Form Ca-6 - Application For Abatement - 1999

ADVERTISEMENT

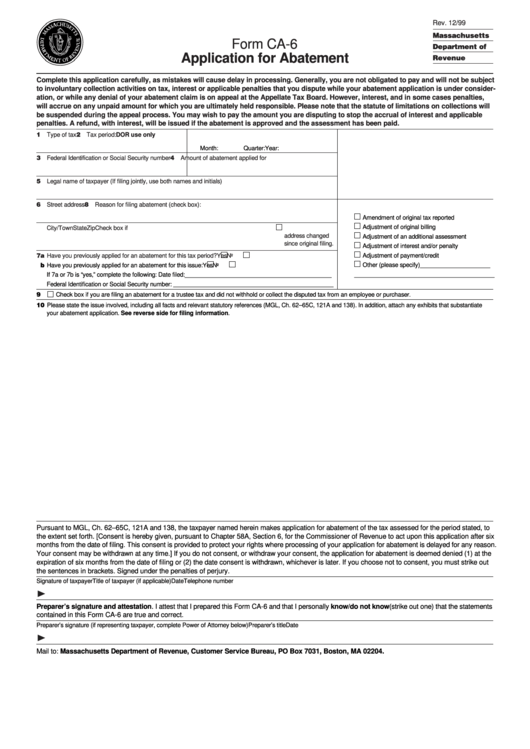

Rev. 12/99

Massachusetts

Form CA-6

Department of

Application for Abatement

Revenue

Complete this application carefully, as mistakes will cause delay in processing. Generally, you are not obligated to pay and will not be subject

to involuntary collection activities on tax, interest or applicable penalties that you dispute while your abatement application is under consider-

ation, or while any denial of your abatement claim is on appeal at the Appellate Tax Board. However, interest, and in some cases penalties,

will accrue on any unpaid amount for which you are ultimately held responsible. Please note that the statute of limitations on collections will

be suspended during the appeal process. You may wish to pay the amount you are disputing to stop the accrual of interest and applicable

penalties. A refund, with interest, will be issued if the abatement is approved and the assessment has been paid.

1 Type of tax

2 Tax period:

DOR use only

Month:

Quarter:

Year:

3 Federal Identification or Social Security number

4 Amount of abatement applied for

5 Legal name of taxpayer (If filing jointly, use both names and initials)

6 Street address

8 Reason for filing abatement (check box):

Amendment of original tax reported

Adjustment of original billing

City/Town

State

Zip

Check box if

address changed

Adjustment of an additional assessment

since original filing.

Adjustment of interest and/or penalty

Adjustment of payment/credit

7a Have you previously applied for an abatement for this tax period?

Yes

No

Other (please specify) _____________________

7b Have you previously applied for an abatement for this issue:

Yes

No

If 7a or 7b is “yes,” complete the following: Date filed: ____________________________________________

__________________________________________

Federal Identification or Social Security number: ________________________________________________

9

Check box if you are filing an abatement for a trustee tax and did not withhold or collect the disputed tax from an employee or purchaser.

10 Please state the issue involved, including all facts and relevant statutory references (MGL, Ch. 62–65C, 121A and 138). In addition, attach any exhibits that substantiate

your abatement application. See reverse side for filing information.

Pursuant to MGL, Ch. 62–65C, 121A and 138, the taxpayer named herein makes application for abatement of the tax assessed for the period stated, to

the extent set forth. [Consent is hereby given, pursuant to Chapter 58A, Section 6, for the Commissioner of Revenue to act upon this application after six

months from the date of filing. This consent is provided to protect your rights where processing of your application for abatement is delayed for any reason.

Your consent may be withdrawn at any time.] If you do not consent, or withdraw your consent, the application for abatement is deemed denied (1) at the

expiration of six months from the date of filing or (2) the date consent is withdrawn, whichever is later. If you choose not to consent, you must strike out

the sentences in brackets. Signed under the penalties of perjury.

Signature of taxpayer

Title of taxpayer (if applicable)

Date

Telephone number

¨

Preparer’s signature and attestation. I attest that I prepared this Form CA-6 and that I personally know/do not know (strike out one) that the statements

contained in this Form CA-6 are true and correct.

Preparer’s signature (if representing taxpayer, complete Power of Attorney below)

Preparer’s title

Date

¨

Mail to: Massachusetts Department of Revenue, Customer Service Bureau, PO Box 7031, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2