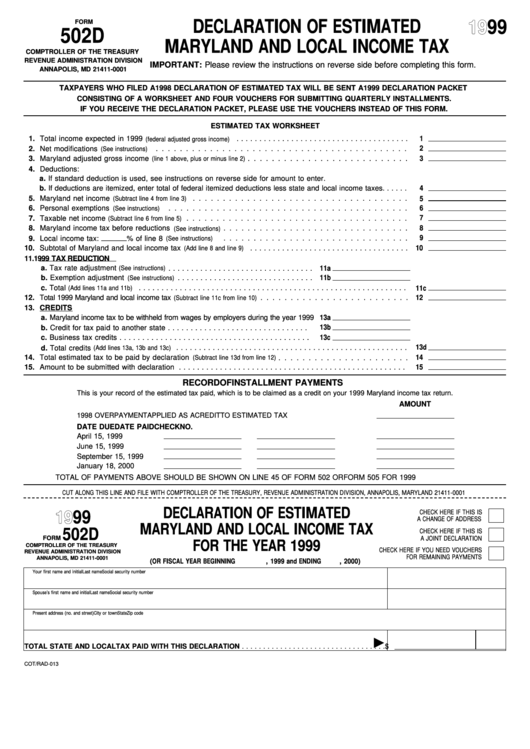

DECLARATION OF ESTIMATED

99

FORM

19

502 D

MARYLAND AND LOCAL INCOME TAX

COMPTROLLER OF THE TREASURY

REVENUE ADMINISTRATION DIVISION

IMPORTANT: Please review the instructions on reverse side before completing this form.

ANNAPOLIS, MD 21411-0001

TAXPAYERS WHO FILED A 1998 DECLARATION OF ESTIMATED TAX WILL BE SENT A 1999 DECLARATION PACKET

CONSISTING OF A WORKSHEET AND FOUR VOUCHERS FOR SUBMITTING QUARTERLY INSTALLMENTS.

IF YOU RECEIVE THE DECLARATION PACKET, PLEASE USE THE VOUCHERS INSTEAD OF THIS FORM.

ESTIMATED TAX WORKSHEET

1

1. Total income expected in 1999

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(federal adjusted gross income)

2

2. Net modifications

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions)

3

3. Maryland adjusted gross income

. . . . . . . . . . . . . . . . . . . . . . . . . . .

(line 1 above, plus or minus line 2)

4. Deductions:

a. If standard deduction is used, see instructions on reverse side for amount to enter.

4

b. If deductions are itemized, enter total of federal itemized deductions less state and local income taxes. . . . . .

5

5. Maryland net income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Subtract line 4 from line 3)

6

6. Personal exemptions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions)

7

7. Taxable net income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Subtract line 6 from line 5)

8

8. Maryland income tax before reductions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions)

9. Local income tax: ______ % of line 8

9

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions)

10

10. Subtotal of Maryland and local income tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Add line 8 and line 9)

11. 1999 TAX REDUCTION

11a

a. Tax rate adjustment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions)

11b

b. Exemption adjustment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(See instructions)

11c

c. Total

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Add lines 11a and 11b)

12

12. Total 1999 Maryland and local income tax

. . . . . . . . . . . . . . . . . . . . . . . . .

(Subtract line 11c from line 10)

13. CREDITS

13a

a. Maryland income tax to be withheld from wages by employers during the year 1999

13b

b. Credit for tax paid to another state . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13c

c. Business tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13d

d. Total credits

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Add lines 13a, 13b and 13c)

14

14. Total estimated tax to be paid by declaration

. . . . . . . . . . . . . . . . . . . . . .

(Subtract line 13d from line 12)

15

15. Amount to be submitted with declaration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

RECORD OF INSTALLMENT PAYMENTS

This is your record of the estimated tax paid, which is to be claimed as a credit on your 1999 Maryland income tax return.

AMOUNT

1998 OVERPAYMENT APPLIED AS A CREDIT TO ESTIMATED TAX

DATE DUE

DATE PAID

CHECK NO.

April 15, 1999

June 15, 1999

September 15, 1999

January 18, 2000

TOTAL OF PAYMENTS ABOVE SHOULD BE SHOWN ON LINE 45 OF FORM 502 OR FORM 505 FOR 1999

CUT ALONG THIS LINE AND FILE WITH COMPTROLLER OF THE TREASURY, REVENUE ADMINISTRATION DIVISION, ANNAPOLIS, MARYLAND 21411-0001

DECLARATION OF ESTIMATED

99

CHECK HERE IF THIS IS

19

A CHANGE OF ADDRESS

MARYLAND AND LOCAL INCOME TAX

502 D

CHECK HERE IF THIS IS

FORM

A JOINT DECLARATION

FOR THE YEAR 1999

COMPTROLLER OF THE TREASURY

CHECK HERE IF YOU NEED VOUCHERS

REVENUE ADMINISTRATION DIVISION

FOR REMAINING PAYMENTS

ANNAPOLIS, MD 21411-0001

(OR FISCAL YEAR BEGINNING

, 1999 and ENDING

, 2000)

Your first name and initial

Last name

Social security number

Spouse’s first name and initial

Last name

Social security number

Present address (no. and street)

City or town

State

Zip code

TOTAL STATE AND LOCAL TAX PAID WITH THIS DECLARATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

COT/RAD-013

1

1