Form Bt-1 - Business Tax Application

ADVERTISEMENT

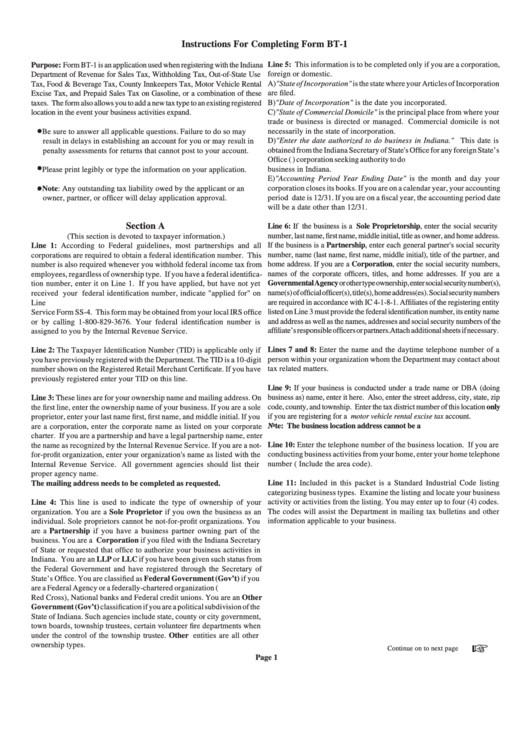

Instructions For Completing Form BT-1

Line 5: This information is to be completed only if you are a corporation,

Purpose: Form BT-1 is an application used when registering with the Indiana

foreign or domestic.

Department of Revenue for Sales Tax, Withholding Tax, Out-of-State Use

A)"State of Incorporation" is the state where your Articles of Incorporation

Tax, Food & Beverage Tax, County Innkeepers Tax, Motor Vehicle Rental

Excise Tax, and Prepaid Sales Tax on Gasoline, or a combination of these

are filed.

B)"Date of Incorporation" is the date you incorporated.

taxes. The form also allows you to add a new tax type to an existing registered

C)"State of Commercial Domicile" is the principal place from where your

location in the event your business activities expand.

trade or business is directed or managed. Commercial domicile is not

l

necessarily in the state of incorporation.

Be sure to answer all applicable questions. Failure to do so may

D)"Enter the date authorized to do business in Indiana." This date is

result in delays in establishing an account for you or may result in

obtained from the Indiana Secretary of State's Office for any foreign State’s

penalty assessments for returns that cannot post to your account.

Office (i.e. not incorporated in Indiana) corporation seeking authority to do

l

business in Indiana.

Please print legibly or type the information on your application.

E)"Accounting Period Year Ending Date" is the month and day your

.

l

corporation closes its books. If you are on a calendar year, your accounting

Note: Any outstanding tax liability owed by the applicant or an

period date is 12/31. If you are on a fiscal year, the accounting period date

owner, partner, or officer will delay application approval.

will be a date other than 12/31.

Section A

Line 6: If the business is a Sole Proprietorship, enter the social security

number, last name, first name, middle initial, title as owner, and home address.

(This section is devoted to taxpayer information.)

If the business is a Partnership, enter each general partner's social security

Line 1: According to Federal guidelines, most partnerships and all

number, name (last name, first name, middle initial), title of the partner, and

corporations are required to obtain a federal identification number. This

number is also required whenever you withhold federal income tax from

home address. If you are a Corporation, enter the social security numbers,

names of the corporate officers, titles, and home addresses. If you are a

employees, regardless of ownership type. If you have a federal identifica-

Governmental Agency or other type ownership, enter social security number(s),

tion number, enter it on Line 1. If you have applied, but have not yet

name(s) of official officer(s), title(s), home address(es). Social security numbers

received your federal identification number, indicate "applied for" on

are required in accordance with IC 4-1-8-1. Affiliates of the registering entity

Line 1.You may get this number by completing the Internal Revenue

listed on Line 3 must provide the federal identification number, its entity name

Service Form SS-4. This form may be obtained from your local IRS office

and address as well as the names, addresses and social security numbers of the

or by calling 1-800-829-3676. Your federal identification number is

affiliate’s responsible officers or partners. Attach additional sheets if necessary.

assigned to you by the Internal Revenue Service.

Line 2: The Taxpayer Identification Number (TID) is applicable only if

Lines 7 and 8: Enter the name and the daytime telephone number of a

person within your organization whom the Department may contact about

you have previously registered with the Department. The TID is a 10-digit

tax related matters.

number shown on the Registered Retail Merchant Certificate. If you have

previously registered enter your TID on this line.

Line 9: If your business is conducted under a trade name or DBA (doing

business as) name, enter it here. Also, enter the street address, city, state, zip

Line 3: These lines are for your ownership name and mailing address. On

code, county, and township. Enter the tax district number of this location only

the first line, enter the ownership name of your business. If you are a sole

if you are registering for a motor vehicle rental excise tax account.

proprietor, enter your last name first, first name, and middle initial. If you

Note: The business location address cannot be a P.O. Box Number.

are a corporation, enter the corporate name as listed on your corporate

charter. If you are a partnership and have a legal partnership name, enter

Line 10: Enter the telephone number of the business location. If you are

the name as recognized by the Internal Revenue Service. If you are a not-

conducting business activities from your home, enter your home telephone

for-profit organization, enter your organization's name as listed with the

number ( Include the area code).

Internal Revenue Service. All government agencies should list their

proper agency name.

Line 11: Included in this packet is a Standard Industrial Code listing

The mailing address needs to be completed as requested.

categorizing business types. Examine the listing and locate your business

activity or activities from the listing. You may enter up to four (4) codes.

Line 4: This line is used to indicate the type of ownership of your

The codes will assist the Department in mailing tax bulletins and other

organization. You are a Sole Proprietor if you own the business as an

information applicable to your business.

individual. Sole proprietors cannot be not-for-profit organizations. You

are a Partnership if you have a business partner owning part of the

business. You are a Corporation if you filed with the Indiana Secretary

of State or requested that office to authorize your business activities in

Indiana. You are an LLP or LLC if you have been given such status from

the Federal Government and have registered through the Secretary of

State’s Office. You are classified as Federal Government (Gov’t) if you

are a Federal Agency or a federally-chartered organization (e.g. American

Red Cross), National banks and Federal credit unions. You are an Other

Government (Gov’t) classification if you are a political subdivision of the

State of Indiana. Such agencies include state, county or city government,

town boards, township trustees, certain volunteer fire departments when

under the control of the township trustee. Other entities are all other

+

ownership types.

Continue on to next page

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12