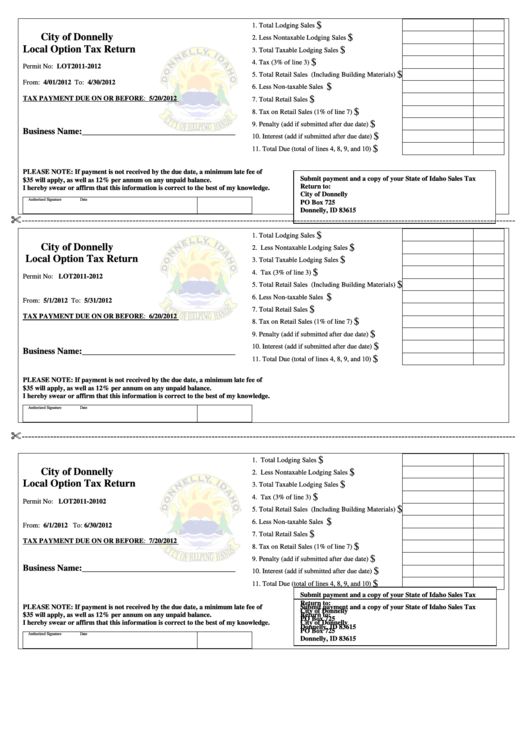

Local Option Tax Return Form - City Of Donnelly

ADVERTISEMENT

$

1. Total Lodging Sales

City of Donnelly

$

2. Less Nontaxable Lodging Sales

Local Option Tax Return

$

3. Total Taxable Lodging Sales

$

4. Tax (3% of line 3)

Permit No: LOT2011-2012

$

5. Total Retail Sales (Including Building Materials)

From: 4/01/2012 To: 4/30/2012

$

6. Less Non-taxable Sales

TAX PAYMENT DUE ON OR BEFORE: 5/20/2012

$

7. Total Retail Sales

$

8. Tax on Retail Sales (1% of line 7)

$

9. Penalty (add if submitted after due date)

Business Name:___________________________________

$

10. Interest (add if submitted after due date)

$

11. Total Due (total of lines 4, 8, 9, and 10)

PLEASE NOTE: If payment is not received by the due date, a minimum late fee of

Submit payment and a copy of your State of Idaho Sales Tax

$35 will apply, as well as 12% per annum on any unpaid balance.

Return to:

I hereby swear or affirm that this information is correct to the best of my knowledge.

City of Donnelly

Authorized Signature

Date

PO Box 725

Donnelly, ID 83615

------------------------------------------------------------------------------------------------------------------------------------------------------------

$

1. Total Lodging Sales

City of Donnelly

$

2. Less Nontaxable Lodging Sales

Local Option Tax Return

$

3. Total Taxable Lodging Sales

$

4. Tax (3% of line 3)

Permit No: LOT2011-2012

$

5. Total Retail Sales (Including Building Materials)

$

6. Less Non-taxable Sales

From: 5/1/2012 To: 5/31/2012

$

7. Total Retail Sales

TAX PAYMENT DUE ON OR BEFORE: 6/20/2012

$

8. Tax on Retail Sales (1% of line 7)

$

9. Penalty (add if submitted after due date)

$

10. Interest (add if submitted after due date)

Business Name:___________________________________

$

11. Total Due (total of lines 4, 8, 9, and 10)

PLEASE NOTE: If payment is not received by the due date, a minimum late fee of

$35 will apply, as well as 12% per annum on any unpaid balance.

I hereby swear or affirm that this information is correct to the best of my knowledge.

Authorized Signature

Date

------------------------------------------------------------------------------------------------------------------------------------------------------------

$

1. Total Lodging Sales

City of Donnelly

$

2. Less Nontaxable Lodging Sales

Local Option Tax Return

$

3. Total Taxable Lodging Sales

$

4. Tax (3% of line 3)

Permit No: LOT2011-20102

$

5. Total Retail Sales (Including Building Materials)

$

6. Less Non-taxable Sales

From: 6/1/2012 To: 6/30/2012

$

7. Total Retail Sales

TAX PAYMENT DUE ON OR BEFORE: 7/20/2012

$

8. Tax on Retail Sales (1% of line 7)

$

9. Penalty (add if submitted after due date)

Business Name:___________________________________

$

10. Interest (add if submitted after due date)

$

11. Total Due (total of lines 4, 8, 9, and 10)

Submit payment and a copy of your State of Idaho Sales Tax

Return to:

PLEASE NOTE: If payment is not received by the due date, a minimum late fee of

Submit payment and a copy of your State of Idaho Sales Tax

City of Donnelly

$35 will apply, as well as 12% per annum on any unpaid balance.

Return to:

PO Box 725

I hereby swear or affirm that this information is correct to the best of my knowledge.

City of Donnelly

Donnelly, ID 83615

PO Box 725

Authorized Signature

Date

Donnelly, ID 83615

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2