Montana Form Frm - Montana Farm And Ranch Risk Management Account - 2012

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

MONTANA

4

FRM

5

5

Rev 02 12

6

6

7

7

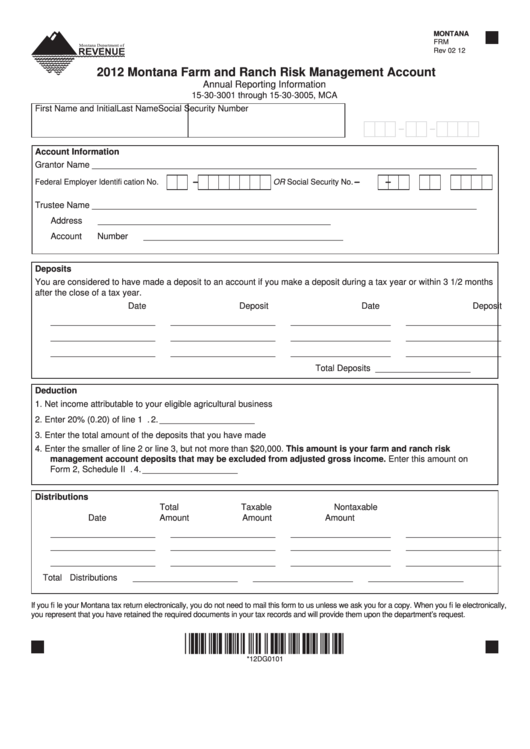

2012 Montana Farm and Ranch Risk Management Account

8

8

Annual Reporting Information

9

9

15-30-3001 through 15-30-3005, MCA

10

10

11

11

First Name and Initial

Last Name

Social Security Number

12

12

13

13

-

-

14

14

15

15

Account Information

16

16

Grantor Name _________________________________________________________________________________

17

17

18

18

Federal Employer Identifi cation No.

-

OR

Social Security No.

-

-

19

19

20

20

Trustee Name _________________________________________________________________________________

21

21

Address _________________________________________________

22

22

23

23

Account Number __________________________________________

24

24

25

25

26

26

Deposits

27

27

You are considered to have made a deposit to an account if you make a deposit during a tax year or within 3 1/2 months

28

28

after the close of a tax year.

29

29

30

30

Date

Deposit

Date

Deposit

31

31

______________________

______________________

_____________________

____________________

32

32

33

33

______________________

______________________

_____________________

____________________

34

34

______________________

______________________

_____________________

____________________

35

35

36

36

Total Deposits

____________________

37

37

38

38

Deduction

39

39

1. Net income attributable to your eligible agricultural business ............................................ 1. ____________________

40

40

41

41

2. Enter 20% (0.20) of line 1 .................................................................................................. 2. ____________________

42

42

3. Enter the total amount of the deposits that you have made ............................................... 3. ____________________

43

43

4. Enter the smaller of line 2 or line 3, but not more than $20,000. This amount is your farm and ranch risk

44

44

management account deposits that may be excluded from adjusted gross income. Enter this amount on

45

45

Form 2, Schedule II ............................................................................................................ 4. ____________________

46

46

47

47

48

48

Distributions

49

49

Total

Taxable

Nontaxable

50

50

Date

Amount

Amount

Amount

51

51

52

52

______________________

______________________

_____________________

____________________

53

53

______________________

______________________

_____________________

____________________

54

54

______________________

______________________

_____________________

____________________

55

55

56

56

Total Distributions

______________________

_____________________

____________________

57

57

58

58

59

59

If you fi le your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you fi le electronically,

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

60

60

61

61

62

*12DG0101*

62

63

63

64

64

*12DG0101

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2