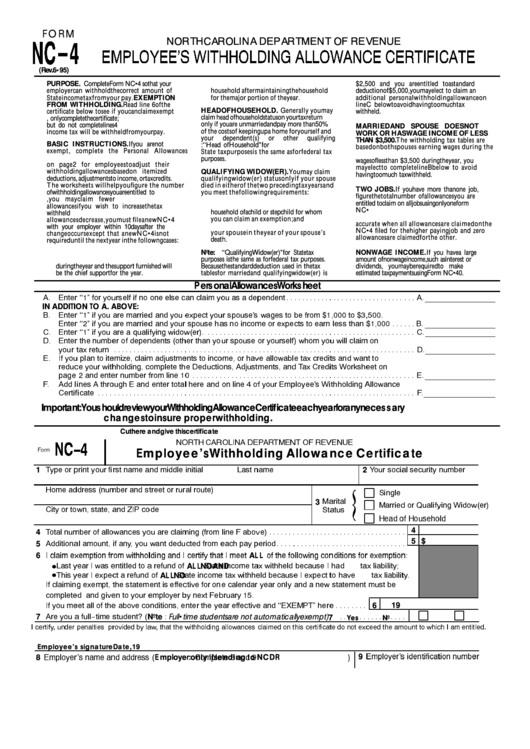

FORM

(Rev. 6•95)

PURPOSE. Complete Form NC• 4 so that your

3. When an individual ceases to be head of

$2,500 and you are entitled to a standard

employer can withhold the correct amount of

household after maintaining the household

deduction of $5,000, you may elect to claim an

State income tax from your pay. EXEMPTION

for the major portion of the year.

additional personal withholding allowance on

FROM WITHHOLDING. Read line 6 of the

line C below to avoid having too much tax

HEAD OF HOUSEHOLD. Generally you may

certificate below to see if you can claim exempt

withheld.

claim head of household status on your tax return

status. If exempt, only complete the certificate;

only if you are unmarried and pay more than 50%

but do not complete lines 4 and 5. No State

MARRIED AND SPOUSE DOES NOT

of the costs of keeping up a home for yourself and

income tax will be withheld from your pay.

WORK OR HAS WAGE INCOME OF LESS

your

dependent(s)

or

other

qualifying

THAN $3,500. The withholding tax tables are

BASIC INSTRUCTIONS.

If you are not

individuals. Note: ‘‘Head of Household” for

based on both spouses earning wages during the

exempt, complete the Personal Allowances

State tax purposes is the same as for federal tax

year. If your spouse does not work or will earn

Worksheet. An additinal worksheet is provided

purposes.

wages of less than $3,500 during the year, you

on page 2 for employees to adjust their

may elect to complete line B below to avoid

withholding allowances based on itemized

QUALIFYING WIDOW(ER). You may claim

having too much tax withheld.

deductions, adjustments to income, or tax credits.

qualifying widow(er) status only if your spouse

The worksheets will help you figure the number

died in either of the two preceding tax years and

TWO JOBS. If you have more than one job,

of withholding allowances you are entitled to

you meet the following requirements:

figure the total number of allowances you are

claim.

However, you may claim fewer

entitled to claim on all jobs using only one form

1. Your home is maintained as the main

allowances if you wish to increase the tax

NC• 4. This total should be divided among all

household of a child or stepchild for whom

withheld during the year. If your withholding

jobs. Your withholding will usually be most

you can claim an exemption; and

allowances decrease, you must file a new NC• 4

accurate when all allowances are claimed on the

2. You were entitled to file a joint return with

with your employer within 10 days after the

NC• 4 filed for the higher paying job and zero

your spouse in the year of your spouse’s

change occurs except that a new NC• 4 is not

allowances are claimed for the other.

death.

required until the next year in the followng cases:

1. When a dependent dies during the year.

Note: ‘‘Qualifying Widow(er)” for State tax

NONWAGE INCOME. If you have a large

2. When an individual ceases to be a dependent

purposes is the same as for federal tax purposes.

amount of nonwage income, such as interest or

during the year and the support furnished will

Because the standard deduction used in the tax

dividends, you may be required to make

be the chief support for the year.

tables for married and qualifying widow(er) is

estimated tax payments using Form NC• 40.

P ers onal Allowances Works heet

�� ����� ��

���

������� �� �� ��� ���� ��� �����

�� �� � ���������

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

��

IN ADDIT ION T O A. AB OVE :

�� ����� ��

��

�� ��� ������� ���

�� ������

��� �������� ����� �� �� ���� � ���� �� � �!���

����� ��"

��

�� ��� ������� ���

��� ������ #�� �� ������ �� ������� �� ���� ���� �#�� � ����

� � � � � �

��

$� ����� ��

��

�� ��� � %�����

��� �����&��'�

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

$�

(� ����� �#� ������ �� ���������� &��#�� �#��

��� ������ ��

�������' �#��

�� ���� ����� ��

��� ��� ������

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

(�

�� )�

�� ���� �� �����*�� ����� ��+�������� �� ������� �� #�,� ��������� ��� ������� ��� ���� ��

������

��� ���##������� �������� �#� (���������� ��+��������� ��� -�� $������ .��/�#��� ��

���� " ��� ����� ������ ���� ���� �

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

��

0� ��� ����� � �#����# � ��� ����� ����� #��� ��� �� ���� 1 ��

��� �����

���� .��##������ ���������

$����������

� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

0�

Important:

You s hould review your Withholding Allowance Certificate each year for any neces s ary

changes to ins ure proper withholding.

. . . . . . . . . . . . . . . . . . . . . .

Cut here and give this certificate to your employer. Keep the top portion for your records

. . . . . . . . . . . . . . . . . . . . . . .

234-5 $�436)2� (�7�4-8�2- 30 4�9�2:�

����

E mployee’s Withholding Allowance Certificate

-

�� �� �����

��� ����� ���� ��� ������ �������

6��� ����

;��� ������ �������

������

1

2

5��� ������� &������ ��� ������ �� ����� �����'

=�����

8������

8������ �� >�����

��� .����&��'

3

$��

�� ����� ������ ��� <)7 ����

=�����

5��� �� 5����#���

-���� ������ �� ����������

�� ��� �������� &���� ���� 0 ���,�' � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

4

4

���������� ������� �� ��

�

�� ���� �������� ���� ���# ��

������� � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �

5 $

5

) ����� ��������� ���� ���##������ ��� ) ������

�#�� ) ����

�� �#� ��������� ���������� ��� ���������?

6

AL L

6���

��� ) ��� �������� �� � ������ ��

=���� ������ ��� ���##��� ������� ) #��

��� ��������

@

�

AL L

NO

AND

-#��

��� ) ������ � ������ ��

=���� ������ ��� ���##��� ������� ) ������ �� #�,�

��� ��������

�

�

AL L

NO

)� �������� ������� �#� ��������� �� �������,� ��� ��� ��������

��� ���

��� � ��� ��������� ���� ��

��������� ��� ��,�� ��

��� �����

�� �

���� 0������

!�

)�

�� ���� ��� �� �#� ���,� ����������� ����� �#�

��� �������,� ��� ���A�87-

#��� � � � � � � � �

6

19

���

�� � ����B���� �������C &

?

� � � � � � � � � � � � � � � � �

7

Note

F ull•time s tudents are not automatically exempt)

7

Yes

No

� �������

����

��������

������� �� ��� ���� ��� ����������� ���������� ������� �� ���� ����������� �� ��� ������ ��� ���

�� �� ����� � �� ���������

E mployee’s s ignature

Date

,19

�����

���� �������������� ������

�����

���� ���� ��� ������� &

$������� D ��� E

'

9

E mployer:

only if s ending to NCDR

8

1

1 2

2