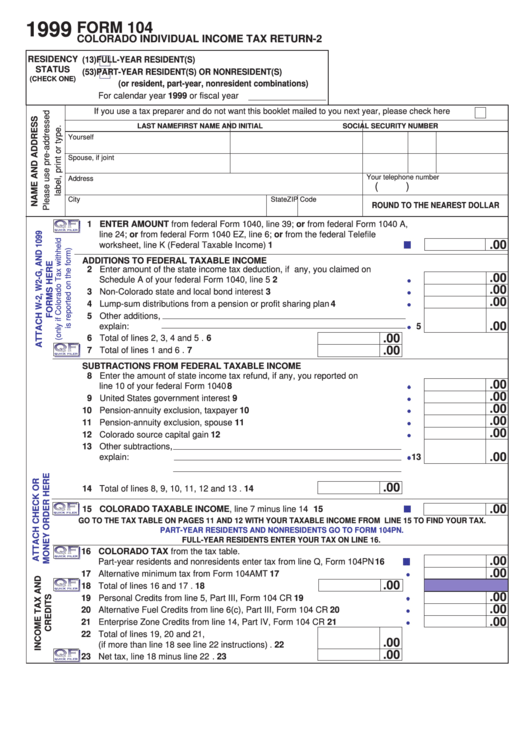

Form 104 - Colorado Individual Income Tax Return-2 - 1999

ADVERTISEMENT

1999

FORM 104

COLORADO INDIVIDUAL INCOME TAX RETURN-2

RESIDENCY

(13)

FULL-YEAR RESIDENT(S)

STATUS

(53)

PART-YEAR RESIDENT(S) OR NONRESIDENT(S)

(CHECK ONE)

(or resident, part-year, nonresident combinations)

For calendar year 1999 or fiscal year

If you use a tax preparer and do not want this booklet mailed to you next year, please check here ......

LAST NAME

FIRST NAME AND INITIAL

SOCIAL SECURITY NUMBER

Yourself

Spouse, if joint

Your telephone number

Address

(

)

City

State

ZIP Code

ROUND TO THE NEAREST DOLLAR

1 ENTER AMOUNT from federal Form 1040, line 39; or from federal Form 1040 A,

line 24; or from federal Form 1040 EZ, line 6; or from the federal Telefile

.00

worksheet, line K (Federal Taxable Income) .......................................................

1

ADDITIONS TO FEDERAL TAXABLE INCOME

2 Enter amount of the state income tax deduction, if any, you claimed on

.00

Schedule A of your federal Form 1040, line 5 .......................................................

2

.00

3 Non-Colorado state and local bond interest ..........................................................

3

.00

4 Lump-sum distributions from a pension or profit sharing plan ...............................

4

5 Other additions,

.00

explain:

5

.00

6 Total of lines 2, 3, 4 and 5 ............................................ 6

.00

7 Total of lines 1 and 6 .................................................... 7

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

8 Enter the amount of state income tax refund, if any, you reported on

.00

line 10 of your federal Form 1040 ..........................................................................

8

.00

9 United States government interest ........................................................................

9

.00

10 Pension-annuity exclusion, taxpayer ..................................................................... 10

.00

11 Pension-annuity exclusion, spouse ....................................................................... 11

.00

12 Colorado source capital gain ................................................................................. 12

13 Other subtractions,

.00

explain:

13

.00

14 Total of lines 8, 9, 10, 11, 12 and 13 ........................... 14

.00

15 COLORADO TAXABLE INCOME, line 7 minus line 14 .....................................

15

GO TO THE TAX TABLE ON PAGES 11 AND 12 WITH YOUR TAXABLE INCOME FROM LINE 15 TO FIND YOUR TAX.

PART-YEAR RESIDENTS AND NONRESIDENTS GO TO FORM 104PN.

FULL-YEAR RESIDENTS ENTER YOUR TAX ON LINE 16.

16 COLORADO TAX from the tax table.

.00

Part-year residents and nonresidents enter tax from line Q, Form 104PN ..........

16

.00

17 Alternative minimum tax from Form 104AMT ........................................................ 17

.00

18 Total of lines 16 and 17 ............................................... 18

.00

19 Personal Credits from line 5, Part III, Form 104 CR .............................................. 19

.00

20 Alternative Fuel Credits from line 6(c), Part III, Form 104 CR ............................... 20

.00

21 Enterprise Zone Credits from line 14, Part IV, Form 104 CR ................................ 21

22 Total of lines 19, 20 and 21,

.00

(if more than line 18 see line 22 instructions) .............. 22

.00

23 Net tax, line 18 minus line 22 ...................................... 23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2