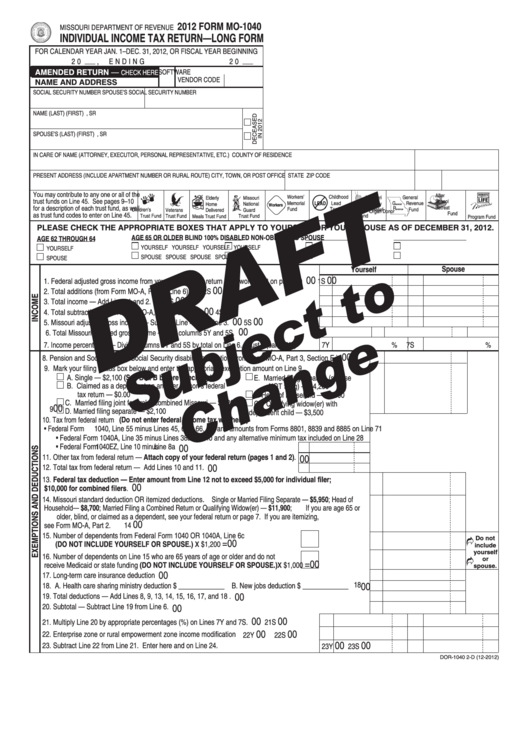

Form Mo-1040 (Draft) - Individual Income Tax Return - Long Form - 2012

ADVERTISEMENT

2012 FORM MO-1040

MISSOURI DEPARTMENT OF REVENUE

INDIVIDUAL INCOME TAX RETURN—LONG FORM

FOR CALENDAR YEAR JAN. 1–DEC. 31, 2012, OR FISCAL YEAR BEGINNING

20 ___ , ENDING

20 ___

AMENDED RETURN —

SOFTWARE

CHECK HERE

VENDOR CODE

NAME AND ADDRESS

SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

NAME (LAST)

(FIRST)

M.I. JR, SR

SPOUSE’S (LAST)

(FIRST)

M.I. JR, SR

IN CARE OF NAME (ATTORNEY, EXECUTOR, PERSONAL REPRESENTATIVE, ETC.)

COUNTY OF RESIDENCE

PRESENT ADDRESS (INCLUDE APARTMENT NUMBER OR RURAL ROUTE)

CITY, TOWN, OR POST OFFICE

STATE

ZIP CODE

You may contribute to any one or all of the

After

Workers’

Childhood

General

Elderly

Missouri

Missouri

trust funds on Line 45. See pages 9–10

School

Memorial

LEAD

Lead

G

Military

Revenue

Home

National

Workers

eneral

for a description of each trust fund, as well

Retreat

R

Fund

Testing

Fund

Children’s

Family Relief

Veterans

Delivered

Guard

evenue

Organ Donor

Fund

as trust fund codes to enter on Line 45.

Fund

Trust Fund

Fund

Trust Fund

Meals Trust Fund

Trust Fund

Program Fund

PLEASE CHECK THE APPROPRIATE BOXES THAT APPLY TO YOURSELF OR YOUR SPOUSE AS OF DECEMBER 31, 2012.

AGE 65 OR OLDER

BLIND

100% DISABLED

NON-OBLIGATED SPOUSE

AGE 62 THROUGH 64

YOURSELF

YOURSELF

YOURSELF

YOURSELF

YOURSELF

SPOUSE

SPOUSE

SPOUSE

SPOUSE

SPOUSE

Spouse

Yourself

00

00

1. Federal adjusted gross income from your 2012 federal return (See worksheet on page 6.) ...... 1Y

1S

00

00

2. Total additions (from Form MO‑A, Part 1, Line 6) ................................................................... 2Y

2S

00

00

3. Total income — Add Lines 1 and 2. ........................................................................................ 3Y

3S

00

00

4. Total subtractions (from Form MO‑A, Part 1, Line 14) ............................................................ 4Y

4S

00

00

5. Missouri adjusted gross income — Subtract Line 4 from Line 3. ............................................ 5Y

5S

00

6. Total Missouri adjusted gross income — Add columns 5Y and 5S. .......................................................................

6

7. Income percentages — Divide columns 5Y and 5S by total on Line 6. (Must equal 100%) ....... 7Y

% 7S

%

00

8. Pension and Social Security/Social Security disability exemption (from Form MO‑A, Part 3, Section E.) ...........

8

9. Mark your filing status box below and enter the appropriate exemption amount on Line 9.

A. Single — $2,100 (See Box B before checking.)

E. Married filing separate (spouse

B. Claimed as a dependent on another person’s federal

NOT filing) — $4,200

tax return — $0.00

F. Head of household — $3,500

C. Married filing joint federal & combined Missouri — $4,200

G. Qualifying widow(er) with

00

9

D. Married filing separate — $2,100

dependent child — $3,500

10. Tax from federal return (Do not enter federal income tax withheld.)

• Federal Form 1040, Line 55 minus Lines 45, 64a, 66, 67, and amounts from Forms 8801, 8839 and 8885 on Line 71

• Federal Form 1040A, Line 35 minus Lines 38a and 40 and any alternative minimum tax included on Line 28

• Federal Form 1040EZ, Line 10 minus Line 8a ..................................................................... 10

00

11. Other tax from federal return — Attach copy of your federal return (pages 1 and 2). ..... 11

00

00

12. Total tax from federal return — Add Lines 10 and 11. .................................................. 12

13. Federal tax deduction — Enter amount from Line 12 not to exceed $5,000 for individual filer;

00

$10,000 for combined filers. ..............................................................................................................................

13

14. Missouri standard deduction OR itemized deductions. Single or Married Filing Separate — $5,950; Head of

Household— $8,700; Married Filing a Combined Return or Qualifying Widow(er) — $11,900; If you are age 65 or

older, blind, or claimed as a dependent, see your federal return or page 7. If you are itemizing,

00

see Form MO‑A, Part 2. ..............................................................................................................

14

15. Number of dependents from Federal Form 1040 OR 1040A, Line 6c

Do not

x

=

00

(DO NOT INCLUDE YOURSELF OR SPOUSE.) ..........................................................

$1,200

.....

15

include

yourself

16. Number of dependents on Line 15 who are 65 years of age or older and do not

or

x

=

00

receive Medicaid or state funding (DO NOT INCLUDE YOURSELF OR SPOUSE.) .....

$1,000

.....

16

spouse.

00

17. Long‑term care insurance deduction ....................................................................................................................

17

18

00

18. A. Health care sharing ministry deduction $ _____________ B. New jobs deduction $ _____________ .......

00

19. Total deductions — Add Lines 8, 9, 13, 14, 15, 16, 17, and 18 . .........................................................................

19

20. Subtotal — Subtract Line 19 from Line 6. ............................................................................................................

20

00

00

00

21. Multiply Line 20 by appropriate percentages (%) on Lines 7Y and 7S. ..................................

21Y

21S

00

00

22. Enterprise zone or rural empowerment zone income modification .........................................

22Y

22S

00

00

23. Subtract Line 22 from Line 21. Enter here and on Line 24. ...................................................

23Y

23S

DOR-1040 2-D (12-2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2