Form Rd-109 - Wage Earner Return Earnings Tax

ADVERTISEMENT

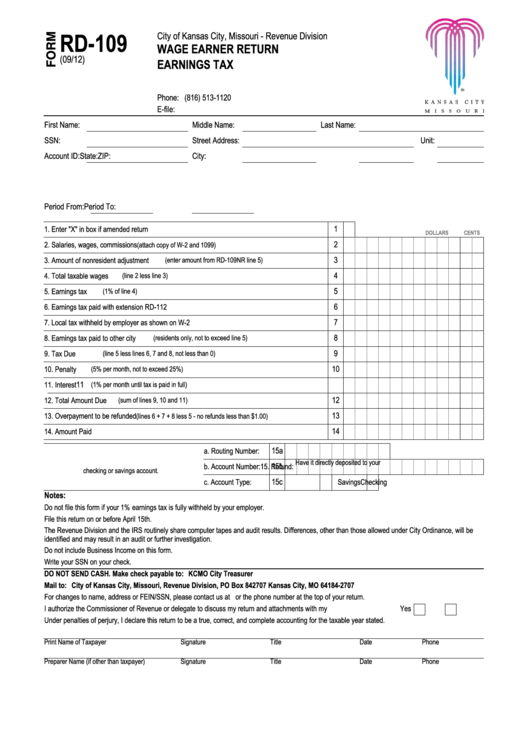

City of Kansas City, Missouri - Revenue Division

RD-109

WAGE EARNER RETURN

(09/12)

EARNINGS TAX

Phone:

(816) 513-1120

E-file:

First Name:

Middle Name:

Last Name:

SSN:

Street Address:

Unit:

Account ID:

City:

State:

ZIP:

Period From:

Period To:

1. Enter "X" in box if amended return

1

DOLLARS

CENTS

2. Salaries, wages, commissions

2

(attach copy of W-2 and 1099)

3

3. Amount of nonresident adjustment

(enter amount from RD-109NR line 5)

4

4. Total taxable wages

(line 2 less line 3)

5. Earnings tax

5

(1% of line 4)

6

6. Earnings tax paid with extension RD-112

7

7. Local tax withheld by employer as shown on W-2

8. Earnings tax paid to other city

8

(residents only, not to exceed line 5)

9. Tax Due

9

(line 5 less lines 6, 7 and 8, not less than 0)

10

10. Penalty

(5% per month, not to exceed 25%)

11

11. Interest

(1% per month until tax is paid in full)

12. Total Amount Due

12

(sum of lines 9, 10 and 11)

13. Overpayment to be refunded

13

(lines 6 + 7 + 8 less 5 - no refunds less than $1.00)

14

14. Amount Paid

15a

a. Routing Number:

Have it directly deposited to your

15b

15. Refund:

b. Account Number:

checking or savings account.

c. Account Type:

15c

Checking

Savings

Notes:

Do not file this form if your 1% earnings tax is fully withheld by your employer.

File this return on or before April 15th.

The Revenue Division and the IRS routinely share computer tapes and audit results. Differences, other than those allowed under City Ordinance, will be

identified and may result in an audit or further investigation.

Do not include Business Income on this form.

Write your SSN on your check.

DO NOT SEND CASH. Make check payable to:

KCMO City Treasurer

Mail to:

City of Kansas City, Missouri, Revenue Division, PO Box 842707 Kansas City, MO 64184-2707

For changes to name, address or FEIN/SSN, please contact us at or the phone number at the top of your return.

I authorize the Commissioner of Revenue or delegate to discuss my return and attachments with my preparer.

Yes

No

Under penalties of perjury, I declare this return to be a true, correct, and complete accounting for the taxable year stated.

Print Name of Taxpayer

Signature

Title

Date

Phone

Preparer Name (if other than taxpayer)

Signature

Title

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1