Form St-Mab-4 - Sales Tax On Meals, Prepared Food And All Beverages Return

ADVERTISEMENT

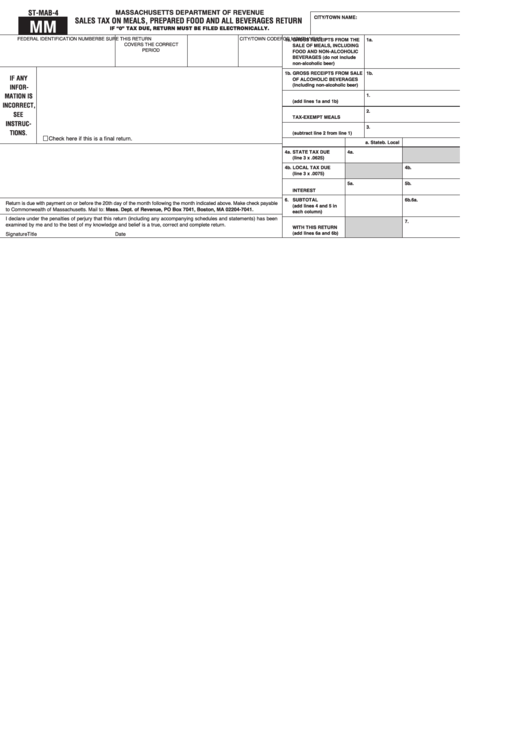

ST-MAB-4

MASSACHUSETTS DEPARTMENT OF REVENUE

CITY/TOWN NAME:

SALES TAX ON MEALS, PREPARED FOOD AND ALL BEVERAGES RETURN

MM

IF “0” TAX DUE, RETURN MUST BE FILED ELECTRONICALLY.

FEDERAL IDENTIFICATION NUMBER

BE SURE THIS RETURN

FOR MONTH/YEAR

CITY/TOWN CODE

1a. GROSS RECEIPTS FROM THE

1a.

COVERS THE CORRECT

SALE OF MEALS, INCLUDING

PERIOD

FOOD AND NON-ALCOHOLIC

BEVERAGES (do not include

non-alcoholic beer)

1b. GROSS RECEIPTS FROM SALE

1b.

IF ANY

OF ALCOHOLIC BEVERAGES

(including non-alcoholic beer)

INFOR-

1. TOTAL GROSS RECEIPTS

1.

MATION IS

(add lines 1a and 1b)

INCORRECT,

2. TOTAL CHARGED FOR

2.

SEE

TAX-EXEMPT MEALS

INSTRUC-

3. TOTAL TAXABLE RECEIPTS

3.

TIONS.

(subtract line 2 from line 1)

Check here if this is a final return.

a. State

b. Local

4a. STATE TAX DUE

4a.

(line 3 x .0625)

4b. LOCAL TAX DUE

4b.

(line 3 x .0075)

5. PENALTY AND

5a.

5b.

INTEREST

6. SUBTOTAL

6a.

6b.

Return is due with payment on or before the 20th day of the month following the month indicated above. Make check payable

(add lines 4 and 5 in

to Commonwealth of Massachusetts. Mail to: Mass. Dept. of Revenue, PO Box 7041, Boston, MA 02204-7041.

each column)

I declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been

7. TOTAL AMOUNT DUE

7.

examined by me and to the best of my knowledge and belief is a true, correct and complete return.

WITH THIS RETURN

(add lines 6a and 6b)

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2