General Instructions - Credit For Investing In Central Administrative Office Property (Form Cd-478e)

ADVERTISEMENT

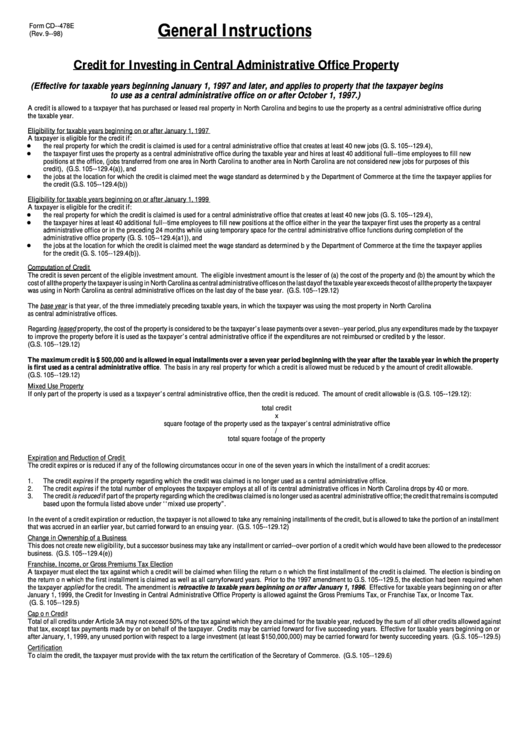

General Instructions

Form CD--478E

(Rev. 9--98)

Credit for Investing in Central Administrative Office Property

(Effective for taxable years beginning January 1, 1997 and later, and applies to property that the taxpayer begins

to use as a central administrative office on or after October 1, 1997.)

A credit is allowed to a taxpayer that has purchased or leased real property in North Carolina and begins to use the property as a central administrative office during

the taxable year.

Eligibility for taxable years beginning on or after January 1, 1997

A taxpayer is eligible for the credit if:

the real property for which the credit is claimed is used for a central administrative office that creates at least 40 new jobs (G. S. 105--129.4),

D

the taxpayer first uses the property as a central administrative office during the taxable year and hires at least 40 additional full--time employees to fill new

D

positions at the office, (jobs transferred from one area in North Carolina to another area in North Carolina are not considered new jobs for purposes of this

credit), (G.S. 105--129.4(a)), and

the jobs at the location for which the credit is claimed meet the wage standard as determined by the Department of Commerce at the time the taxpayer applies for

D

the credit (G.S. 105--129.4(b))

Eligibility for taxable years beginning on or after January 1, 1999

A taxpayer is eligible for the credit if:

the real property for which the credit is claimed is used for a central administrative office that creates at least 40 new jobs (G. S. 105--129.4),

D

the taxpayer hires at least 40 additional full--time employees to fill new positions at the office either in the year the taxpayer first uses the property as a central

D

administrative office or in the preceding 24 months while using temporary space for the central administrative office functions during completion of the

administrative office property (G. S. 105--129.4(a1)), and

the jobs at the location for which the credit is claimed meet the wage standard as determined by the Department of Commerce at the time the taxpayer applies

D

for the credit (G. S. 105--129.4(b)).

Computation of Credit

The credit is seven percent of the eligible investment amount. The eligible investment amount is the lesser of (a) the cost of the property and (b) the amount by which the

cost of all the property the taxpayer is using in North Carolina as central administrative offices on the last day of the taxable year exceeds the cost of all the property the taxpayer

was using in North Carolina as central administrative offices on the last day of the base year. (G.S. 105--129.12)

The base year is that year, of the three immediately preceding taxable years, in which the taxpayer was using the most property in North Carolina

as central administrative offices.

Regarding leased property, the cost of the property is considered to be the taxpayer’ s lease payments over a seven--year period, plus any expenditures made by the taxpayer

to improve the property before it is used as the taxpayer’ s central administrative office if the expenditures are not reimbursed or credited by the lessor.

(G.S. 105--129.12)

The maximum credit is $ 500,000 and is allowed in equal installments over a seven year period beginning with the year after the taxable year in which the property

is first used as a central administrative office. The basis in any real property for which a credit is allowed must be reduced by the amount of credit allowable.

(G.S. 105--129.12)

Mixed Use Property

If only part of the property is used as a taxpayer’ s central administrative office, then the credit is reduced. The amount of credit allowable is (G.S. 105--129.12):

total credit

x

square footage of the property used as the taxpayer’ s central administrative office

/

total square footage of the property

Expiration and Reduction of Credit

The credit expires or is reduced if any of the following circumstances occur in one of the seven years in which the installment of a credit accrues:

1.

The credit expires if the property regarding which the credit was claimed is no longer used as a central administrative office.

2.

The credit expires if the total number of employees the taxpayer employs at all of its central administrative offices in North Carolina drops by 40 or more.

3.

The credit is reduced if part of the property regarding which the credit was claimed is no longer used as a central administrative office; the credit that remains is computed

based upon the formula listed above under ‘ ‘ mixed use property”.

In the event of a credit expiration or reduction, the taxpayer is not allowed to take any remaining installments of the credit, but is allowed to take the portion of an installment

that was accrued in an earlier year, but carried forward to an ensuing year. (G.S. 105--129.12)

Change in Ownership of a Business

This does not create new eligibility, but a successor business may take any installment or carried--over portion of a credit which would have been allowed to the predecessor

business. (G.S. 105--129.4(e))

Franchise, Income, or Gross Premiums Tax Election

A taxpayer must elect the tax against which a credit will be claimed when filing the return on which the first installment of the credit is claimed. The election is binding on

the return on which the first installment is claimed as well as all carryforward years. Prior to the 1997 amendment to G.S. 105--129.5, the election had been required when

the taxpayer applied for the credit. The amendment is retroactive to taxable years beginning on or after January 1, 1996. Effective for taxable years beginning on or after

January 1, 1999, the Credit for Investing in Central Administrative Office Property is allowed against the Gross Premiums Tax, or Franchise Tax, or Income Tax.

(G. S. 105--129.5)

Cap on Credit

Total of all credits under Article 3A may not exceed 50% of the tax against which they are claimed for the taxable year, reduced by the sum of all other credits allowed against

that tax, except tax payments made by or on behalf of the taxpayer. Credits may be carried forward for five succeeding years. Effective for taxable years beginning on or

after January, 1, 1999, any unused portion with respect to a large investment (at least $150,000,000) may be carried forward for twenty succeeding years. (G.S. 105--129.5)

Certification

To claim the credit, the taxpayer must provide with the tax return the certification of the Secretary of Commerce. (G.S. 105--129.6)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1