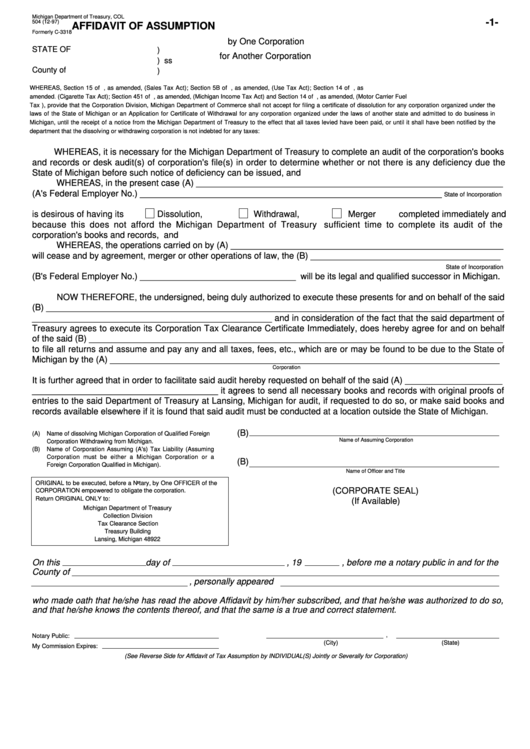

Michigan Department of Treasury, COL

-1-

504 (12-97)

AFFIDAVIT OF ASSUMPTION

Formerly C-3318

by One Corporation

STATE OF

)

for Another Corporation

) ss

County of

)

WHEREAS, Section 15 of P.A. 167 of 1933, as amended, (Sales Tax Act); Section 5B of P.A. 94 of 1937, as amended, (Use Tax Act); Section 14 of P.A. 265 of 1947, as

amended. (Cigarette Tax Act); Section 451 of P.A. 281 of 1967, as amended, (Michigan Income Tax Act) and Section 14 of P.A. 119 of 1980, as amended, (Motor Carrier Fuel

Tax ), provide that the Corporation Division, Michigan Department of Commerce shall not accept for filing a certificate of dissolution for any corporation organized under the

laws of the State of Michigan or an Application for Certificate of Withdrawal for any corporation organized under the laws of another state and admitted to do business in

Michigan, until the receipt of a notice from the Michigan Department of Treasury to the effect that all taxes levied have been paid, or until it shall have been notified by the

department that the dissolving or withdrawing corporation is not indebted for any taxes:

WHEREAS, it is necessary for the Michigan Department of Treasury to complete an audit of the corporation's books

and records or desk audit(s) of corporation's file(s) in order to determine whether or not there is any deficiency due the

State of Michigan before such notice of deficiency can be issued, and

WHEREAS, in the present case (A) _______________________________________________________________

(A's Federal Employer No.) ______________________________________________________________

State of Incorporation

is desirous of having its

Dissolution,

Withdrawal,

Merger

completed immediately and

because this does not afford the Michigan Department of Treasury sufficient time to complete its audit of the

corporation's books and records, and

WHEREAS, the operations carried on by (A) ________________________________________________________

will cease and by agreement, merger or other operations of law, the (B) _______________________________________

State of Incorporation

(B's Federal Employer No.) ________________________________ will be its legal and qualified successor in Michigan.

NOW THEREFORE, the undersigned, being duly authorized to execute these presents for and on behalf of the said

(B) ______________________________________________________________________________________________

_________________________________________________ and in consideration of the fact that the said department of

Treasury agrees to execute its Corporation Tax Clearance Certificate Immediately, does hereby agree for and on behalf

of the said (B) _____________________________________________________________________________________

to file all returns and assume and pay any and all taxes, fees, etc., which are or may be found to be due to the State of

Michigan by the (A) ________________________________________________________________________________

Corporation

It is further agreed that in order to facilitate said audit hereby requested on behalf of the said (A) ____________________

______________________________________ it agrees to send all necessary books and records with original proofs of

entries to the said Department of Treasury at Lansing, Michigan for audit, if requested to do so, or make said books and

records available elsewhere if it is found that said audit must be conducted at a location outside the State of Michigan.

(B)

(A)

Name of dissolving Michigan Corporation of Qualified Foreign

Name of Assuming Corporation

Corporation Withdrawing from Michigan.

(B)

Name of Corporation Assuming (A's) Tax Liability (Assuming

Corporation must be either a Michigan Corporation or a

(B)

Foreign Corporation Qualified in Michigan).

Name of Officer and Title

ORIGINAL to be executed, before a Notary, by One OFFICER of the

(CORPORATE SEAL)

CORPORATION empowered to obligate the corporation.

Return ORIGINAL ONLY to:

(If Available)

Michigan Department of Treasury

Collection Division

Tax Clearance Section

Treasury Building

Lansing, Michigan 48922

On this

day of

, 19

, before me a notary public in and for the

County of

, personally appeared

who made oath that he/she has read the above Affidavit by him/her subscribed, and that he/she was authorized to do so,

and that he/she knows the contents thereof, and that the same is a true and correct statement.

,

Notary Public:

(City)

(State)

My Commission Expires:

(See Reverse Side for Affidavit of Tax Assumption by INDIVIDUAL(S) Jointly or Severally for Corporation)

1

1 2

2