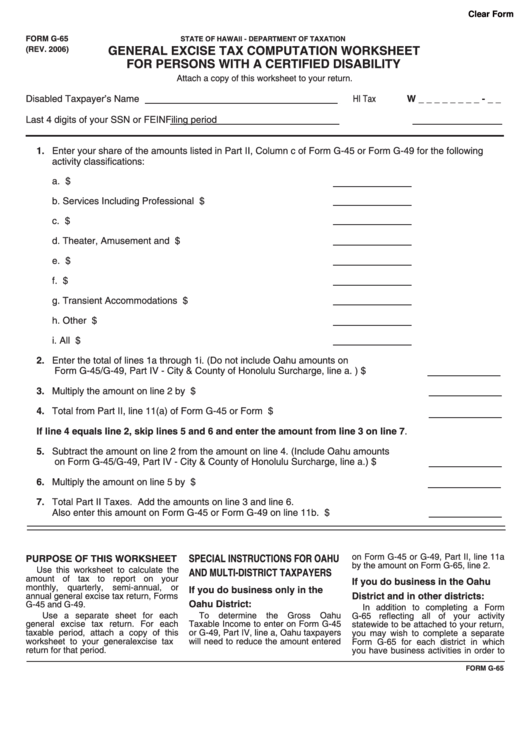

Clear Form

FORM G-65

STATE OF HAWAII - DEPARTMENT OF TAXATION

GENERAL EXCISE TAX COMPUTATION WORKSHEET

(REV. 2006)

FOR PERSONS WITH A CERTIFIED DISABILITY

Attach a copy of this worksheet to your return.

Disabled Taxpayer’s Name

HI Tax I.D. No. W _ _ _ _ _ _ _ _ - _ _

Last 4 digits of your SSN or FEIN

Filing period

1. Enter your share of the amounts listed in Part II, Column c of Form G-45 or Form G-49 for the following

activity classifications:

a. Retailing .................................................................................

$

b. Services Including Professional .............................................

$

c. Contracting .............................................................................

$

d. Theater, Amusement and Broadcasting .................................

$

e. Interest ...................................................................................

$

f. Commissions...........................................................................

$

g. Transient Accommodations Rentals.......................................

$

h. Other Rentals .........................................................................

$

i. All Others.................................................................................

$

2. Enter the total of lines 1a through 1i. (Do not include Oahu amounts on

Form G-45/G-49, Part IV - City & County of Honolulu Surcharge, line a. ) ..................

$

3. Multiply the amount on line 2 by .005 ............................................................................

$

4. Total from Part II, line 11(a) of Form G-45 or Form G-49. ............................................

$

If line 4 equals line 2, skip lines 5 and 6 and enter the amount from line 3 on line 7.

5. Subtract the amount on line 2 from the amount on line 4. (Include Oahu amounts

on Form G-45/G-49, Part IV - City & County of Honolulu Surcharge, line a.) ..............

$

6. Multiply the amount on line 5 by .04 ..............................................................................

$

7. Total Part II Taxes. Add the amounts on line 3 and line 6.

Also enter this amount on Form G-45 or Form G-49 on line 11b. .................................

$

on Form G-45 or G-49, Part II, line 11a

SPECIAL INSTRUCTIONS FOR OAHU

PURPOSE OF THIS WORKSHEET

by the amount on Form G-65, line 2.

Use this worksheet to calculate the

AND MULTI-DISTRICT TAXPAYERS

amount of tax to report on your

If you do business in the Oahu

monthly, quarterly, semi-annual, or

If you do business only in the

District and in other districts:

annual general excise tax return, Forms

Oahu District:

G-45 and G-49.

In addition to completing a Form

Use a separate sheet for each

To

determine

the

Gross

Oahu

G-65 reflecting all of your activity

general excise tax return. For each

Taxable Income to enter on Form G-45

statewide to be attached to your return,

taxable period, attach a copy of this

or G-49, Part IV, line a, Oahu taxpayers

you may wish to complete a separate

worksheet to your general excise tax

will need to reduce the amount entered

Form G-65 for each district in which

return for that period.

you have business activities in order to

FORM G-65

1

1