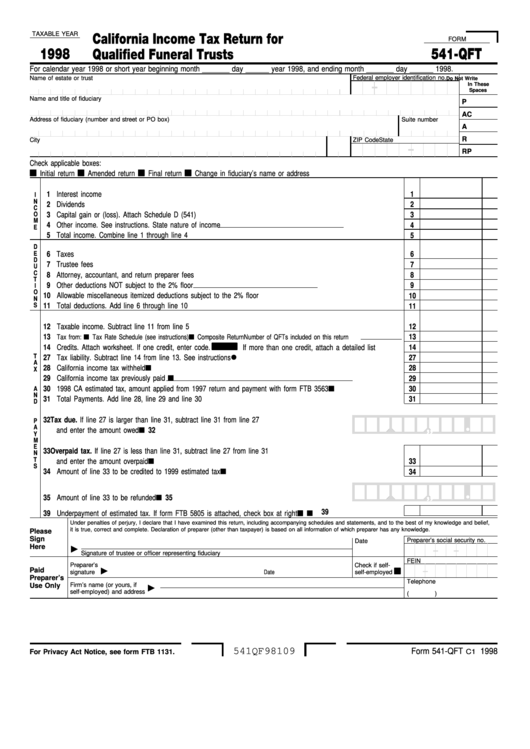

TAXABLE YEAR

California Income Tax Return for

FORM

1998

541-QFT

Qualified Funeral Trusts

For calendar year 1998 or short year beginning month _______ day ______ year 1998, and ending month _______ day ______ 1998.

Federal employer identification no.

Name of estate or trust

Do Not Write

In These

Spaces

Name and title of fiduciary

P

AC

Address of fiduciary (number and street or PO box)

Suite number

A

R

City

State

ZIP Code

RP

Check applicable boxes:

Initial return

Amended return

Final return

Change in fiduciary’s name or address

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

I

N

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

C

O

3 Capital gain or (loss). Attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

M

4 Other income. See instructions. State nature of income

. . . . . . . . . . .

4

E

5 Total income. Combine line 1 through line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

D

E

6 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

D

7 Trustee fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

U

C

8 Attorney, accountant, and return preparer fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

T

9 Other deductions NOT subject to the 2% floor

. . . . . . . . . . . . . . . .

9

I

O

10 Allowable miscellaneous itemized deductions subject to the 2% floor . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

N

S

11 Total deductions. Add line 6 through line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Taxable income. Subtract line 11 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

13

Tax from:

Tax Rate Schedule (see instructions)

Composite Return Number of QFTs included on this return

14 Credits. Attach worksheet. If one credit, enter code.

If more than one credit, attach a detailed list . . . . .

14

•

T

27 Tax liability. Subtract line 14 from line 13. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

A

28 California income tax withheld. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

X

29 California income tax previously paid

. . . . . .

29

30 1998 CA estimated tax, amount applied from 1997 return and payment with form FTB 3563 . . . . . . . . . . .

A

30

N

31 Total Payments. Add line 28, line 29 and line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

D

32 Tax due. If line 27 is larger than line 31, subtract line 31 from line 27

P

,

,

,

,

,

,

,

,

•

•

•

•

A

and enter the amount owed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

Y

M

E

33 Overpaid tax. If line 27 is less than line 31, subtract line 27 from line 31

N

T

and enter the amount overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

S

34 Amount of line 33 to be credited to 1999 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

,

,

,

,

,

,

,

,

•

•

•

•

35 Amount of line 33 to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

39

39 Underpayment of estimated tax. If form FTB 5805 is attached, check box at right . . . . . . . . . . . . . . .

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign

Preparer’s social security no.

Date

Here

–

–

Signature of trustee or officer representing fiduciary

FEIN

Preparer’s

Check if self-

Paid

–

signature

Date

self-employed

Preparer’s

Telephone

Use Only

Firm’s name (or yours, if

self-employed) and address

(

)

541QF98109

Form 541-QFT

1998

For Privacy Act Notice, see form FTB 1131.

C1

1

1