Form Stc 1019 - Notice Of Assessment, Taxable Valuation, And Property Classification

ADVERTISEMENT

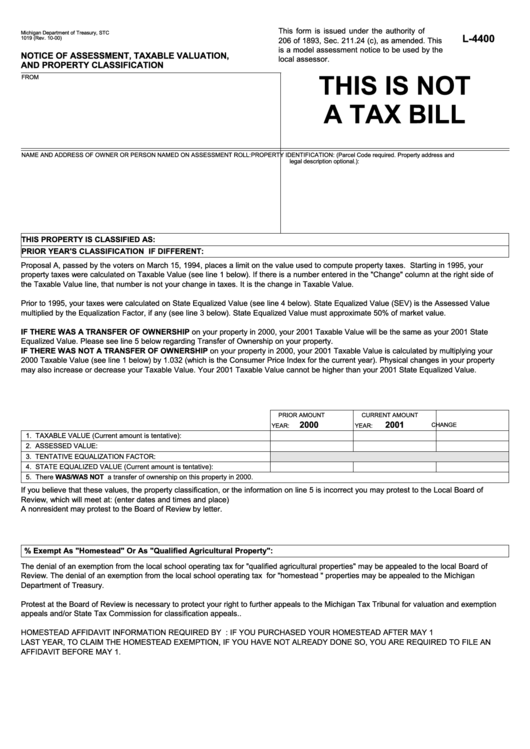

This form is issued under the authority of P.A.

Michigan Department of Treasury, STC

L-4400

1019 (Rev. 10-00)

206 of 1893, Sec. 211.24 (c), as amended. This

is a model assessment notice to be used by the

NOTICE OF ASSESSMENT, TAXABLE VALUATION,

local assessor.

AND PROPERTY CLASSIFICATION

THIS IS NOT

FROM

A TAX BILL

NAME AND ADDRESS OF OWNER OR PERSON NAMED ON ASSESSMENT ROLL:

PROPERTY IDENTIFICATION: (Parcel Code required. Property address and

legal description optional.):

THIS PROPERTY IS CLASSIFIED AS:

PRIOR YEAR'S CLASSIFICATION IF DIFFERENT:

Proposal A, passed by the voters on March 15, 1994, places a limit on the value used to compute property taxes. Starting in 1995, your

property taxes were calculated on Taxable Value (see line 1 below). If there is a number entered in the "Change" column at the right side of

the Taxable Value line, that number is not your change in taxes. It is the change in Taxable Value.

Prior to 1995, your taxes were calculated on State Equalized Value (see line 4 below). State Equalized Value (SEV) is the Assessed Value

multiplied by the Equalization Factor, if any (see line 3 below). State Equalized Value must approximate 50% of market value.

IF THERE WAS A TRANSFER OF OWNERSHIP on your property in 2000, your 2001 Taxable Value will be the same as your 2001 State

Equalized Value. Please see line 5 below regarding Transfer of Ownership on your property.

IF THERE WAS NOT A TRANSFER OF OWNERSHIP on your property in 2000, your 2001 Taxable Value is calculated by multiplying your

2000 Taxable Value (see line 1 below) by 1.032 (which is the Consumer Price Index for the current year). Physical changes in your property

may also increase or decrease your Taxable Value. Your 2001 Taxable Value cannot be higher than your 2001 State Equalized Value.

PRIOR AMOUNT

CURRENT AMOUNT

2000

2001

CHANGE

YEAR:

YEAR:

1. TAXABLE VALUE (Current amount is tentative):

2. ASSESSED VALUE:

3. TENTATIVE EQUALIZATION FACTOR:

4. STATE EQUALIZED VALUE (Current amount is tentative):

5. There WAS/WAS NOT a transfer of ownership on this property in 2000.

If you believe that these values, the property classification, or the information on line 5 is incorrect you may protest to the Local Board of

Review, which will meet at: (enter dates and times and place)

A nonresident may protest to the Board of Review by letter.

% Exempt As "Homestead" Or As "Qualified Agricultural Property":

The denial of an exemption from the local school operating tax for "qualified agricultural properties" may be appealed to the local Board of

Review. The denial of an exemption from the local school operating tax for "homestead " properties may be appealed to the Michigan

Department of Treasury.

Protest at the Board of Review is necessary to protect your right to further appeals to the Michigan Tax Tribunal for valuation and exemption

appeals and/or State Tax Commission for classification appeals..

HOMESTEAD AFFIDAVIT INFORMATION REQUIRED BY P.A. 237 OF 1994: IF YOU PURCHASED YOUR HOMESTEAD AFTER MAY 1

LAST YEAR, TO CLAIM THE HOMESTEAD EXEMPTION, IF YOU HAVE NOT ALREADY DONE SO, YOU ARE REQUIRED TO FILE AN

AFFIDAVIT BEFORE MAY 1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1