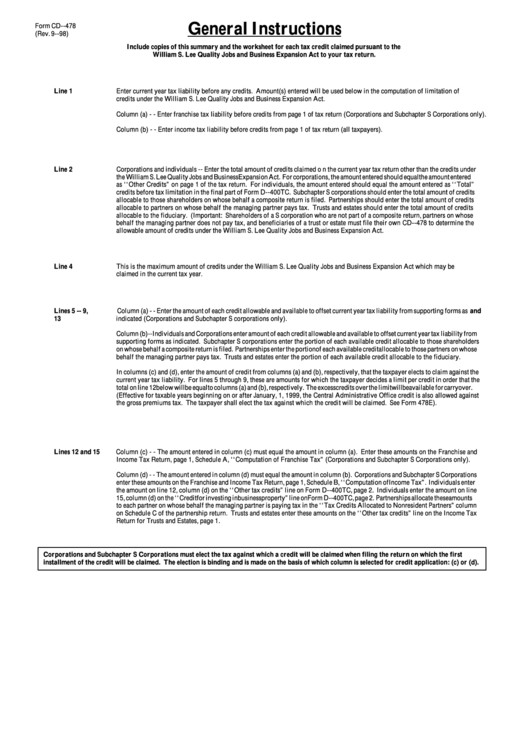

Form Cd - 478 General Instructions

ADVERTISEMENT

General Instructions

Form CD--478

(Rev. 9--98)

Include copies of this summary and the worksheet for each tax credit claimed pursuant to the

William S. Lee Quality Jobs and Business Expansion Act to your tax return.

Line 1

Enter current year tax liability before any credits. Amount(s) entered will be used below in the computation of limitation of

credits under the William S. Lee Quality Jobs and Business Expansion Act.

Column (a) -- Enter franchise tax liability before credits from page 1 of tax return (Corporations and Subchapter S Corporations only).

Column (b) -- Enter income tax liability before credits from page 1 of tax return (all taxpayers).

Line 2

Corporations and individuals -- Enter the total amount of credits claimed on the current year tax return other than the credits under

the William S. Lee Quality Jobs and Business Expansion Act. For corporations, the amount entered should equal the amount entered

as ‘ ‘ Other Credits” on page 1 of the tax return. For individuals, the amount entered should equal the amount entered as ‘ ‘ Total”

credits before tax limitation in the final part of Form D--400TC. Subchapter S corporations should enter the total amount of credits

allocable to those shareholders on whose behalf a composite return is filed. Partnerships should enter the total amount of credits

allocable to partners on whose behalf the managing partner pays tax. Trusts and estates should enter the total amount of credits

allocable to the fiduciary. (Important: Shareholders of a S corporation who are not part of a composite return, partners on whose

behalf the managing partner does not pay tax, and beneficiaries of a trust or estate must file their own CD--478 to determine the

allowable amount of credits under the William S. Lee Quality Jobs and Business Expansion Act.

Line 4

This is the maximum amount of credits under the William S. Lee Quality Jobs and Business Expansion Act which may be

claimed in the current tax year.

Lines 5 -- 9,

Column (a) -- Enter the amount of each credit allowable and available to offset current year tax liability from supporting forms as and

13

indicated (Corporations and Subchapter S corporations only).

Column (b) -- Individuals and Corporations enter amount of each credit allowable and available to offset current year tax liability from

supporting forms as indicated. Subchapter S corporations enter the portion of each available credit allocable to those shareholders

on whose behalf a composite return is filed. Partnerships enter the portion of each available credit allocable to those partners on whose

behalf the managing partner pays tax. Trusts and estates enter the portion of each available credit allocable to the fiduciary.

In columns (c) and (d), enter the amount of credit from columns (a) and (b), respectively, that the taxpayer elects to claim against the

current year tax liability. For lines 5 through 9, these are amounts for which the taxpayer decides a limit per credit in order that the

total on line 12 below will be equal to columns (a) and (b), respectively. The excess credits over the limit will be available for carryover.

(Effective for taxable years beginning on or after January, 1, 1999, the Central Administrative Office credit is also allowed against

the gross premiums tax. The taxpayer shall elect the tax against which the credit will be claimed. See Form 478E).

Lines 12 and 15

Column (c) -- The amount entered in column (c) must equal the amount in column (a). Enter these amounts on the Franchise and

Income Tax Return, page 1, Schedule A, ‘ ‘ Computation of Franchise Tax” (Corporations and Subchapter S Corporations only).

Column (d) -- The amount entered in column (d) must equal the amount in column (b). Corporations and Subchapter S Corporations

enter these amounts on the Franchise and Income Tax Return, page 1, Schedule B, ‘ ‘ Computation of Income Tax”. Individuals enter

the amount on line 12, column (d) on the ‘ ‘ Other tax credits”line on Form D--400TC, page 2. Individuals enter the amount on line

15, column (d) on the ‘ ‘ Credit for investing in business property”line on Form D--400TC, page 2. Partnerships allocate these amounts

to each partner on whose behalf the managing partner is paying tax in the ‘ ‘ Tax Credits Allocated to Nonresident Partners”column

on Schedule C of the partnership return. Trusts and estates enter these amounts on the ‘ ‘ Other tax credits”line on the Income Tax

Return for Trusts and Estates, page 1.

Corporations and Subchapter S Corporations must elect the tax against which a credit will be claimed when filing the return on which the first

installment of the credit will be claimed. The election is binding and is made on the basis of which column is selected for credit application: (c) or (d).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1