Clear This Page

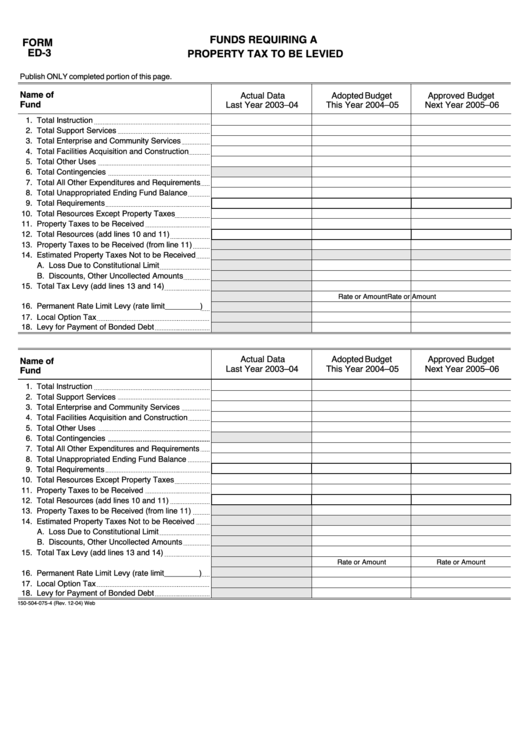

FUNDS REQUIRING A

FORM

ED-3

PROPERTY TAX TO BE LEVIED

Publish ONLY completed portion of this page.

Name of

Actual Data

Adopted Budget

Approved Budget

Fund

Last Year 2003–04

This Year 2004–05

Next Year 2005–06

1. Total Instruction

2. Total Support Services

3. Total Enterprise and Community Services

4. Total Facilities Acquisition and Construction

5. Total Other Uses

6. Total Contingencies

7. Total All Other Expenditures and Requirements

8. Total Unappropriated Ending Fund Balance

9. Total Requirements

10. Total Resources Except Property Taxes

11. Property Taxes to be Received

12. Total Resources (add lines 10 and 11)

13. Property Taxes to be Received (from line 11)

14. Estimated Property Taxes Not to be Received

A. Loss Due to Constitutional Limit

B. Discounts, Other Uncollected Amounts

15. Total Tax Levy (add lines 13 and 14)

Rate or Amount

Rate or Amount

16. Permanent Rate Limit Levy (rate limit________)

17. Local Option Tax

18. Levy for Payment of Bonded Debt

Actual Data

Adopted Budget

Approved Budget

Name of

Last Year 2003–04

This Year 2004–05

Next Year 2005–06

Fund

1. Total Instruction

2. Total Support Services

3. Total Enterprise and Community Services

4. Total Facilities Acquisition and Construction

5. Total Other Uses

6. Total Contingencies

7. Total All Other Expenditures and Requirements

8. Total Unappropriated Ending Fund Balance

9. Total Requirements

10. Total Resources Except Property Taxes

11. Property Taxes to be Received

12. Total Resources (add lines 10 and 11)

13. Property Taxes to be Received (from line 11)

14. Estimated Property Taxes Not to be Received

A. Loss Due to Constitutional Limit

B. Discounts, Other Uncollected Amounts

15. Total Tax Levy (add lines 13 and 14)

Rate or Amount

Rate or Amount

16. Permanent Rate Limit Levy (rate limit________)

17. Local Option Tax

18. Levy for Payment of Bonded Debt

150-504-075-4 (Rev. 12-04) Web

1

1