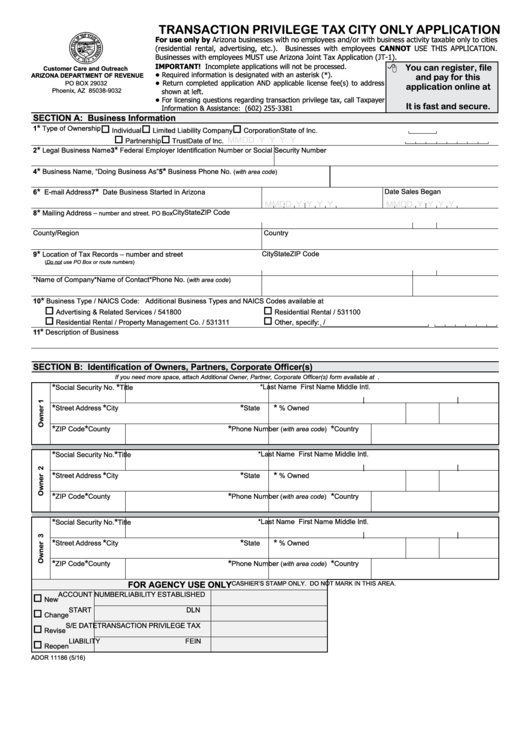

TRANSACTION PRIVILEGE TAX CITY ONLY APPLICATION

For use only by Arizona businesses with no employees and/or with business activity taxable only to cities

(residential rental, advertising, etc.). Businesses with employees CANNOT USE THIS APPLICATION.

Businesses with employees MUST use Arizona Joint Tax Application (JT‑1).

IMPORTANT! Incomplete applications will not be processed.

You can register, file

Customer Care and Outreach

• Required information is designated with an asterisk (*).

ARIZONA DEPARTMENT OF REVENUE

and pay for this

• Return completed application AND applicable license fee(s) to address

PO BOX 29032

application online at

Phoenix, AZ 85038-9032

shown at left.

• For licensing questions regarding transaction privilege tax, call Taxpayer

It is fast and secure.

Information & Assistance: (602) 255‑3381

SECTION A: Business Information

1

*

Type of Ownership

Individual

Limited Liability Company

Corporation

State of Inc.

M M D D Y Y Y Y

Partnership

Trust

Date of Inc.

*

*

2

Legal Business Name

3

Federal Employer Identification Number or Social Security Number

4

*

Business Name, “Doing Business As”

5

*

Business Phone No.

(with area code)

*

*

Date Sales Began

6

E-mail Address

7

Date Business Started in Arizona

M M D D Y Y Y Y

M M D D Y Y Y Y

City

State

ZIP Code

8

*

Mailing Address –

number and street. PO Box

County/Region

Country

City

State

ZIP Code

9

*

Location of Tax Records – number and street

(Do not use PO Box or route numbers)

*Name of Company

*Name of Contact

*Phone No.

(with area code)

10

*

Business Type / NAICS Code: Additional Business Types and NAICS Codes available at

Advertising & Related Services / 541800

Residential Rental / 531100

Residential Rental / Property Management Co. / 531311

Other, specify:

/

*

11

Description of Business

SECTION B: Identification of Owners, Partners, Corporate Officer(s)

If you need more space, attach Additional Owner, Partner, Corporate Officer(s) form available at .

*Last Name

First Name

Middle Intl.

*

*

Social Security No.

Title

|

|

*

*

*

*

Street Address

City

State

% Owned

*

*

*

*

ZIP Code

County

Phone Number

Country

(with area code)

*Last Name

First Name

Middle Intl.

*

Social Security No.

*

Title

|

|

*

*

*

*

Street Address

City

State

% Owned

*

ZIP Code

*

County

*

Phone Number

*

Country

(with area code)

*

*

*Last Name

First Name

Middle Intl.

Social Security No.

Title

|

|

*

Street Address

*

City

*

State

*

% Owned

*

*

*

*

ZIP Code

County

Phone Number

Country

(with area code)

FOR AGENCY USE ONLY

CASHIER’S STAMP ONLY. DO NOT MARK IN THIS AREA.

ACCOUNT NUMBER

LIABILITY ESTABLISHED

New

START

DLN

Change

S/E DATE

TRANSACTION PRIVILEGE TAX

Revise

LIABILITY

FEIN

Reopen

ADOR 11186 (5/16)

1

1 2

2 3

3 4

4 5

5