Motor Fuel Bulk Plant Exporter Return Instructions

ADVERTISEMENT

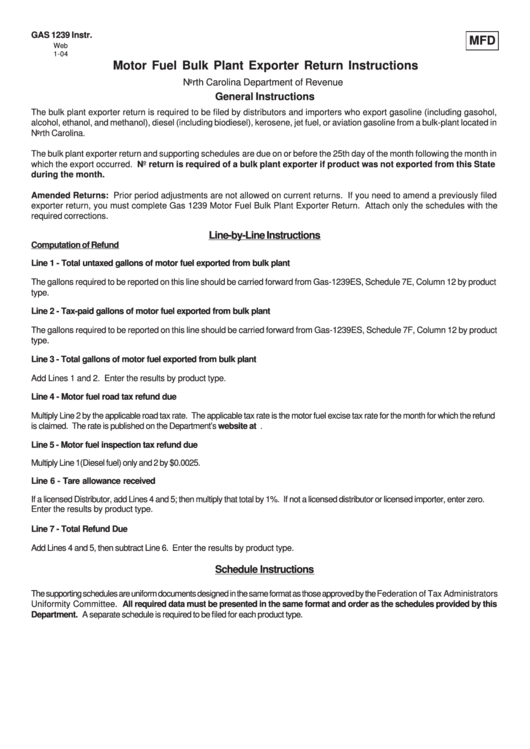

GAS 1239 Instr.

MFD

Web

1-04

Motor Fuel Bulk Plant Exporter Return Instructions

North Carolina Department of Revenue

General Instructions

The bulk plant exporter return is required to be filed by distributors and importers who export gasoline (including gasohol,

alcohol, ethanol, and methanol), diesel (including biodiesel), kerosene, jet fuel, or aviation gasoline from a bulk-plant located in

North Carolina.

The bulk plant exporter return and supporting schedules are due on or before the 25th day of the month following the month in

which the export occurred. No return is required of a bulk plant exporter if product was not exported from this State

during the month.

Amended Returns: Prior period adjustments are not allowed on current returns. If you need to amend a previously filed

exporter return, you must complete Gas 1239 Motor Fuel Bulk Plant Exporter Return. Attach only the schedules with the

required corrections.

Line-by-Line Instructions

Computation of Refund

Line 1 - Total untaxed gallons of motor fuel exported from bulk plant

The gallons required to be reported on this line should be carried forward from Gas-1239ES, Schedule 7E, Column 12 by product

type.

Line 2 - Tax-paid gallons of motor fuel exported from bulk plant

The gallons required to be reported on this line should be carried forward from Gas-1239ES, Schedule 7F, Column 12 by product

type.

Line 3 - Total gallons of motor fuel exported from bulk plant

Add Lines 1 and 2. Enter the results by product type.

Line 4 - Motor fuel road tax refund due

Multiply Line 2 by the applicable road tax rate. The applicable tax rate is the motor fuel excise tax rate for the month for which the refund

is claimed. The rate is published on the Department’s website at

Line 5 - Motor fuel inspection tax refund due

Multiply Line 1(Diesel fuel) only and 2 by $0.0025.

Line 6 - Tare allowance received

If a licensed Distributor, add Lines 4 and 5; then multiply that total by 1%. If not a licensed distributor or licensed importer, enter zero.

Enter the results by product type.

Line 7 - Total Refund Due

Add Lines 4 and 5, then subtract Line 6. Enter the results by product type.

Schedule Instructions

The supporting schedules are uniform documents designed in the same format as those approved by the Federation of Tax Administrators

Uniformity Committee. All required data must be presented in the same format and order as the schedules provided by this

Department. A separate schedule is required to be filed for each product type.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2