Instructions For Schedule P (541) - Alternative Minimum Tax And Credit Limitations - Fiduciaries - 1999

ADVERTISEMENT

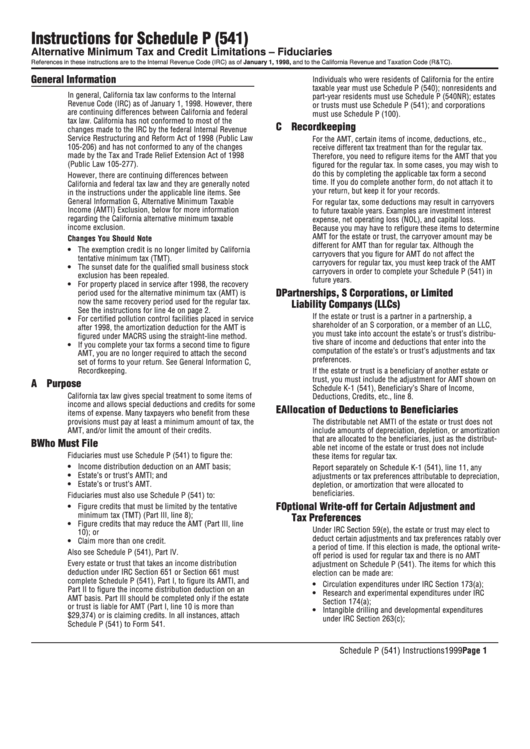

Instructions for Schedule P (541)

Alternative Minimum Tax and Credit Limitations – Fiduciaries

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

General Information

Individuals who were residents of California for the entire

taxable year must use Schedule P (540); nonresidents and

In general, California tax law conforms to the Internal

part-year residents must use Schedule P (540NR); estates

Revenue Code (IRC) as of January 1, 1998. However, there

or trusts must use Schedule P (541); and corporations

are continuing differences between California and federal

must use Schedule P (100).

tax law. California has not conformed to most of the

C Recordkeeping

changes made to the IRC by the federal Internal Revenue

Service Restructuring and Reform Act of 1998 (Public Law

For the AMT, certain items of income, deductions, etc.,

105-206) and has not conformed to any of the changes

receive different tax treatment than for the regular tax.

made by the Tax and Trade Relief Extension Act of 1998

Therefore, you need to refigure items for the AMT that you

(Public Law 105-277).

figured for the regular tax. In some cases, you may wish to

do this by completing the applicable tax form a second

However, there are continuing differences between

time. If you do complete another form, do not attach it to

California and federal tax law and they are generally noted

your return, but keep it for your records.

in the instructions under the applicable line items. See

General Information G, Alternative Minimum Taxable

For regular tax, some deductions may result in carryovers

Income (AMTI) Exclusion, below for more information

to future taxable years. Examples are investment interest

regarding the California alternative minimum taxable

expense, net operating loss (NOL), and capital loss.

income exclusion.

Because you may have to refigure these items to determine

AMT for the estate or trust, the carryover amount may be

Changes You Should Note

different for AMT than for regular tax. Although the

• The exemption credit is no longer limited by California

carryovers that you figure for AMT do not affect the

tentative minimum tax (TMT).

carryovers for regular tax, you must keep track of the AMT

• The sunset date for the qualified small business stock

carryovers in order to complete your Schedule P (541) in

exclusion has been repealed.

future years.

• For property placed in service after 1998, the recovery

D Partnerships, S Corporations, or Limited

period used for the alternative minimum tax (AMT) is

now the same recovery period used for the regular tax.

Liability Companys (LLCs)

See the instructions for line 4e on page 2.

If the estate or trust is a partner in a partnership, a

• For certified pollution control facilities placed in service

shareholder of an S corporation, or a member of an LLC,

after 1998, the amortization deduction for the AMT is

you must take into account the estate’s or trust’s distribu-

figured under MACRS using the straight-line method.

tive share of income and deductions that enter into the

• If you complete your tax forms a second time to figure

computation of the estate’s or trust’s adjustments and tax

AMT, you are no longer required to attach the second

preferences.

set of forms to your return. See General Information C,

Recordkeeping.

If the estate or trust is a beneficiary of another estate or

trust, you must include the adjustment for AMT shown on

A Purpose

Schedule K-1 (541), Beneficiary’s Share of Income,

California tax law gives special treatment to some items of

Deductions, Credits, etc., line 8.

income and allows special deductions and credits for some

E Allocation of Deductions to Beneficiaries

items of expense. Many taxpayers who benefit from these

provisions must pay at least a minimum amount of tax, the

The distributable net AMTI of the estate or trust does not

AMT, and/or limit the amount of their credits.

include amounts of depreciation, depletion, or amortization

that are allocated to the beneficiaries, just as the distribut-

B Who Must File

able net income of the estate or trust does not include

Fiduciaries must use Schedule P (541) to figure the:

these items for regular tax.

• Income distribution deduction on an AMT basis;

Report separately on Schedule K-1 (541), line 11, any

• Estate’s or trust’s AMTI; and

adjustments or tax preferences attributable to depreciation,

• Estate’s or trust’s AMT.

depletion, or amortization that were allocated to

beneficiaries.

Fiduciaries must also use Schedule P (541) to:

F Optional Write-off for Certain Adjustment and

• Figure credits that must be limited by the tentative

minimum tax (TMT) (Part III, line 8);

Tax Preferences

• Figure credits that may reduce the AMT (Part III, line

Under IRC Section 59(e), the estate or trust may elect to

10); or

deduct certain adjustments and tax preferences ratably over

• Claim more than one credit.

a period of time. If this election is made, the optional write-

Also see Schedule P (541), Part IV.

off period is used for regular tax and there is no AMT

Every estate or trust that takes an income distribution

adjustment on Schedule P (541). The items for which this

deduction under IRC Section 651 or Section 661 must

election can be made are:

complete Schedule P (541), Part I, to figure its AMTI, and

• Circulation expenditures under IRC Section 173(a);

Part II to figure the income distribution deduction on an

• Research and experimental expenditures under IRC

AMT basis. Part III should be completed only if the estate

Section 174(a);

or trust is liable for AMT (Part I, line 10 is more than

• Intangible drilling and developmental expenditures

$29,374) or is claiming credits. In all instances, attach

under IRC Section 263(c);

Schedule P (541) to Form 541.

Schedule P (541) Instructions 1999 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8