General Instructions - Credit For Investing In Business Property (Form Cd-478f)

ADVERTISEMENT

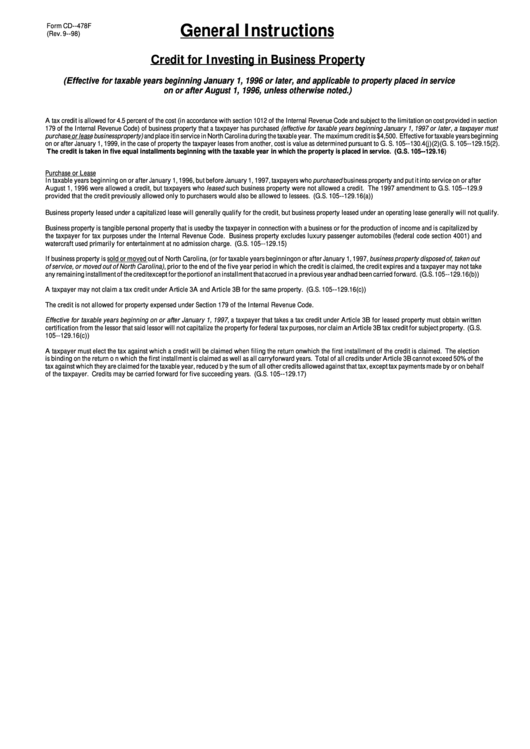

General Instructions

Form CD--478F

(Rev. 9--98)

Credit for Investing in Business Property

(Effective for taxable years beginning January 1, 1996 or later, and applicable to property placed in service

on or after August 1, 1996, unless otherwise noted.)

A tax credit is allowed for 4.5 percent of the cost (in accordance with section 1012 of the Internal Revenue Code and subject to the limitation on cost provided in section

179 of the Internal Revenue Code) of business property that a taxpayer has purchased (effective for taxable years beginning January 1, 1997 or later, a taxpayer must

purchase or lease business property) and place it in service in North Carolina during the taxable year. The maximum credit is $4,500. Effective for taxable years beginning

on or after January 1, 1999, in the case of property the taxpayer leases from another, cost is value as determined pursuant to G. S. 105--130.4(j)(2)(G. S. 105--129.15(2).

The credit is taken in five equal installments beginning with the taxable year in which the property is placed in service. (G.S. 105--129.16)

Purchase or Lease

In taxable years beginning on or after January 1, 1996, but before January 1, 1997, taxpayers who purchased business property and put it into service on or after

August 1, 1996 were allowed a credit, but taxpayers who leased such business property were not allowed a credit. The 1997 amendment to G.S. 105--129.9

provided that the credit previously allowed only to purchasers would also be allowed to lessees. (G.S. 105--129.16(a))

Business property leased under a capitalized lease will generally qualify for the credit, but business property leased under an operating lease generally will not qualify.

Business property is tangible personal property that is used by the taxpayer in connection with a business or for the production of income and is capitalized by

the taxpayer for tax purposes under the Internal Revenue Code. Business property excludes luxury passenger automobiles (federal code section 4001) and

watercraft used primarily for entertainment at no admission charge. (G.S. 105--129.15)

If business property is sold or moved out of North Carolina, (or for taxable years beginning on or after January 1, 1997, business property disposed of, taken out

of service, or moved out of North Carolina), prior to the end of the five year period in which the credit is claimed, the credit expires and a taxpayer may not take

any remaining installment of the credit except for the portion of an installment that accrued in a previous year and had been carried forward. (G.S. 105--129.16(b))

A taxpayer may not claim a tax credit under Article 3A and Article 3B for the same property. (G.S. 105--129.16(c))

The credit is not allowed for property expensed under Section 179 of the Internal Revenue Code.

Effective for taxable years beginning on or after January 1, 1997, a taxpayer that takes a tax credit under Article 3B for leased property must obtain written

certification from the lessor that said lessor will not capitalize the property for federal tax purposes, nor claim an Article 3B tax credit for subject property. (G.S.

105--129.16(c))

A taxpayer must elect the tax against which a credit will be claimed when filing the return on which the first installment of the credit is claimed. The election

is binding on the return on which the first installment is claimed as well as all carryforward years. Total of all credits under Article 3B cannot exceed 50% of the

tax against which they are claimed for the taxable year, reduced by the sum of all other credits allowed against that tax, except tax payments made by or on behalf

of the taxpayer. Credits may be carried forward for five succeeding years. (G.S. 105--129.17)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1