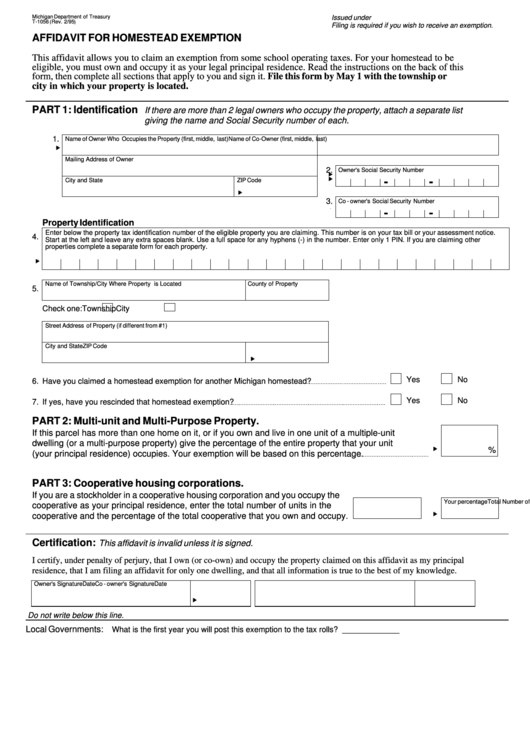

Michigan Department of Treasury

Issued under P.A. 237 of 1994.

T-1056 (Rev. 2/95)

Filing is required if you wish to receive an exemption.

AFFIDAVIT FOR HOMESTEAD EXEMPTION

This affidavit allows you to claim an exemption from some school operating taxes. For your homestead to be

eligible, you must own and occupy it as your legal principal residence. Read the instructions on the back of this

form, then complete all sections that apply to you and sign it. File this form by May 1 with the township or

city in which your property is located.

PART 1: Identification

If there are more than 2 legal owners who occupy the property, attach a separate list

giving the name and Social Security number of each.

1.

Name of Owner Who Occupies the Property (first, middle, last)

Name of Co-Owner (first, middle, last)

Mailing Address of Owner

2.

Owner's Social Security Number

-

-

City and State

ZIP Code

3.

Co - owner's Social Security Number

-

-

Property Identification

Enter below the property tax identification number of the eligible property you are claiming. This number is on your tax bill or your assessment notice.

4.

Start at the left and leave any extra spaces blank. Use a full space for any hyphens (-) in the number. Enter only 1 PIN. If you are claiming other

properties complete a separate form for each property.

Name of Township/City Where Property is Located

County of Property

5.

Check one:

Township

City

Street Address of Property (if different from #1)

City and State

ZIP Code

Yes

No

6.

Have you claimed a homestead exemption for another Michigan homestead?

Yes

No

7.

If yes, have you rescinded that homestead exemption?

PART 2: Multi-unit and Multi-Purpose Property.

If this parcel has more than one home on it, or if you own and live in one unit of a multiple-unit

dwelling (or a multi-purpose property) give the percentage of the entire property that your unit

%

(your principal residence) occupies. Your exemption will be based on this percentage.

PART 3: Cooperative housing corporations.

If you are a stockholder in a cooperative housing corporation and you occupy the

Total Number of Units

Your percentage

cooperative as your principal residence, enter the total number of units in the

cooperative and the percentage of the total cooperative that you own and occupy.

Certification:

This affidavit is invalid unless it is signed.

I certify, under penalty of perjury, that I own (or co-own) and occupy the property claimed on this affidavit as my principal

residence, that I am filing an affidavit for only one dwelling, and that all information is true to the best of my knowledge.

Owner's Signature

Date

Co - owner's Signature

Date

Do not write below this line.

Local Governments:

What is the first year you will post this exemption to the tax rolls? _____________

1

1