Instructions For Form 4567 - Michigan Business Tax Annual Return

ADVERTISEMENT

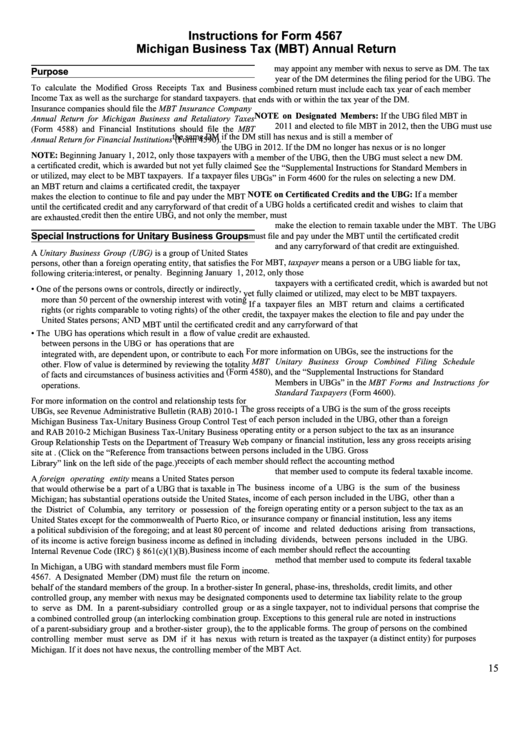

Instructions for Form 4567

Michigan Business Tax (MBT) Annual Return

may appoint any member with nexus to serve as DM. The tax

Purpose

year of the DM determines the filing period for the UBG. The

To calculate the Modified Gross Receipts Tax and Business

combined return must include each tax year of each member

Income Tax as well as the surcharge for standard taxpayers.

that ends with or within the tax year of the DM.

Insurance companies should file the MBT Insurance Company

NOTE on Designated Members: If the UBG filed MBT in

Annual Return for Michigan Business and Retaliatory Taxes

2011 and elected to file MBT in 2012, then the UBG must use

(Form 4588) and Financial Institutions should file the MBT

the same DM if the DM still has nexus and is still a member of

Annual Return for Financial Institutions

(Form 4590).

the UBG in 2012. If the DM no longer has nexus or is no longer

NOTE: Beginning January 1, 2012, only those taxpayers with

a member of the UBG, then the UBG must select a new DM.

a certificated credit, which is awarded but not yet fully claimed

See the “Supplemental Instructions for Standard Members in

or utilized, may elect to be MBT taxpayers. If a taxpayer files

UBGs” in Form 4600 for the rules on selecting a new DM.

an MBT return and claims a certificated credit, the taxpayer

NOTE on Certificated Credits and the UBG: If a member

makes the election to continue to file and pay under the MBT

of a UBG holds a certificated credit and wishes to claim that

until the certificated credit and any carryforward of that credit

credit then the entire UBG, and not only the member, must

are exhausted.

make the election to remain taxable under the MBT. The UBG

Special Instructions for Unitary Business Groups

must file and pay under the MBT until the certificated credit

and any carryforward of that credit are extinguished.

A Unitary Business Group (UBG) is a group of United States

For MBT, taxpayer means a person or a UBG liable for tax,

persons, other than a foreign operating entity, that satisfies the

interest, or penalty. Beginning January 1, 2012, only those

following criteria:

taxpayers with a certificated credit, which is awarded but not

• One of the persons owns or controls, directly or indirectly,

yet fully claimed or utilized, may elect to be MBT taxpayers.

more than 50 percent of the ownership interest with voting

If a taxpayer files an MBT return and claims a certificated

rights (or rights comparable to voting rights) of the other

credit, the taxpayer makes the election to file and pay under the

United States persons; AND

MBT until the certificated credit and any carryforward of that

• The UBG has operations which result in a flow of value

credit are exhausted.

between persons in the UBG or has operations that are

For more information on UBGs, see the instructions for the

integrated with, are dependent upon, or contribute to each

MBT Unitary Business Group Combined Filing Schedule

other. Flow of value is determined by reviewing the totality

(Form 4580), and the “Supplemental Instructions for Standard

of facts and circumstances of business activities and

Members in UBGs” in the MBT Forms and Instructions for

operations.

Standard Taxpayers (Form 4600).

For more information on the control and relationship tests for

The gross receipts of a UBG is the sum of the gross receipts

UBGs, see Revenue Administrative Bulletin (RAB) 2010-1

of each person included in the UBG, other than a foreign

Michigan Business Tax-Unitary Business Group Control Test

operating entity or a person subject to the tax as an insurance

and RAB 2010-2 Michigan Business Tax-Unitary Business

company or financial institution, less any gross receipts arising

Group Relationship Tests on the Department of Treasury Web

from transactions between persons included in the UBG. Gross

site at (Click on the “Reference

receipts of each member should reflect the accounting method

Library” link on the left side of the page.)

that member used to compute its federal taxable income.

A foreign operating entity means a United States person

The business income of a UBG is the sum of the business

that would otherwise be a part of a UBG that is taxable in

income of each person included in the UBG, other than a

Michigan; has substantial operations outside the United States,

foreign operating entity or a person subject to the tax as an

the District of Columbia, any territory or possession of the

insurance company or financial institution, less any items

United States except for the commonwealth of Puerto Rico, or

of income and related deductions arising from transactions,

a political subdivision of the foregoing; and at least 80 percent

including dividends, between persons included in the UBG.

of its income is active foreign business income as defined in

Business income of each member should reflect the accounting

Internal Revenue Code (IRC) § 861(c)(1)(B).

method that member used to compute its federal taxable

In Michigan, a UBG with standard members must file Form

income.

4567. A Designated Member (DM) must file the return on

In general, phase-ins, thresholds, credit limits, and other

behalf of the standard members of the group. In a brother-sister

components used to determine tax liability relate to the group

controlled group, any member with nexus may be designated

as a single taxpayer, not to individual persons that comprise the

to serve as DM. In a parent-subsidiary controlled group or

group. Exceptions to this general rule are noted in instructions

a combined controlled group (an interlocking combination

to the applicable forms. The group of persons on the combined

of a parent-subsidiary group and a brother-sister group), the

return is treated as the taxpayer (a distinct entity) for purposes

controlling member must serve as DM if it has nexus with

of the MBT Act.

Michigan. If it does not have nexus, the controlling member

15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11