Form St-3 - Sales And Use Tax Report

ADVERTISEMENT

Vendor’s Compensation Formula

Vendor’s Compensation rate on collected taxes (for State Tax, Marta Tax, Local Tax, 2

Local Tax, Special Tax, Educational Tax,

nd

Homestead Tax, and Excess Tax) is three percent (.03) of the first $3,000 ($90.00) of tax plus one half of one percent (.005) on the

tax above $3,000.

Example: Collected Taxes of $4500 would equal $97.50.

$3,000.00 x .03 = $90.00

$1,500.00 x .005 = $7.50

Total $4,500.00

= $97.50

In addition, Motor Fuel Dealers may also take a Vendor’s Compensation on 2

Motor Fuel Sales.

nd

Vendor’s Compensation rate on 2

Motor Fuel Sales is calculated as follows: Total 2

Motor Fuel Sales multiplied by the county

nd

nd

of registration tax rate (see enclosed rate chart) multiplied by three percent (.03).

Example: 2nd Motor Fuel Sales of $5,000.00

$5,000 x .07 (as an example for Fulton County) x .03 = $10.50

Master Inserts

Any dealer with 4 or more locations is required to report on a consolidated Sales and Use Tax Form (ST-3). Consolidated reporting

requires each individual location to be reported on a master insert declaring total gross motor fuel and non-motor fuel sales and

use, exemptions and deductions, total tax due by tax type, and the calculation of Vendor’s Compensation by locations. Failure to

submit the master insert may result in the loss of Vendor’s Compensation.

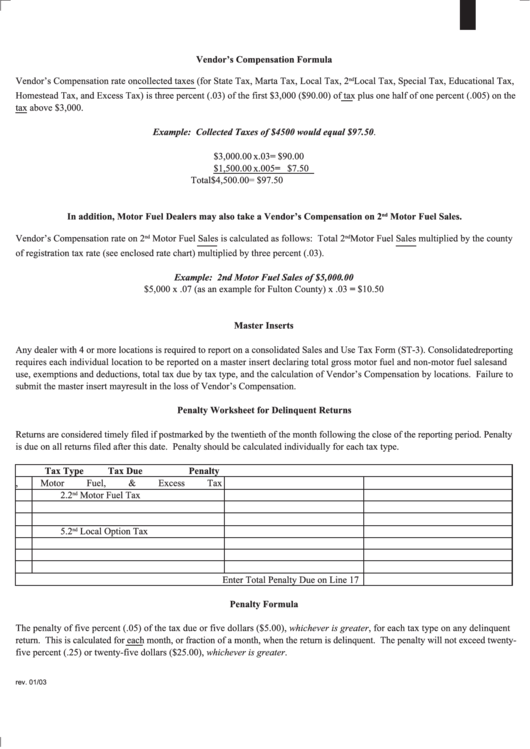

Penalty Worksheet for Delinquent Returns

Returns are considered timely filed if postmarked by the twentieth of the month following the close of the reporting period. Penalty

is due on all returns filed after this date. Penalty should be calculated individually for each tax type.

Tax Type

Tax Due

Penalty

1.

State Sales Tax, Motor Fuel, & Excess Tax

2.

2

Motor Fuel Tax

nd

3.

MARTA Tax

4.

Local Option Tax

5.

2

Local Option Tax

nd

6.

Special Purpose Tax

7.

Educational Tax

8.

Homestead Tax

Enter Total Penalty Due on Line 17

Penalty Formula

The penalty of five percent (.05) of the tax due or five dollars ($5.00), whichever is greater, for each tax type on any delinquent

return. This is calculated for each month, or fraction of a month, when the return is delinquent. The penalty will not exceed twenty-

five percent (.25) or twenty-five dollars ($25.00), whichever is greater.

rev. 01/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4