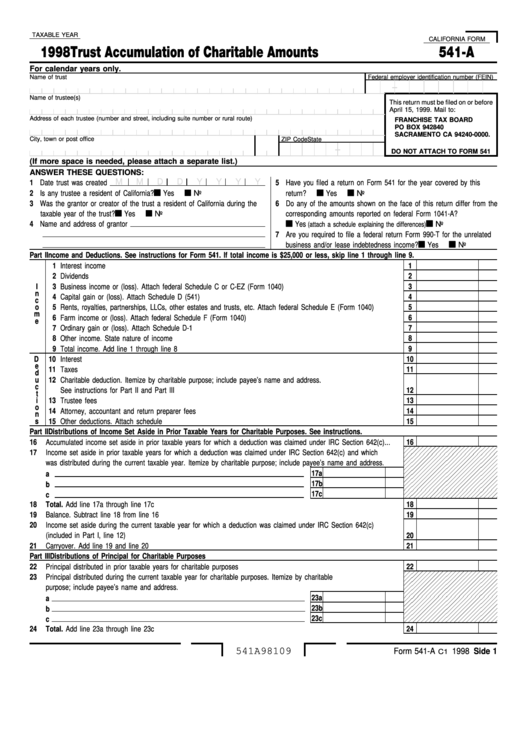

TAXABLE YEAR

CALIFORNIA FORM

1998

Trust Accumulation of Charitable Amounts

541-A

For calendar years only.

Name of trust

Federal employer identification number (FEIN)

–

Name of trustee(s)

This return must be filed on or before

April 15, 1999. Mail to:

Address of each trustee (number and street, including suite number or rural route)

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-0000.

City, town or post office

State

ZIP Code

–

DO NOT ATTACH TO FORM 541

(If more space is needed, please attach a separate list.)

ANSWER THESE QUESTIONS:

M

M

D

D

Y

Y

Y

Y

1 Date trust was created

5 Have you filed a return on Form 541 for the year covered by this

2 Is any trustee a resident of California?

Yes

No

return?

Yes

No

3 Was the grantor or creator of the trust a resident of California during the

6 Do any of the amounts shown on the face of this return differ from the

taxable year of the trust?

Yes

No

corresponding amounts reported on federal Form 1041-A?

4 Name and address of grantor

Yes

No

(attach a schedule explaining the differences)

7 Are you required to file a federal return Form 990-T for the unrelated

business and/or lease indebtedness income?

Yes

No

Part I Income and Deductions. See instructions for Form 541. If total income is $25,000 or less, skip line 1 through line 9.

1

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

I

3

Business income or (loss). Attach federal Schedule C or C-EZ (Form 1040) . . . . . . . . . . . . . . . . . . . . . . .

3

n

4

Capital gain or (loss). Attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

c

o

5

Rents, royalties, partnerships, LLCs, other estates and trusts, etc. Attach federal Schedule E (Form 1040) . . . . . .

5

m

6

Farm income or (loss). Attach federal Schedule F (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

e

7

Ordinary gain or (loss). Attach Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

Other income. State nature of income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Total income. Add line 1 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

D

10

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

e

11

Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

d

u

12

Charitable deduction. Itemize by charitable purpose; include payee’s name and address.

c

See instructions for Part II and Part III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

t

i

13

Trustee fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

o

14

Attorney, accountant and return preparer fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

n

s

15

Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Part II Distributions of Income Set Aside in Prior Taxable Years for Charitable Purposes. See instructions.

16

Accumulated income set aside in prior taxable years for which a deduction was claimed under IRC Section 642(c) . . .

16

17

Income set aside in prior taxable years for which a deduction was claimed under IRC Section 642(c) and which

was distributed during the current taxable year. Itemize by charitable purpose; include payee’s name and address.

17a

a

17b

b

17c

c

18

Total. Add line 17a through line 17c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

Balance. Subtract line 18 from line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20

Income set aside during the current taxable year for which a deduction was claimed under IRC Section 642(c)

(included in Part I, line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21

Carryover. Add line 19 and line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

Part III Distributions of Principal for Charitable Purposes

22

Principal distributed in prior taxable years for charitable purposes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23

Principal distributed during the current taxable year for charitable purposes. Itemize by charitable

purpose; include payee’s name and address.

23a

a

23b

b

23c

c

24

Total. Add line 23a through line 23c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

541A98109

Form 541-A

1998 Side 1

C1

1

1 2

2