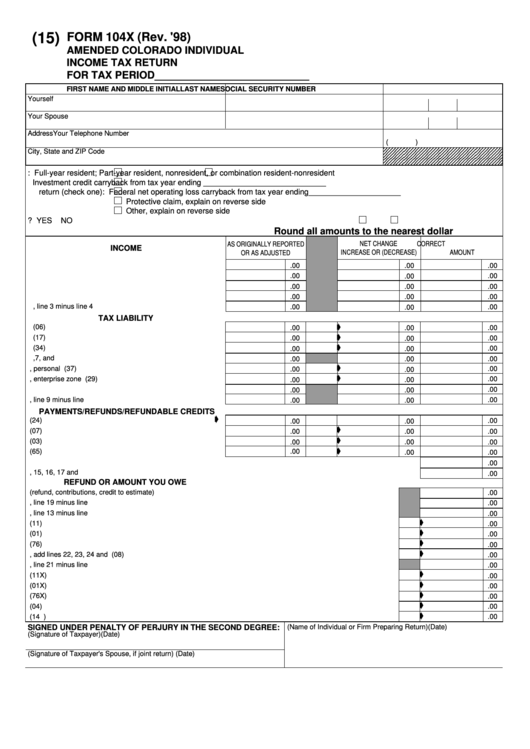

(15)

FORM 104X (Rev. '98)

AMENDED COLORADO INDIVIDUAL

INCOME TAX RETURN

FOR TAX PERIOD ___________________________

FIRST NAME AND MIDDLE INITIAL

LAST NAME

SOCIAL SECURITY NUMBER

Yourself

Your Spouse

Address

Your Telephone Number

(

)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

City, State and ZIP Code

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1

A. Residency status:

Full-year resident;

Part-year resident, nonresident, or combination resident-nonresident

B. Reason for amended

Investment credit carryback from tax year ending ____________________________

return (check one):

Federal net operating loss carryback from tax year ending _____________________

Protective claim, explain on reverse side

Other, explain on reverse side

C. Has original return for year being amended been adjusted by the Department of Revenue?

YES

NO

Round all amounts to the nearest dollar

NET CHANGE

CORRECT

AS ORIGINALLY REPORTED

INCOME

INCREASE OR (DECREASE)

AMOUNT

OR AS ADJUSTED

1. Federal taxable income .................................................. 1

.00

.00

.00

2. Colorado additions to federal income ............................ 2

.00

.00

.00

3. Total of lines 1 and 2 ...................................................... 3

.00

.00

.00

4. Colorado subtractions from federal income .................... 4

.00

.00

.00

5. Colorado taxable income, line 3 minus line 4 ................. 5

.00

.00

.00

TAX LIABILITY

6. Colorado Tax .................................................................. 6

(06

)

.00

.00

.00

7. Alternative minimum tax ................................................. 7

(17

)

.00

.00

.00

8. Recapture taxes ............................................................. 8

(34

)

.00

.00

.00

9. Total lines 6,7, and 8 ...................................................... 9

.00

.00

.00

10. Form 104CR - Part II, personal credits ......................... 10

(37

)

.00

.00

.00

11. Form 104CR - Part III, enterprise zone credits ............. 11

(29

)

.00

.00

.00

12. Total lines 10 and 11 .................................................... 12

.00

.00

.00

13. Net tax, line 9 minus line 12 ......................................... 13

.00

.00

.00

PAYMENTS/REFUNDS/REFUNDABLE CREDITS

14. State sales tax refund ................................................... 14

(24

)

.00

.00

.00

15. Colorado income tax withheld ...................................... 15

(07

)

.00

.00

.00

16. Extension and estimated tax payments and credits ..... 16

(03

)

.00

.00

.00

17. Child care/child tax credit ............................................. 17

.00

(65

)

.00

.00

18. Payments on balance of tax due per return or as previously adjusted ............................................................................... 18

.00

19. Total of lines 14, 15, 16, 17 and 18 .................................................................................................................................... 19

.00

REFUND OR AMOUNT YOU OWE

20. Overpayment of tax on original return or as previously adjusted (refund, contributions, credit to estimate) ........... 20

.00

21. Net credit available, line 19 minus line 20 ............................................................................................................... 21

.00

22. Additional tax due, line 13 minus line 21 ................................................................................................................. 22

.00

23. Interest due on additional tax - see instructions ...................................................................................................... 23

(11)

.00

24. Penalty due - see instructions ................................................................................................................................. 24

(01)

.00

25. Estimated tax penalty due - see instructions ........................................................................................................... 25

(76)

.00

26. Payment due with this return, add lines 22, 23, 24 and 25 ...................................................................................... 26

(08)

.00

27. Refund claimed with this return, line 21 minus line 13 ............................................................................................ 27

.00

28. Interest allowed on refund. To be computed by Department of Revenue .............................................................. 28 (11X)

.00

29. Penalty reduced ....................................................................................................................................................... 29 (01X)

.00

30. Estimated tax penalty reduced ................................................................................................................................ 30 (76X)

.00

31. Total refund due. To be computed by Department of Revenue .............................................................................. 31 (04)

.00

32. Overpayment credited to estimated tax ................................................................................................................... 32 (14 )

.00

(Name of Individual or Firm Preparing Return)

(Date)

SIGNED UNDER PENALTY OF PERJURY IN THE SECOND DEGREE:

(Signature of Taxpayer)

(Date)

(Signature of Taxpayer's Spouse, if joint return)

(Date)

1

1