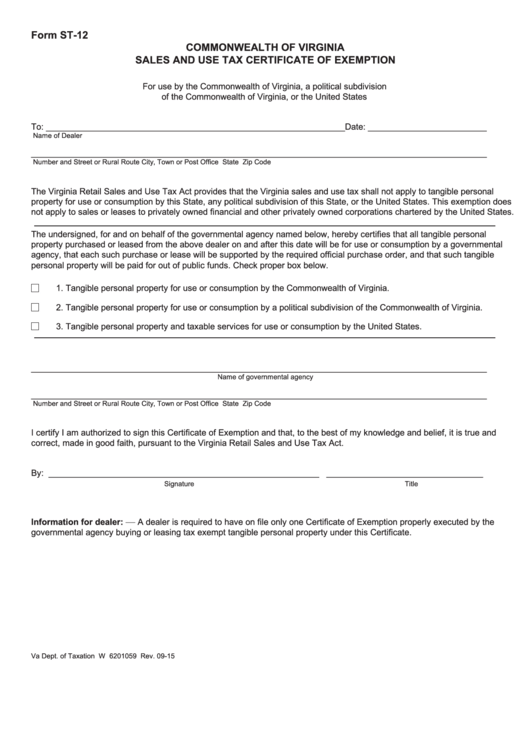

Form ST-12

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

For use by the Commonwealth of Virginia, a political subdivision

of the Commonwealth of Virginia, or the United States

To: _______________________________________________________________Date: _________________________

Name of Dealer

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

State

Zip Code

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to tangible personal

property for use or consumption by this State, any political subdivision of this State, or the United States. This exemption does

not apply to sales or leases to privately owned financial and other privately owned corporations chartered by the United States.

The undersigned, for and on behalf of the governmental agency named below, hereby certifies that all tangible personal

property purchased or leased from the above dealer on and after this date will be for use or consumption by a governmental

agency, that each such purchase or lease will be supported by the required official purchase order, and that such tangible

personal property will be paid for out of public funds. Check proper box below.

1. Tangible personal property for use or consumption by the Commonwealth of Virginia.

2. Tangible personal property for use or consumption by a political subdivision of the Commonwealth of Virginia.

3. Tangible personal property and taxable services for use or consumption by the United States.

________________________________________________________________________________________________

Name of governmental agency

________________________________________________________________________________________________

Number and Street or Rural Route

City, Town or Post Office

State

Zip Code

I certify I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it is true and

correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: _________________________________________________________

f

_________________________________

Signature

Title

—

Information for dealer:

A dealer is required to have on file only one Certificate of Exemption properly executed by the

governmental agency buying or leasing tax exempt tangible personal property under this Certificate.

Va Dept. of Taxation W 6201059 Rev. 09-15

1

1