Worksheet For Credit For Income Tax Paid To Other Jurisdictions - 2010

ADVERTISEMENT

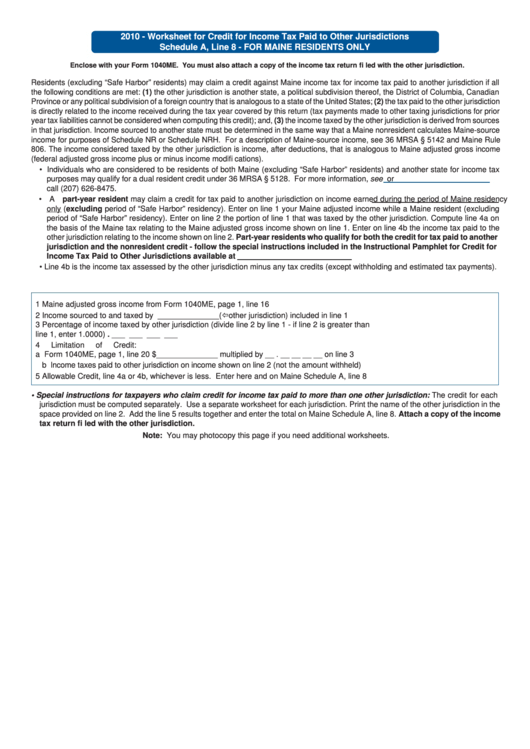

2010 - Worksheet for Credit for Income Tax Paid to Other Jurisdictions

Schedule A, Line 8 - FOR MAINE RESIDENTS ONLY

Enclose with your Form 1040ME. You must also attach a copy of the income tax return fi led with the other jurisdiction.

Residents (excluding “Safe Harbor” residents) may claim a credit against Maine income tax for income tax paid to another jurisdiction if all

the following conditions are met: (1) the other jurisdiction is another state, a political subdivision thereof, the District of Columbia, Canadian

Province or any political subdivision of a foreign country that is analogous to a state of the United States; (2) the tax paid to the other jurisdiction

is directly related to the income received during the tax year covered by this return (tax payments made to other taxing jurisdictions for prior

year tax liabilities cannot be considered when computing this credit); and, (3) the income taxed by the other jurisdiction is derived from sources

in that jurisdiction. Income sourced to another state must be determined in the same way that a Maine nonresident calculates Maine-source

income for purposes of Schedule NR or Schedule NRH. For a description of Maine-source income, see 36 MRSA § 5142 and Maine Rule

806. The income considered taxed by the other jurisdiction is income, after deductions, that is analogous to Maine adjusted gross income

(federal adjusted gross income plus or minus income modifi cations).

• Individuals who are considered to be residents of both Maine (excluding “Safe Harbor” residents) and another state for income tax

purposes may qualify for a dual resident credit under 36 MRSA § 5128. For more information, see

or

call (207) 626-8475.

• A part-year resident may claim a credit for tax paid to another jurisdiction on income earned during the period of Maine residency

only (excluding period of “Safe Harbor” residency). Enter on line 1 your Maine adjusted income while a Maine resident (excluding

period of “Safe Harbor” residency). Enter on line 2 the portion of line 1 that was taxed by the other jurisdiction. Compute line 4a on

the basis of the Maine tax relating to the Maine adjusted gross income shown on line 1. Enter on line 4b the income tax paid to the

other jurisdiction relating to the income shown on line 2. Part-year residents who qualify for both the credit for tax paid to another

jurisdiction and the nonresident credit - follow the special instructions included in the Instructional Pamphlet for Credit for

Income Tax Paid to Other Jurisdictions available at .

• Line 4b is the income tax assessed by the other jurisdiction minus any tax credits (except withholding and estimated tax payments).

1

Maine adjusted gross income from Form 1040ME, page 1, line 16 .................................................. 1 _____________________

2

Income sourced to and taxed by ______________ (

other jurisdiction) included in line 1 ........... 2 _____________________

3

Percentage of income taxed by other jurisdiction (divide line 2 by line 1 - if line 2 is greater than

line 1, enter 1.0000)........................................................................................................................... 3

___ . ___ ___ ___ ___

4

Limitation of Credit:

a Form 1040ME, page 1, line 20 $______________ multiplied by __ . __ __ __ __ on line 3 ....... 4a _____________________

b Income taxes paid to other jurisdiction on income shown on line 2 (not the amount withheld) ..... 4b _____________________

5

Allowable Credit, line 4a or 4b, whichever is less. Enter here and on Maine Schedule A, line 8 ..... 5 _____________________

• Special instructions for taxpayers who claim credit for income tax paid to more than one other jurisdiction: The credit for each

jurisdiction must be computed separately. Use a separate worksheet for each jurisdiction. Print the name of the other jurisdiction in the

space provided on line 2. Add the line 5 results together and enter the total on Maine Schedule A, line 8. Attach a copy of the income

tax return fi led with the other jurisdiction.

Note: You may photocopy this page if you need additional worksheets.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1