Instructions For Preparing Boe-531-Te Rev. 4 (7-04), Schedule Te For The Boe-401-E Return

ADVERTISEMENT

BOE-531-TE (BACK) REV. 4 (7-04)

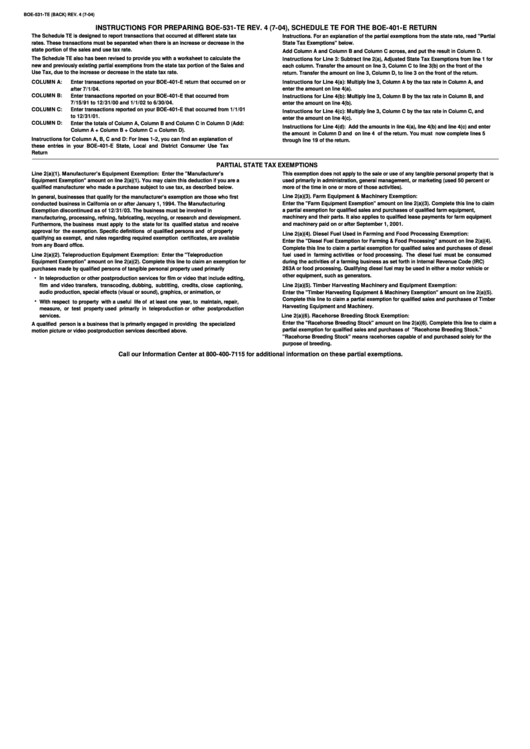

INSTRUCTIONS FOR PREPARING BOE-531-TE REV. 4 (7-04), SCHEDULE TE FOR THE BOE-401-E RETURN

The Schedule TE is designed to report transactions that occurred at different state tax

Instructions. For an explanation of the partial exemptions from the state rate, read "Partial

rates. These transactions must be separated when there is an increase or decrease in the

State Tax Exemptions" below.

state portion of the sales and use tax rate.

Add Column A and Column B and Column C across, and put the result in Column D.

The Schedule TE also has been revised to provide you with a worksheet to calculate the

Instructions for Line 3: Subtract line 2(a), Adjusted State Tax Exemptions from line 1 for

new and previously existing partial exemptions from the state tax portion of the Sales and

each column. Transfer the amount on line 3, Column C to line 3(b) on the front of the

Use Tax, due to the increase or decrease in the state tax rate.

return. Transfer the amount on line 3, Column D, to line 3 on the front of the return.

COLUMN A:

Instructions for Line 4(a): Multiply line 3, Column A by the tax rate in Column A, and

Enter transactions reported on your BOE-401-E return that occurred on or

enter the amount on line 4(a).

after 7/1/04.

COLUMN B:

Enter transactions reported on your BOE-401-E that occurred from

Instructions for Line 4(b): Multiply line 3, Column B by the tax rate in Column B, and

7/15/91 to 12/31/00 and 1/1/02 to 6/30/04.

enter the amount on line 4(b).

COLUMN C:

Enter transactions reported on your BOE-401-E that occurred from 1/1/01

Instructions for Line 4(c): Multiply line 3, Column C by the tax rate in Column C, and

to 12/31/01.

enter the amount on line 4(c).

COLUMN D:

Enter the totals of Column A, Column B and Column C in Column D (Add:

Instructions for Line 4(d): Add the amounts in line 4(a), line 4(b) and line 4(c) and enter

Column A + Column B + Column C = Column D).

the amount in Column D and on line 4 of the return. You must now complete lines 5

Instructions for Column A, B, C and D: For lines 1-2, you can find an explanation of

through line 19 of the return.

these entries in your BOE-401-E State, Local and District Consumer Use Tax

Return

PARTIAL STATE TAX EXEMPTIONS

Line 2(a)(1). Manufacturer's Equipment Exemption:

Enter the "Manufacturer's

This exemption does not apply to the sale or use of any tangible personal property that is

Equipment Exemption" amount on line 2(a)(1). You may claim this deduction if you are a

used primarily in administration, general management, or marketing (used 50 percent or

qualified manufacturer who made a purchase subject to use tax, as described below.

more of the time in one or more of those activities).

Line 2(a)(3). Farm Equipment & Machinery Exemption:

In general, businesses that qualify for the manufacturer's exemption are those who first

Enter the "Farm Equipment Exemption" amount on line 2(a)(3). Complete this line to claim

conducted business in California on or after January 1, 1994. The Manufacturing

a partial exemption for qualified sales and purchases of qualified farm equipment,

Exemption discontinued as of 12/31/03. The business must be involved in

machinery and their parts. It also applies to qualified lease payments for farm equipment

manufacturing, processing, refining, fabricating, recycling, or research and development.

and machinery paid on or after September 1, 2001.

Furthermore, the business must apply to the state for its qualified status and receive

approval for the exemption. Specific definitions of qualified persons and of property

Line 2(a)(4). Diesel Fuel Used in Farming and Food Processing Exemption:

qualifying as exempt, and rules regarding required exemption certificates, are available

Enter the "Diesel Fuel Exemption for Farming & Food Processing" amount on line 2(a)(4).

from any Board office.

Complete this line to claim a partial exemption for qualified sales and purchases of diesel

Line 2(a)(2). Teleproduction Equipment Exemption:

Enter the "Teleproduction

fuel used in farming activities or food processing. The diesel fuel must be consumed

Equipment Exemption" amount on line 2(a)(2). Complete this line to claim an exemption for

during the activities of a farming business as set forth in Internal Revenue Code (IRC)

263A or food processing. Qualifying diesel fuel may be used in either a motor vehicle or

purchases made by qualified persons of tangible personal property used primarily

other equipment, such as generators.

In teleproduction or other postproduction services for film or video that include editing,

Line 2(a)(5). Timber Harvesting Machinery and Equipment Exemption:

film and video transfers, transcoding, dubbing, subtitling, credits, close captioning,

audio production, special effects (visual or sound), graphics, or animation, or

Enter the "Timber Harvesting Equipment & Machinery Exemption" amount on line 2(a)(5).

Complete this line to claim a partial exemption for qualified sales and purchases of Timber

With respect to property with a useful life of at least one year, to maintain, repair,

Harvesting Equipment and Machinery.

measure, or test property used primarily in teleproduction or other postproduction

Line 2(a)(6). Racehorse Breeding Stock Exemption:

services.

Enter the "Racehorse Breeding Stock" amount on line 2(a)(6). Complete this line to claim a

A qualified person is a business that is primarily engaged in providing the specialized

partial exemption for qualified sales and purchases of "Racehorse Breeding Stock."

motion picture or video postproduction services described above.

"Racehorse Breeding Stock" means racehorses capable of and purchased solely for the

purpose of breeding.

Call our Information Center at 800-400-7115 for additional information on these partial exemptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1