Instructions For Form Ftb 3885l - Depreciation And Amortization - 1998

ADVERTISEMENT

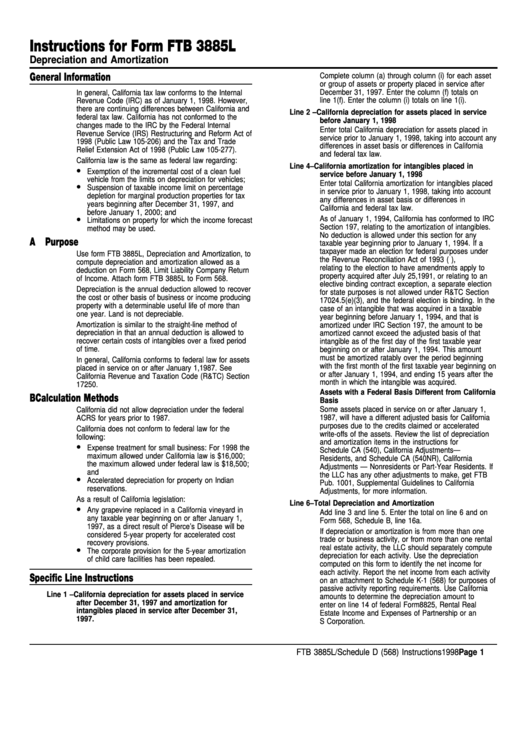

Instructions for Form FTB 3885L

Depreciation and Amortization

General Information

Complete column (a) through column (i) for each asset

or group of assets or property placed in service after

December 31, 1997. Enter the column (f) totals on

In general, California tax law conforms to the Internal

Revenue Code (IRC) as of January 1, 1998. However,

line 1(f). Enter the column (i) totals on line 1(i).

there are continuing differences between California and

Line 2 – California depreciation for assets placed in service

federal tax law. California has not conformed to the

before January 1, 1998

changes made to the IRC by the Federal Internal

Enter total California depreciation for assets placed in

Revenue Service (IRS) Restructuring and Reform Act of

service prior to January 1, 1998, taking into account any

1998 (Public Law 105-206) and the Tax and Trade

differences in asset basis or differences in California

Relief Extension Act of 1998 (Public Law 105-277).

and federal tax law.

California law is the same as federal law regarding:

Line 4 – California amortization for intangibles placed in

•

Exemption of the incremental cost of a clean fuel

service before January 1, 1998

vehicle from the limits on depreciation for vehicles;

Enter total California amortization for intangibles placed

•

Suspension of taxable income limit on percentage

in service prior to January 1, 1998, taking into account

depletion for marginal production properties for tax

any differences in asset basis or differences in

years beginning after December 31, 1997, and

California and federal tax law.

before January 1, 2000; and

•

As of January 1, 1994, California has conformed to IRC

Limitations on property for which the income forecast

Section 197, relating to the amortization of intangibles.

method may be used.

No deduction is allowed under this section for any

A Purpose

taxable year beginning prior to January 1, 1994. If a

taxpayer made an election for federal purposes under

Use form FTB 3885L, Depreciation and Amortization, to

the Revenue Reconciliation Act of 1993 (P.L. 103-66),

compute depreciation and amortization allowed as a

relating to the election to have amendments apply to

deduction on Form 568, Limit Liability Company Return

property acquired after July 25, 1991, or relating to an

of Income. Attach form FTB 3885L to Form 568.

elective binding contract exception, a separate election

Depreciation is the annual deduction allowed to recover

for state purposes is not allowed under R&TC Section

the cost or other basis of business or income producing

17024.5(e)(3), and the federal election is binding. In the

property with a determinable useful life of more than

case of an intangible that was acquired in a taxable

one year. Land is not depreciable.

year beginning before January 1, 1994, and that is

Amortization is similar to the straight-line method of

amortized under IRC Section 197, the amount to be

depreciation in that an annual deduction is allowed to

amortized cannot exceed the adjusted basis of that

recover certain costs of intangibles over a fixed period

intangible as of the first day of the first taxable year

of time.

beginning on or after January 1, 1994. This amount

must be amortized ratably over the period beginning

In general, California conforms to federal law for assets

with the first month of the first taxable year beginning on

placed in service on or after January 1, 1987. See

or after January 1, 1994, and ending 15 years after the

California Revenue and Taxation Code (R&TC) Section

month in which the intangible was acquired.

17250.

Assets with a Federal Basis Different from California

B Calculation Methods

Basis

Some assets placed in service on or after January 1,

California did not allow depreciation under the federal

ACRS for years prior to 1987.

1987, will have a different adjusted basis for California

purposes due to the credits claimed or accelerated

California does not conform to federal law for the

write-offs of the assets. Review the list of depreciation

following:

and amortization items in the instructions for

•

Expense treatment for small business: For 1998 the

Schedule CA (540), California Adjustments —

maximum allowed under California law is $16,000;

Residents, and Schedule CA (540NR), California

the maximum allowed under federal law is $18,500;

Adjustments — Nonresidents or Part-Year Residents. If

and

the LLC has any other adjustments to make, get FTB

•

Accelerated depreciation for property on Indian

Pub. 1001, Supplemental Guidelines to California

reservations.

Adjustments, for more information.

As a result of California legislation:

Line 6 – Total Depreciation and Amortization

•

Any grapevine replaced in a California vineyard in

Add line 3 and line 5. Enter the total on line 6 and on

any taxable year beginning on or after January 1,

Form 568, Schedule B, line 16a.

1997, as a direct result of Pierce’s Disease will be

If depreciation or amortization is from more than one

considered 5-year property for accelerated cost

trade or business activity, or from more than one rental

recovery provisions.

•

real estate activity, the LLC should separately compute

The corporate provision for the 5-year amortization

depreciation for each activity. Use the depreciation

of child care facilities has been repealed.

computed on this form to identify the net income for

each activity. Report the net income from each activity

Specific Line Instructions

on an attachment to Schedule K-1 (568) for purposes of

passive activity reporting requirements. Use California

Line 1 – California depreciation for assets placed in service

amounts to determine the depreciation amount to

after December 31, 1997 and amortization for

enter on line 14 of federal Form 8825, Rental Real

intangibles placed in service after December 31,

Estate Income and Expenses of Partnership or an

1997.

S Corporation.

FTB 3885L/Schedule D (568) Instructions 1998 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2