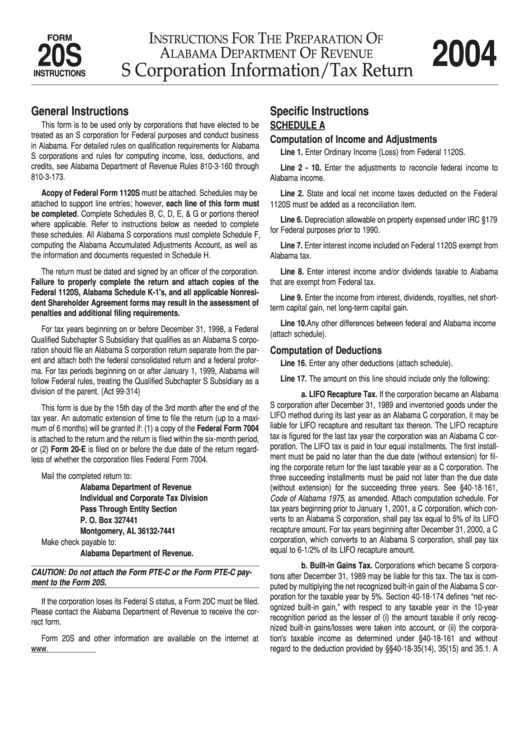

Instructions For The Preparation Of Alabama Department Of Revenue S Corporation Information/tax Return (Form 20s) - 2004

ADVERTISEMENT

I

F

T

P

O

FORM

NSTRUCTIONS

OR

HE

REPARATION

F

2004

20S

A

D

O

R

LABAMA

EPARTMENT

F

EVENUE

S Corporation Information/Tax Return

INSTRUCTIONS

General Instructions

Specific Instructions

This form is to be used only by corporations that have elected to be

SCHEDULE A

treated as an S corporation for Federal purposes and conduct business

Computation of Income and Adjustments

in Alabama. For detailed rules on qualification requirements for Alabama

Line 1. Enter Ordinary Income (Loss) from Federal 1120S.

S corporations and rules for computing income, loss, deductions, and

credits, see Alabama Department of Revenue Rules 810-3-160 through

Line 2 - 10. Enter the adjustments to reconcile federal income to

810-3-173.

Alabama income.

A copy of Federal Form 1120S must be attached. Schedules may be

Line 2. State and local net income taxes deducted on the Federal

attached to support line entries; however, each line of this form must

1120S must be added as a reconciliation item.

be completed. Complete Schedules B, C, D, E, & G or portions thereof

Line 6. Depreciation allowable on property expensed under IRC §179

where applicable. Refer to instructions below as needed to complete

for Federal purposes prior to 1990.

these schedules. All Alabama S corporations must complete Schedule F,

computing the Alabama Accumulated Adjustments Account, as well as

Line 7. Enter interest income included on Federal 1120S exempt from

the information and documents requested in Schedule H.

Alabama tax.

The return must be dated and signed by an officer of the corporation.

Line 8. Enter interest income and/or dividends taxable to Alabama

that are exempt from Federal tax.

Failure to properly complete the return and attach copies of the

Federal 1120S, Alabama Schedule K-1's, and all applicable Nonresi-

Line 9. Enter the income from interest, dividends, royalties, net short-

dent Shareholder Agreement forms may result in the assessment of

term capital gain, net long-term capital gain.

penalties and additional filing requirements.

Line 10. Any other differences between federal and Alabama income

For tax years beginning on or before December 31, 1998, a Federal

(attach schedule).

Qualified Subchapter S Subsidiary that qualifies as an Alabama S corpo-

ration should file an Alabama S corporation return separate from the par-

Computation of Deductions

ent and attach both the federal consolidated return and a federal profor-

Line 16. Enter any other deductions (attach schedule).

ma. For tax periods beginning on or after January 1, 1999, Alabama will

Line 17. The amount on this line should include only the following:

follow Federal rules, treating the Qualified Subchapter S Subsidiary as a

division of the parent. (Act 99-314)

a. LIFO Recapture Tax. If the corporation became an Alabama

S corporation after December 31, 1989 and inventoried goods under the

This form is due by the 15th day of the 3rd month after the end of the

LIFO method during its last year as an Alabama C corporation, it may be

tax year. An automatic extension of time to file the return (up to a maxi-

liable for LIFO recapture and resultant tax thereon. The LIFO recapture

mum of 6 months) will be granted if: (1) a copy of the Federal Form 7004

tax is figured for the last tax year the corporation was an Alabama C cor-

is attached to the return and the return is filed within the six-month period,

poration. The LIFO tax is paid in four equal installments. The first install-

or (2) Form 20-E is filed on or before the due date of the return regard-

ment must be paid no later than the due date (without extension) for fil-

less of whether the corporation files Federal Form 7004.

ing the corporate return for the last taxable year as a C corporation. The

Mail the completed return to:

three succeeding installments must be paid not later than the due date

Alabama Department of Revenue

(without extension) for the succeeding three years. See §40-18-161,

Individual and Corporate Tax Division

Code of Alabama 1975 , as amended. Attach computation schedule. For

tax years beginning prior to January 1, 2001, a C corporation, which con-

Pass Through Entity Section

verts to an Alabama S corporation, shall pay tax equal to 5% of its LIFO

P. O. Box 327441

recapture amount. For tax years beginning after December 31, 2000, a C

Montgomery, AL 36132-7441

corporation, which converts to an Alabama S corporation, shall pay tax

Make check payable to:

equal to 6-1/2% of its LIFO recapture amount.

Alabama Department of Revenue.

b. Built-in Gains Tax. Corporations which became S corpora-

CAUTION: Do not attach the Form PTE-C or the Form PTE-C pay-

tions after December 31, 1989 may be liable for this tax. The tax is com-

ment to the Form 20S.

puted by multiplying the net recognized built-in gain of the Alabama S cor-

poration for the taxable year by 5%. Section 40-18-174 defines “net rec-

If the corporation loses its Federal S status, a Form 20C must be filed.

ognized built-in gain,” with respect to any taxable year in the 10-year

Please contact the Alabama Department of Revenue to receive the cor-

recognition period as the lesser of (i) the amount taxable if only recog-

rect form.

nized built-in gains/losses were taken into account, or (ii) the corpora-

Form 20S and other information are available on the internet at

tion's taxable income as determined under §40-18-161 and without

regard to the deduction provided by §§40-18-35(14), 35(15) and 35.1. A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3