*VA500C115888*

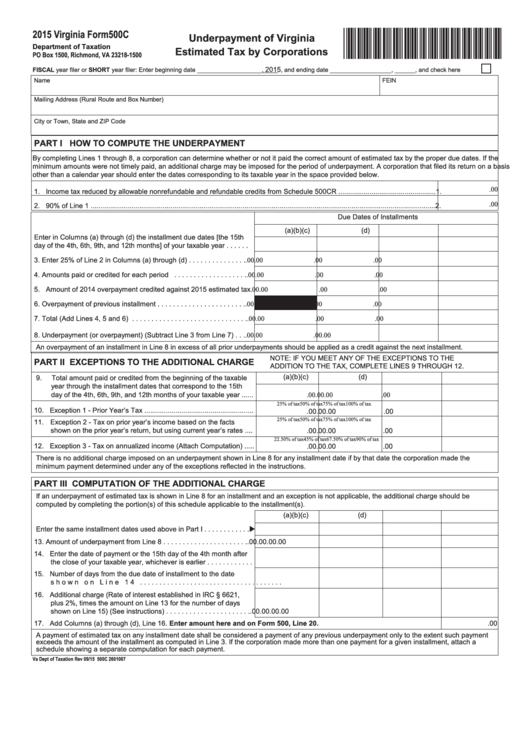

2015 Virginia Form 500C

underpayment of Virginia

department of Taxation

estimated Tax by Corporations

PO Box 1500, Richmond, VA 23218-1500

2015

FISCAL year filer or SHORT year filer: Enter beginning date ___________________,

, and ending date __________________, ______, and check here

Name

fEIN

Mailing Address (rural route and Box Number)

City or Town, State and ZIp Code

PART I HOw TO COmPuTe THe undeRPAymenT

By completing Lines 1 through 8, a corporation can determine whether or not it paid the correct amount of estimated tax by the proper due dates. If the

minimum amounts were not timely paid, an additional charge may be imposed for the period of underpayment. A corporation that filed its return on a basis

other than a calendar year should enter the dates corresponding to its taxable year in the space provided below.

.00

1. Income tax reduced by allowable nonrefundable and refundable credits from Schedule 500Cr ..................................................1.

.00

2. 90% of Line 1 .................................................................................................................................................................................2.

Due Dates of Installments

(a)

(b)

(c)

(d)

Enter in Columns (a) through (d) the installment due dates [the 15th

day of the 4th, 6th, 9th, and 12th months] of your taxable year . . . . . .

3. Enter 25% of Line 2 in Columns (a) through (d) . . . . . . . . . . . . . . .

.00

.00

.00

.00

4. Amounts paid or credited for each period . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

5. Amount of 2014 overpayment credited against 2015 estimated tax

.00

.00

.00

.00

6. Overpayment of previous installment . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

7. Total (Add Lines 4, 5 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

8. Underpayment (or overpayment) (Subtract Line 3 from Line 7) . . .

.00

.00

.00

.00

An overpayment of an installment in Line 8 in excess of all prior underpayments should be applied as a credit against the next installment.

NOTE: If YOU MEET ANY Of ThE ExCEpTIONS TO ThE

PART II exCePTIOnS TO THe AddITIOnAL CHARge

ADDITION TO ThE TAx, COMpLETE LINES 9 ThrOUgh 12.

(a)

(b)

(c)

(d)

9.

Total amount paid or credited from the beginning of the taxable

year through the installment dates that correspond to the 15th

day of the 4th, 6th, 9th, and 12th months of your taxable year ......

.00

.00

.00

.00

25% of tax

50% of tax

75% of tax

100% of tax

10. Exception 1 - prior Year’s Tax ........................................................

.00

.00

.00

.00

25% of tax

50% of tax

75% of tax

100% of tax

11. Exception 2 - Tax on prior year’s income based on the facts

shown on the prior year’s return, but using current year’s rates ....

.00

.00

.00

.00

22.50% of tax

45% of tax

67.50% of tax

90% of tax

12. Exception 3 - Tax on annualized income (Attach Computation) .....

.00

.00

.00

.00

There is no additional charge imposed on an underpayment shown in Line 8 for any installment date if by that date the corporation made the

minimum payment determined under any of the exceptions reflected in the instructions.

PART III COmPuTATIOn OF THe AddITIOnAL CHARge

If an underpayment of estimated tax is shown in Line 8 for an installment and an exception is not applicable, the additional charge should be

computed by completing the portion(s) of this schedule applicable to the installment(s).

(a)

(b)

(c)

(d)

Enter the same installment dates used above in part I . . . . . . . . . . . .u

13. Amount of underpayment from Line 8 . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

14. Enter the date of payment or the 15th day of the 4th month after

the close of your taxable year, whichever is earlier . . . . . . . . . . . .

15. Number of days from the due date of installment to the date

shown on Line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Additional charge (rate of interest established in IrC § 6621,

plus 2%, times the amount on Line 13 for the number of days

shown on Line 15) (See instructions) . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

17. Add Columns (a) through (d), Line 16. enter amount here and on Form 500, Line 20.

.00

A payment of estimated tax on any installment date shall be considered a payment of any previous underpayment only to the extent such payment

exceeds the amount of the installment as computed in Line 3. If the corporation made more than one payment for a given installment, attach a

schedule showing a separate computation for each payment.

Va Dept of Taxation Rev 09/15 500C 2601007

1

1 2

2