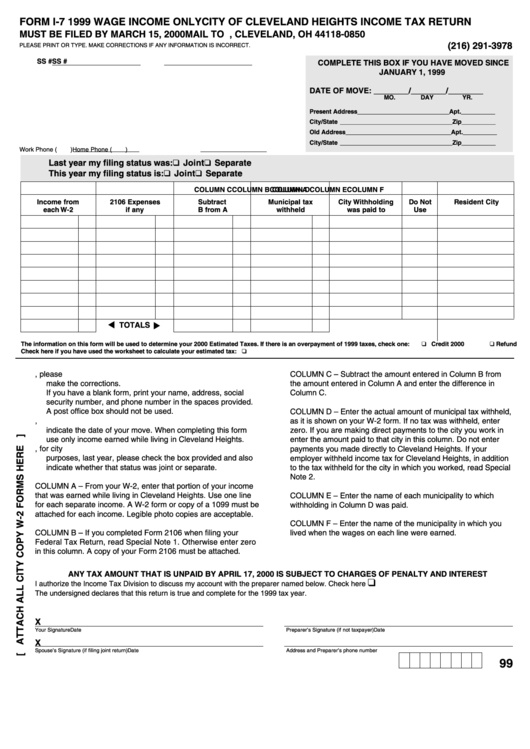

Form I-7 - 1999 Wage Income Only - City Of Cleveland Heights Income Tax Return

ADVERTISEMENT

FORM I-7 1999 WAGE INCOME ONLY

CITY OF CLEVELAND HEIGHTS INCOME TAX RETURN

MUST BE FILED BY MARCH 15, 2000

MAIL TO P.O. BOX 18850, CLEVELAND, OH 44118-0850

(216) 291-3978

PLEASE PRINT OR TYPE. MAKE CORRECTIONS IF ANY INFORMATION IS INCORRECT.

SS #

SS #

COMPLETE THIS BOX IF YOU HAVE MOVED SINCE

JANUARY 1, 1999

DATE OF MOVE: ________/________/________

MO.

DAY

YR.

Present Address ___________________________

Apt. __________

City/State _________________________________

Zip

__________

Old Address _______________________________

Apt. __________

City/State _________________________________

Zip

__________

Work Phone (

)

Home Phone (

)

❑ Joint

❑ Separate

Last year my filing status was:

❑ Joint

❑ Separate

This year my filing status is:

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

Income from

2106 Expenses

Subtract

Municipal tax

City Withholding

Do Not

Resident City

each W-2

if any

B from A

withheld

was paid to

Use

TOTALS

❑ Credit 2000

❑ Refund

The information on this form will be used to determine your 2000 Estimated Taxes. If there is an overpayment of 1999 taxes, check one:

Check here if you have used the worksheet to calculate your estimated tax: ❑

1. If any of the information on the address is in error, please

COLUMN C – Subtract the amount entered in Column B from

make the corrections.

the amount entered in Column A and enter the difference in

If you have a blank form, print your name, address, social

Column C.

security number, and phone number in the spaces provided.

A post office box should not be used.

COLUMN D – Enter the actual amount of municipal tax withheld,

2. If you moved into or out of the City of Cleveland Heights,

as it is shown on your W-2 form. If no tax was withheld, enter

indicate the date of your move. When completing this form

zero. If you are making direct payments to the city you work in

use only income earned while living in Cleveland Heights.

enter the amount paid to that city in this column. Do not enter

3. If you or your spouse had a different filing status, for city

payments you made directly to Cleveland Heights. If your

purposes, last year, please check the box provided and also

employer withheld income tax for Cleveland Heights, in addition

indicate whether that status was joint or separate.

to the tax withheld for the city in which you worked, read Special

Note 2.

COLUMN A – From your W-2, enter that portion of your income

that was earned while living in Cleveland Heights. Use one line

COLUMN E – Enter the name of each municipality to which

for each separate income. A W-2 form or copy of a 1099 must be

withholding in Column D was paid.

attached for each income. Legible photo copies are acceptable.

COLUMN F – Enter the name of the municipality in which you

COLUMN B – If you completed Form 2106 when filing your

lived when the wages on each line were earned.

Federal Tax Return, read Special Note 1. Otherwise enter zero

in this column. A copy of your Form 2106 must be attached.

ANY TAX AMOUNT THAT IS UNPAID BY APRIL 17, 2000 IS SUBJECT TO CHARGES OF PENALTY AND INTEREST

❑

I authorize the Income Tax Division to discuss my account with the preparer named below. Check here

The undersigned declares that this return is true and complete for the 1999 tax year.

X

Your Signature

Date

Preparer’s Signature (if not taxpayer)

Date

X

Spouse’s Signature (if filing joint return)

Date

Address and Preparer’s phone number

99

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1