Form 529 Draft - Small Business Guaranty Fee Credit - 2007

ADVERTISEMENT

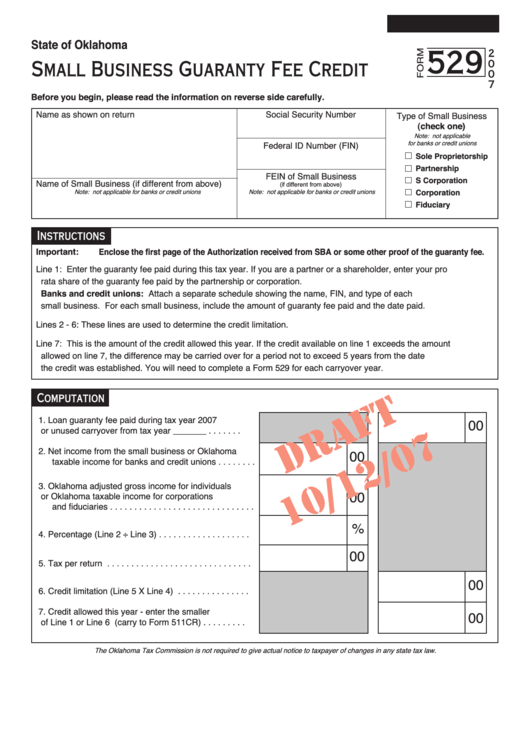

State of Oklahoma

529

2

Small Business Guaranty Fee Credit

0

0

7

Before you begin, please read the information on reverse side carefully.

Name as shown on return

Social Security Number

Type of Small Business

(check one)

Note: not applicable

for banks or credit unions

Federal ID Number (FIN)

Sole Proprietorship

Partnership

FEIN of Small Business

S Corporation

Name of Small Business (if different from above)

(if different from above)

Note: not applicable for banks or credit unions

Corporation

Note: not applicable for banks or credit unions

Fiduciary

Instructions

Important:

Enclose the first page of the Authorization received from SBA or some other proof of the guaranty fee.

Line 1:

Enter the guaranty fee paid during this tax year. If you are a partner or a shareholder, enter your pro

rata share of the guaranty fee paid by the partnership or corporation.

Banks and credit unions: Attach a separate schedule showing the name, FIN, and type of each

small business. For each small business, include the amount of guaranty fee paid and the date paid.

Lines 2 - 6:

These lines are used to determine the credit limitation.

Line 7:

This is the amount of the credit allowed this year. If the credit available on line 1 exceeds the amount

allowed on line 7, the difference may be carried over for a period not to exceed 5 years from the date

the credit was established. You will need to complete a Form 529 for each carryover year.

Computation

1. Loan guaranty fee paid during tax year 2007

00

or unused carryover from tax year _______ . . . . . . .

2. Net income from the small business or Oklahoma

00

taxable income for banks and credit unions . . . . . . . .

3. Oklahoma adjusted gross income for individuals

00

or Oklahoma taxable income for corporations

and fiduciaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

4. Percentage (Line 2 ÷ Line 3) . . . . . . . . . . . . . . . . . . .

00

5. Tax per return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6. Credit limitation (Line 5 X Line 4) . . . . . . . . . . . . . . .

7. Credit allowed this year - enter the smaller

00

of Line 1 or Line 6 (carry to Form 511CR) . . . . . . . . .

The Oklahoma Tax Commission is not required to give actual notice to taxpayer of changes in any state tax law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2