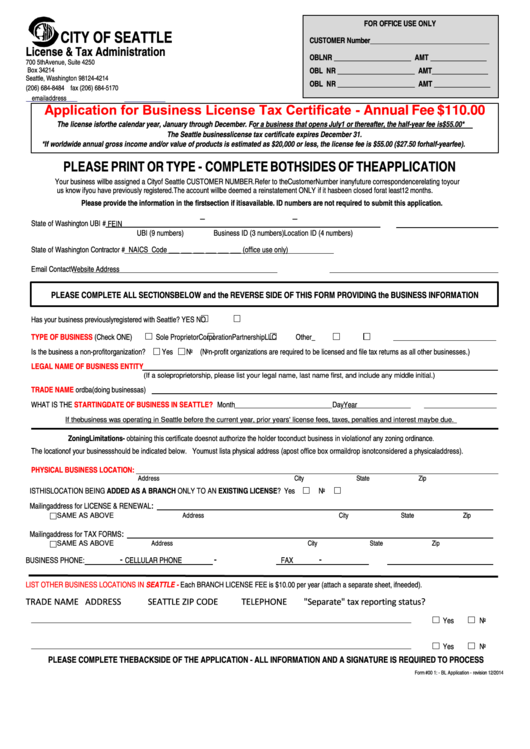

Form 001 - Bl Application - Application For Business License Tax Certificate

ADVERTISEMENT

FOR OFFICE USE ONLY

CITY OF SEATTLE

CUSTOMER Number__________________________________

License & Tax Administration

OBL NR ______________________ AMT ________________

700 5th Avenue, Suite 4250

OBL NR ______________________ AMT ________________

P.O. Box 34214

Seattle, Washington 98124-4214

OBL NR ______________________ AMT ________________

(206) 684-8484 fax (206) 684-5170

email address

tax@seattle.gov

Application for Business License Tax Certificate - Annual Fee $110.00

The license is for the calendar year, January through December. For a business that opens July 1 or thereafter, the half-year fee is $55.00*

The Seattle business license tax certificate expires December 31.

*If worldwide annual gross income and/or value of products is estimated as $20,000 or less, the license fee is $55.00 ($27.50 for half-year fee).

PLEASE PRINT OR TYPE - COMPLETE BOTH SIDES OF THE APPLICATION

Your business will be assigned a City of Seattle CUSTOMER NUMBER. Refer to the Customer Number in any future correspondence relating to your

license. Let us know if you have previously registered. The account will be deemed a reinstatement ONLY if it has been closed for at least 12 months.

Please provide the information in the first section if it is available. ID numbers are not required to submit this application.

_

_

State of Washington UBI #

FEIN

UBI (9 numbers)

Business ID (3 numbers)

Location ID (4 numbers)

State of Washington Contractor #

NAICS Code ___ ___ ___ ___ ___ ___ (office use only)

Email Contact

Website Address

PLEASE COMPLETE ALL SECTIONS BELOW and the REVERSE SIDE OF THIS FORM PROVIDING the BUSINESS INFORMATION

Has your business previously registered with Seattle?

YES

NO

TYPE OF BUSINESS

(Check ONE)

Sole Proprietor

Corporation

Partnership

LLC

Other_

Is the business a non-profit organization?

Yes

No (Non-profit organizations are required to be licensed and file tax returns as all other businesses.)

LEGAL NAME OF BUSINESS ENTITY

(If a sole proprietorship, please list your legal name, last name first, and include any middle initial.)

TRADE NAME

or dba (doing business as)

WHAT IS THE

STARTING DATE OF BUSINESS IN SEATTLE?

Month

Day

Year

If the business was operating in Seattle before the current year, prior years' license fees, taxes, penalties and interest may be due.

Zoning Limitations - obtaining this certificate does not authorize the holder to conduct business in violation of any zoning ordinance.

The location of your business should be indicated below. You must list a physical address (a post office box or mail drop is not considered a physical address).

PHYSICAL BUSINESS LOCATION:

Address

City

State

Zip

IS THIS LOCATION BEING ADDED AS A BRANCH ONLY TO AN EXISTING LICENSE? Yes

No

:

Mailing address for LICENSE & RENEWAL

Address

City

State

Zip

SAME AS ABOVE

:

Mailing address for TAX FORMS

Address

City

State

Zip

SAME AS ABOVE

-

-

-

BUSINESS PHONE:

CELLULAR PHONE

FAX

LIST OTHER BUSINESS LOCATIONS IN SEATTLE -

Each BRANCH LICENSE FEE is $10.00 per year (attach a separate sheet, if needed).

TRADE NAME

ADDRESS

SEATTLE ZIP CODE

TELEPHONE

"Separate" tax reporting status?

Yes

No

Yes

No

PLEASE COMPLETE THE BACK SIDE OF THE APPLICATION - ALL INFORMATION AND A SIGNATURE IS REQUIRED TO PROCESS

Form #00 1: - BL Application - revision 12/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2