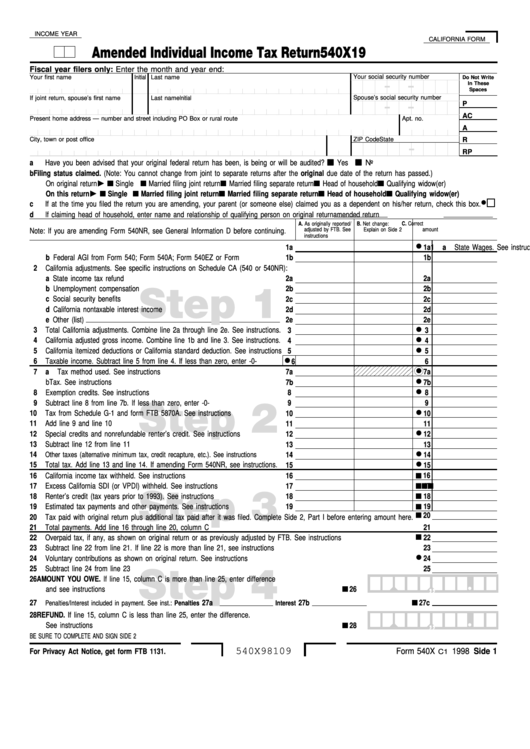

INCOME YEAR

CALIFORNIA FORM

19

Amended Individual Income Tax Return

540X

Fiscal year filers only: Enter the month and year end:

Your social security number

Your first name

Initial

Last name

Do Not Write

In These

Spaces

Spouse’s social security number

If joint return, spouse’s first name

Initial

Last name

P

AC

Present home address — number and street including PO Box or rural route

Apt. no.

A

City, town or post office

State

ZIP Code

R

RP

a

Have you been advised that your original federal return has been, is being or will be audited? . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b

Filing status claimed. (Note: You cannot change from joint to separate returns after the original due date of the return has passed.)

On original return

Single

Married filing joint return

Married filing separate return

Head of household

Qualifying widow(er)

On this return

Single

Married filing joint return

Married filing separate return

Head of household

Qualifying widow(er)

•

c

If at the time you filed the return you are amending, your parent (or someone else) claimed you as a dependent on his/her return, check this box.

d

If claiming head of household, enter name and relationship of qualifying person on original return

amended return

A. As originally reported/

B. Net change:

C. Correct

adjusted by FTB. See

Explain on Side 2

amount

Note: If you are amending Form 540NR, see General Information D before continuing.

instructions

•

1

a State Wages. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

1a

b Federal AGI from Form 540; Form 540A; Form 540EZ or Form 540-ADS . . .

1b

1b

2

California adjustments. See specific instructions on Schedule CA (540 or 540NR):

a State income tax refund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

2a

b Unemployment compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b

2b

Step 1

c Social security benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2c

2c

d California nontaxable interest income . . . . . . . . . . . . . . . . . . . . . . .

2d

2d

e Other (list)

2e

2e

•

3

Total California adjustments. Combine line 2a through line 2e. See instructions .

3

3

•

4

California adjusted gross income. Combine line 1b and line 3. See instructions .

4

4

•

5

California itemized deductions or California standard deduction. See instructions

5

5

•

6

Taxable income. Subtract line 5 from line 4. If less than zero, enter -0- . . . . .

6

6

•

7

a Tax method used. See instructions . . . . . . . . . . . . . . . . . . . . . . . .

7a

7a

•

b Tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

7b

•

8

Exemption credits. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8

9

Subtract line 8 from line 7b. If less than zero, enter -0- . . . . . . . . . . . . . .

9

9

Step 2

•

10

Tax from Schedule G-1 and form FTB 5870A. See instructions . . . . . . . . . .

10

10

11

Add line 9 and line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11

•

12

Special credits and nonrefundable renter’s credit. See instructions . . . . . . . .

12

12

13

Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13

•

14

Other taxes (alternative minimum tax, credit recapture, etc.). See instructions . . . .

14

14

•

15

Total tax. Add line 13 and line 14. If amending Form 540NR, see instructions .

15

15

16

California income tax withheld. See instructions . . . . . . . . . . . . . . . . . . .

16

16

17

Excess California SDI (or VPDI) withheld. See instructions. . . . . . . . . . . . .

17

17

Step 3

18

Renter’s credit (tax years prior to 1993). See instructions . . . . . . . . . . . . .

18

18

19

Estimated tax payments and other payments. See instructions . . . . . . . . . .

19

19

20

20

Tax paid with original return plus additional tax paid after it was filed. Complete Side 2, Part I before entering amount here.

21

Total payments. Add line 16 through line 20, column C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22

Overpaid tax, if any, as shown on original return or as previously adjusted by FTB. See instructions . . . . . . . . . . . . . .

22

23

Subtract line 22 from line 21. If line 22 is more than line 21, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

•

24

Voluntary contributions as shown on original return. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

Subtract line 24 from line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

Step 4

26

AMOUNT YOU OWE. If line 15, column C is more than line 25, enter difference

,

,

•

and see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27

27a

27b

27c

Penalties/Interest included in payment. See inst.: Penalties

Interest

28

REFUND. If line 15, column C is less than line 25, enter the difference.

,

,

•

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

BE SURE TO COMPLETE AND SIGN SIDE 2

540X98109

Form 540X

1998 Side 1

For Privacy Act Notice, get form FTB 1131.

C1

1

1 2

2