Form Sp-00 - Combined Report Form - Multnomah County Business Income Tax

ADVERTISEMENT

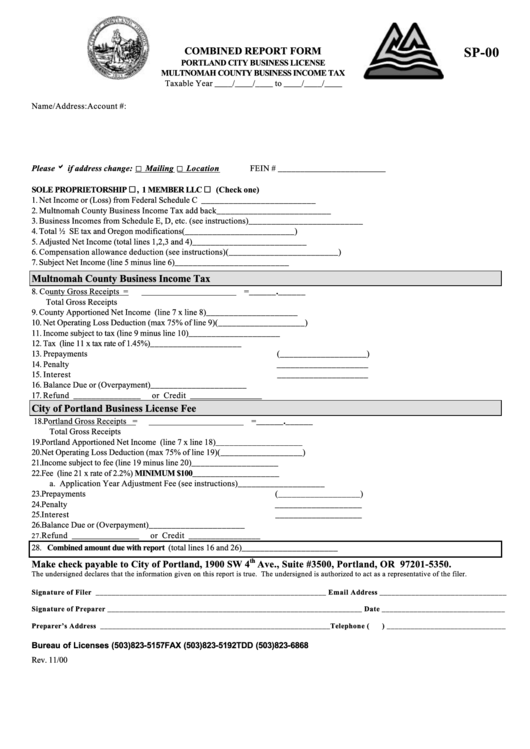

COMBINED REPORT FORM

SP-00

PORTLAND CITY BUSINESS LICENSE

MULTNOMAH COUNTY BUSINESS INCOME TAX

Taxable Year ____/____/____ to ____/____/____

Name/Address:

Account #:

Please b if address change: U Mailing U Location

FEIN # ________________________

SOLE PROPRIETORSHIP ¨ , 1 MEMBER LLC ¨ (Check one)

1.

Net Income or (Loss) from Federal Schedule C

_________________________

2.

Multnomah County Business Income Tax add back

_________________________

3.

Business Incomes from Schedule E, D, etc. (see instructions)

_________________________

4.

Total ½ SE tax and Oregon modifications

(________________________)

5.

Adjusted Net Income (total lines 1,2,3 and 4)

_________________________

6.

Compensation allowance deduction (see instructions)

(________________________)

7.

Subject Net Income (line 5 minus line 6)

_________________________

Multnomah County Business Income Tax

8.

County Gross Receipts =

=______.______

Total Gross Receipts

9.

County Apportioned Net Income (line 7 x line 8)

____________________

10. Net Operating Loss Deduction (max 75% of line 9)

(___________________)

11. Income subject to tax (line 9 minus line 10)

____________________

12. Tax (line 11 x tax rate of 1.45%)

____________________

13. Prepayments

(___________________)

14. Penalty

____________________

15. Interest

____________________

16. Balance Due or (Overpayment)

_____________________

17. Refund _______________

or Credit ________________

City of Portland Business License Fee

18. Portland Gross Receipts =

=______.______

Total Gross Receipts

19. Portland Apportioned Net Income (line 7 x line 18)

___________________

20. Net Operating Loss Deduction (max 75% of line 19)

(__________________)

21. Income subject to fee (line 19 minus line 20)

___________________

22. Fee (line 21 x rate of 2.2%) MINIMUM $100

___________________

a. Application Year Adjustment Fee (see instructions)

___________________

23. Prepayments

(__________________)

24. Penalty

___________________

25. Interest

___________________

26. Balance Due or (Overpayment)

_____________________

Refund _______________

or Credit ________________

27.

28. Combined amount due with report (total lines 16 and 26)

_____________________

th

Make check payable to City of Portland, 1900 SW 4

Ave., Suite #3500, Portland, OR 97201-5350.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer.

Signature of Filer __________________________________________________________ Email Address ________________________________

Signature of Preparer ________________________________________________________________ Date _______________________________

Preparer’s Address __________________________________________________________Telephone (

) ______________________________

Bureau of Licenses (503)823-5157

FAX (503)823-5192

TDD (503)823-6868

Rev. 11/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1