine the

Form 502CR must be completed and attached to Form 502. A com-

income taxable in both states.

pleted, signed copy of the income tax return filed in the other state

must also be attached to Form 502.

Line 4 — Enter the Maryland tax as determined on line 27, Form 502.

This is the Maryland tax based on your total income for the year.

CAUTION: Do not use the income or withholding tax reported on the

wage and tax statement issued by your employer for the credit com-

Line 5 — Compute the Maryland tax that would be due on the revised

putation. Use the taxable income and the income tax calculated on the

taxable net income (line 3) by using the Maryland Tax Table or Compu-

return you filed with the other state.

tation Worksheet contained in the instructions for Form 502. Do not

include the local income tax.

If you are claiming credit for taxes paid to more than one state, a sep-

arate Form 502CR must be completed for each state. Credit cannot be

Line 7 — Enter the total amount of your 1998 income tax liability to a

allowed against the local portion of the tax calculated on the return of

state other than Maryland. In the space provided, enter the name of

the other state or on the Maryland return (line 38 of Form 502).

the state. It is important that a copy of the tax return that was filed

with the other state be attached to your Maryland return.

Line 8 — Your credit for taxes paid to another state is the smaller of

the tax actually paid (line 7) or the reduction in Maryland tax resulting

from the exclusion of income in the other state (line 6).

COT/RAD-012

1

1 2

2