How To Complete Your Periodic Rental Motor Vehicle And Tour Vehicle Surcharge Tax Return (Form Rv-2)

ADVERTISEMENT

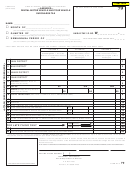

HOW TO COMPLETE YOUR PERIODIC

FORM RV-2

INSTRUCTIONS

RENTAL MOTOR VEHICLE AND TOUR VEHICLE

(REV. 1999)

SURCHARGE TAX RETURN (FORM RV-2)

INTRODUCTION

These instructions will assist you in filling out your periodic Rental Motor Vehicle and Tour Vehicle

Surcharge (RV) Tax returns (Form RV-2) correctly. Effective January 1, 1992, taxpayers who are in the

business of providing rental motor vehicles and/or who are in the tour business utilizing vans and buses

are subject to this tax.

To properly enter the necessary information into our computer system, the tax returns must be filled in

completely and accurately.

CHANGES TO NOTE

Act 223, Session Laws of Hawaii 1999, provides the following changes to the Rental Motor Vehicle

Surcharge Tax for the periods September 1, 1999 through August 31, 2007:

1) Increases the surcharge tax on rental motor vehicles from $2 per day to $3 per day during the period

September 1, 1999 to August 31, 2007.

2) Allows any lessor to exclude from the total rental days, the days a motor vehicle is rented to a lessee

whose vehicle is being repaired, provided:

• the lessor obtain a copy of the repair order from the lessee, AND

• the lessor retain the copy of the repair order for a period of four years for verification purposes.

For the purposes of this exclusion, a “repair order” is an invoice as required under section 437B-13,

Hawaii Revised Statutes (HRS). Also, for the purposes of this exclusion “repair” shall have the same

meaning as the definition of “Repair of motor vehicles” in section 437B-1, HRS.

IMPORTANT!!!

Write “RV”, the filing period, and your RV identification number on your check so that it may be properly

credited to your account. If you do not have any activity, and the result is no tax liability, enter “0”

on Line 8. This periodic return must be filed.

If you have questions, please contact your district tax office. The street addresses and telephone numbers

are listed below.

OAHU DISTRICT OFFICE

MAUI DISTRICT OFFICE

HAWAII DISTRICT OFFICE

KAUAI DISTRICT OFFICE

First Taxation District

Second Taxation District

Third Taxation District

Fourth Taxation District

830 Punchbowl Street

State Office Building

State Office Building

State Office Building

Honolulu, HI 96813-5094

54 S. High Street, #208

75 Aupuni Street, #101

3060 Eiwa Street, #105

Wailuku, HI 96793-2198

Hilo, HI 96720-4245

Lihue, HI 96766-1889

(808) 587-4242

Toll Free 1-800-222-3229

(808) 984-8500

(808) 974-6321

(808) 274-3456

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4