Instructions For Industrial Property Return

ADVERTISEMENT

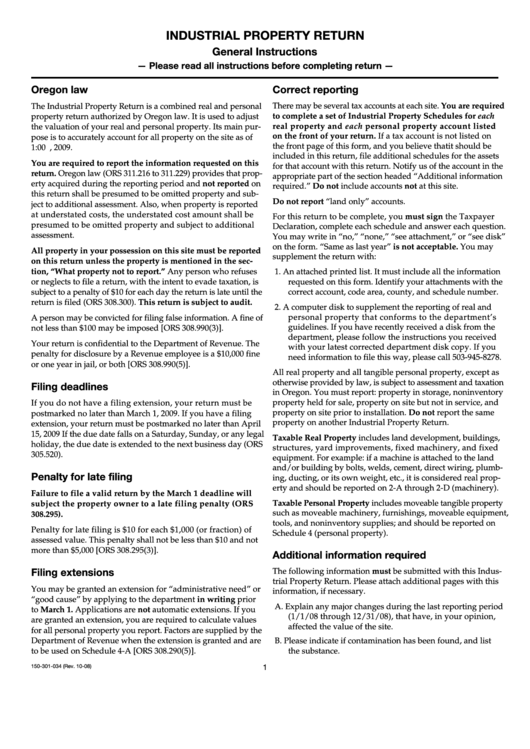

INDUSTRIAL PROPERTY RETURN

General Instructions

— Please read all instructions before completing return —

Oregon law

Correct reporting

There may be several tax accounts at each site. You are required

The Industrial Property Return is a combined real and personal

to complete a set of Industrial Property Schedules for each

property return authorized by Oregon law. It is used to adjust

real property and each personal property account listed

the valuation of your real and personal property. Its main pur-

on the front of your return. If a tax account is not listed on

pose is to accurately account for all property on the site as of

the front page of this form, and you believe that it should be

1:00 a.m. on January 1, 2009.

included in this return, file additional schedules for the assets

You are required to report the information requested on this

for that account with this return. Notify us of the account in the

return. Oregon law (ORS 311.216 to 311.229) provides that prop-

appropriate part of the section headed “Additional information

erty acquired during the reporting period and not reported on

required.” Do not include accounts not at this site.

this return shall be presumed to be omitted property and sub-

Do not report “land only” accounts.

ject to additional assessment. Also, when property is reported

at understated costs, the understated cost amount shall be

For this return to be complete, you must sign the Taxpayer

presumed to be omitted property and subject to additional

Declaration, complete each schedule and answer each question.

assessment.

You may write in “no,” “none,” “see attachment,” or “see disk”

on the form. “Same as last year” is not acceptable. You may

All property in your possession on this site must be reported

supplement the return with:

on this return unless the property is mentioned in the sec‑

tion, “What property not to report.” Any person who refuses

1. An attached printed list. It must include all the information

or neglects to file a return, with the intent to evade taxation, is

requested on this form. Identify your attachments with the

subject to a penalty of $10 for each day the return is late until the

correct account, code area, county, and schedule number.

return is filed (ORS 308.300). This return is subject to audit.

2. A computer disk to supplement the reporting of real and

personal property that conforms to the department’s

A person may be convicted for filing false information. A fine of

guidelines. If you have recently received a disk from the

not less than $100 may be imposed [ORS 308.990(3)].

department, please follow the instructions you received

Your return is confidential to the Department of Revenue. The

with your latest corrected department disk copy. If you

penalty for disclosure by a Revenue employee is a $10,000 fine

need information to file this way, please call 503-945-8278.

or one year in jail, or both [ORS 308.990(5)].

All real property and all tangible personal property, except as

otherwise provided by law, is subject to assessment and taxation

Filing deadlines

in Oregon. You must report: property in storage, noninventory

property held for sale, property on site but not in service, and

If you do not have a filing extension, your return must be

property on site prior to installation. Do not report the same

postmarked no later than March 1, 2009. If you have a filing

property on another Industrial Property Return.

extension, your return must be postmarked no later than April

15, 2009 If the due date falls on a Saturday, Sunday, or any legal

Taxable Real Property includes land development, buildings,

holiday, the due date is extended to the next business day (ORS

structures, yard improvements, fixed machinery, and fixed

305.520).

equipment. For example: if a machine is attached to the land

and/or building by bolts, welds, cement, direct wiring, plumb-

Penalty for late filing

ing, ducting, or its own weight, etc., it is considered real prop-

erty and should be reported on 2-A through 2-D (machinery).

Failure to file a valid return by the March 1 deadline will

Taxable Personal Property includes moveable tangible property

subject the property owner to a late filing penalty (ORS

such as moveable machinery, furnishings, moveable equipment,

308.295).

tools, and noninventory supplies; and should be reported on

Penalty for late filing is $10 for each $1,000 (or fraction) of

Schedule 4 (personal property).

assessed value. This penalty shall not be less than $10 and not

more than $5,000 [ORS 308.295(3)].

Additional information required

Filing extensions

The following information must be submitted with this Indus-

trial Property Return. Please attach additional pages with this

You may be granted an extension for “administrative need” or

information, if necessary.

“good cause” by applying to the department in writing prior

A. Explain any major changes during the last reporting period

to March 1. Applications are not automatic extensions. If you

(1/1/08 through 12/31/08), that have, in your opinion,

are granted an extension, you are required to calculate values

affected the value of the site.

for all personal property you report. Factors are supplied by the

Department of Revenue when the extension is granted and are

B. Please indicate if contamination has been found, and list

to be used on Schedule 4-A [ORS 308.290(5)].

the substance.

1

150-301-034 (Rev. 10-08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4