Form Dr 1101 - Annual Reconciliation Of Income Tax Withheld On Gaming Winnings - Colorado Department Of Revenue

ADVERTISEMENT

DR 1101 (09/30/09)

AnnuAl ReconciliAtion of income tAx

Withheld on GAminG WinninGs

instRuctions

Use this form to reconcile the amount of backup withholding remitted with the total

reported on Forms W-2G.

If additional tax is due, put the amount on Line 3A. Compute penalty at the larger

of 5% (.05) of the balance due for the first month you are late and 1/2% (.005)

additional penalty for each additional month you are late. The maximum penalty is

12% (.12), and the minimum penalty is $5.

Compute the interest due at the statutory rate printed on the form.

If there is an overpayment, put the amount of Line 3B. You must apply for a refund

of the overpayment of tax by filing Form DR 0137. This form may be obtained online

at

Do not send Forms W-2G with this form. Mail them to:

Colorado Department of Revenue

Attn: Fair Share Section

1375 Sherman St., Rm. 634

Denver CO 80261-0009

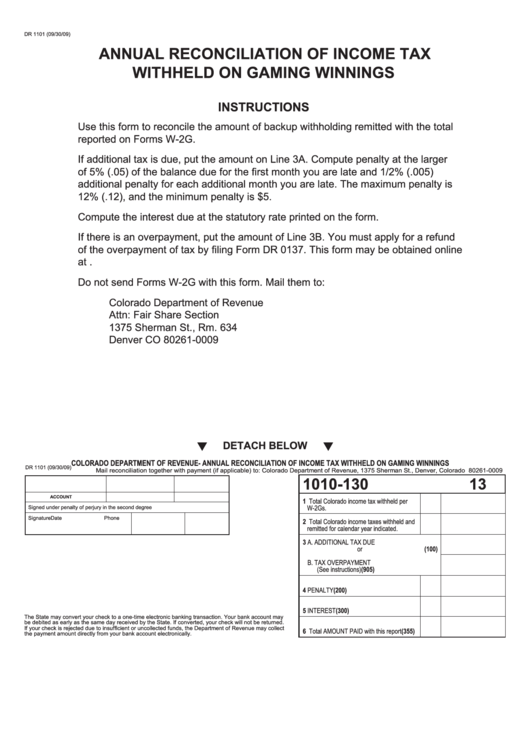

detAch beloW

COLORADO DEPARTMENT OF REVENUE- ANNUAL RECONCiLiATiON OF iNCOME TAx wiThhELD ON GAMiNG wiNNiNGs

DR 1101 (09/30/09)

Mail reconciliation together with payment (if applicable) to: Colorado Department of Revenue, 1375 Sherman St., Denver, Colorado 80261-0009

1010-130

13

Account no.

RepoRt foR YeAR

due dAte

1 Total Colorado income tax withheld per

W-2Gs.

Signed under penalty of perjury in the second degree

Signature

Date

Phone

2 Total Colorado income taxes withheld and

remitted for calendar year indicated.

S.S. NO. 1

3 A. ADDITIONAL TAX DUE

(100)

or

S.S. NO. 2

F.E.I.N.

B. TAX OVERPAYMENT

(905)

(See instructions)

4 PENALTY

(200)

5 INTEREST

(300)

The State may convert your check to a one-time electronic banking transaction. Your bank account may

be debited as early as the same day received by the State. If converted, your check will not be returned.

If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect

6 Total AMOUNT PAID with this report

(355)

the payment amount directly from your bank account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1