Form It-643 Draft - Hire A Veteran Credit - New York Department Of Taxation And Finance - 2015

ADVERTISEMENT

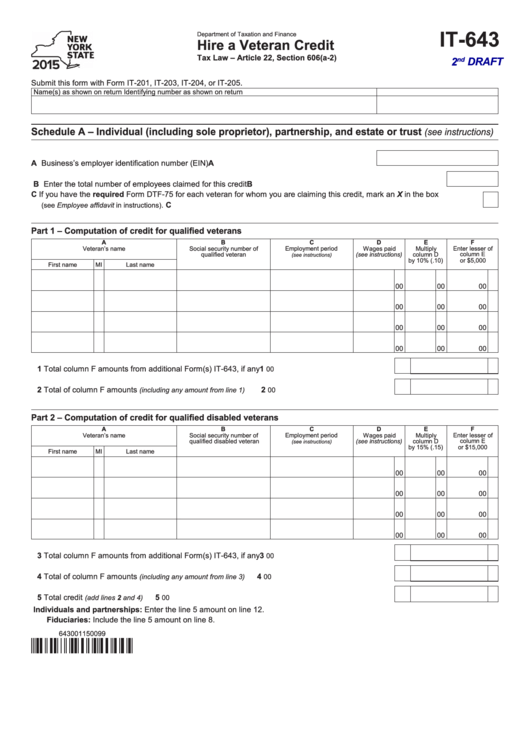

IT-643

Department of Taxation and Finance

Hire a Veteran Credit

Tax Law – Article 22, Section 606(a-2)

2

DRAFT

nd

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Identifying number as shown on return

Schedule A – Individual (including sole proprietor), partnership, and estate or trust

(see instructions)

A Business’s employer identification number (EIN) ........................................................................ A

B Enter the total number of employees claimed for this credit ........................................................................................ B

C If you have the required Form DTF-75 for each veteran for whom you are claiming this credit, mark an X in the box

. ............................................................................................................................................... C

(see Employee affidavit in instructions)

Part 1 – Computation of credit for qualified veterans

A

B

C

D

E

F

Veteran’s name

Social security number of

Employment period

Wages paid

Multiply

Enter lesser of

qualified veteran

(see instructions)

column D

column E

(see instructions)

by 10% (.10)

or $5,000

First name

MI

Last name

00

00

00

00

00

00

00

00

00

00

00

00

1 Total column F amounts from additional Form(s) IT-643, if any ............................................................

1

00

2 Total of column F amounts

...................................................................

2

(including any amount from line 1)

00

Part 2 – Computation of credit for qualified disabled veterans

A

B

C

D

E

F

Veteran’s name

Social security number of

Employment period

Wages paid

Multiply

Enter lesser of

qualified disabled veteran

(see instructions)

column D

column E

(see instructions)

by 15% (.15)

or $15,000

First name

MI

Last name

00

00

00

00

00

00

00

00

00

00

00

00

3 Total column F amounts from additional Form(s) IT-643, if any ............................................................

3

00

4 Total of column F amounts

..................................................................

4

(including any amount from line 3)

00

5 Total credit

5

.................................................................................................................

(add lines 2 and 4)

00

Individuals and partnerships: Enter the line 5 amount on line 12.

Fiduciaries: Include the line 5 amount on line 8.

643001150099

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3